French budget minister Jérôme Cahuzac is being investigated by the tax authorities for suspected irregularities in his tax statements, notably undeclared and under-declared assets, Mediapart can reveal.

The investigation, in itself, does not imply that Cahuzac is suspected of voluntarily committing any irregularity.

Cahuzac is currently the subject of a preliminary judicial investigation for suspected 'laundering of the proceeds of tax fraud' which was opened last month following Mediapart’s exclusive revelations of evidence that he held, from the 1990s until 2010 and before he entered government, a secret Swiss bank account (see links to articles at the end of page 2).

Cahuzac, who last November announced his ministry was launching a crackdown on tax fraud, has vehemently and publicly denied ever holding a bank account outside France.

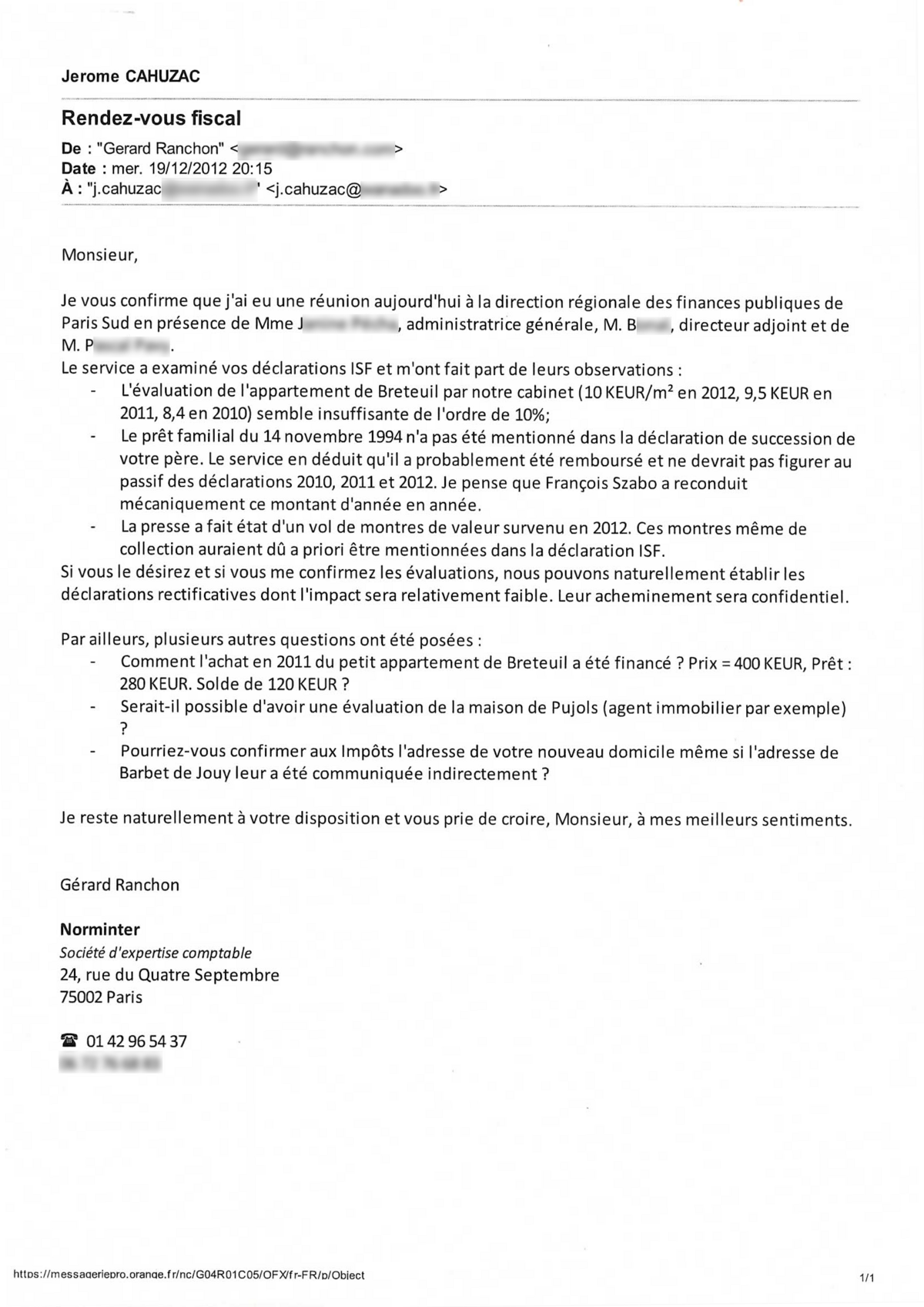

Mediapart has gained access to an email written and sent to Cahuzac by chartered accountant Gérard Ranchon, who belongs to the Paris accountancy firm Norminter with which the budget minister is a client. The email, a copy of which is published here, was sent to the budget minister on December 19th 2012 at 8.15p.m. Its subject title was “Rendez-vous fiscal”, meaning “Fiscal appointment”.

In the email, Ranchon informs Cahuzac about questions over his tax returns that were raised during an appointment he had that same day with three high-ranking tax inspectors from the south Paris regional public finances office (the Direction régionale des finances publiques de Paris-Sud).

Enlargement : Illustration 1

“The service has examined your ISF [wealth tax] statements and have informed me of their following observations,” wrote Ranchon. These are set out in a list of bullet points which begin with the suggestion that Cahuzac may have undervalued the worth of his apartment situated on the Avenue de Breteuil, in the plush 7th arrondissement of Paris, which he bought in October 1994.

“The evaluation by our agency (10K euros/square metre in 2012, 9.4 K euros in 2011, 8.4K euros in 2010) appears insufficient to the tune of 10%,” Ranchon explained.

Enlargement : Illustration 2

The accountant then informed Cahuzac that the tax authorities were investigating the conditions of a loan he received from his father of 1.5 million French francs (about 228,600 euros) which was used to help meet the 6.4 million-franc (about 975,600-euro) purchase price of the apartment. “The family loan on November 14th 1994 was not mentioned in the [financial] statement of the succession of your father’s estate,” wrote Ranchon, adding: “The service has deduced that it was probably repaid and should not figure in the liabilities [declared] in the 2010, 2011 and 2012 tax statements. I think that [Ranchon’s colleague] François Szabo had mechanically carried over this sum from year to year.”

The suggestion here is that the tax authorities suspected that the supposed liability of the loan served to diminish the amount Cahuzac paid in taxes of his assets.

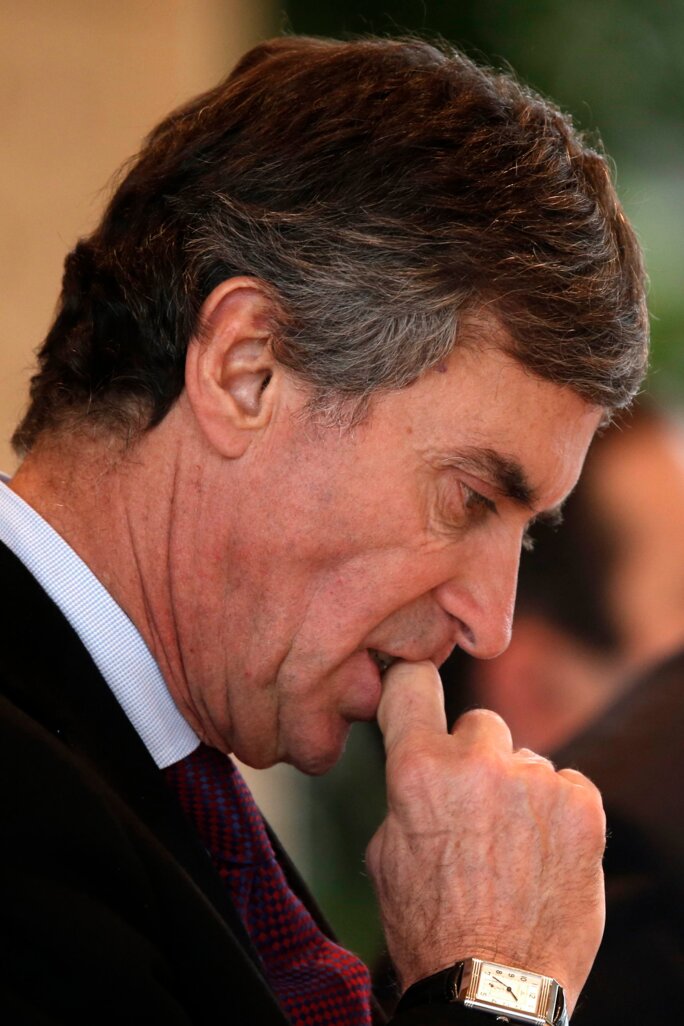

The third point listed in the email concerned revelations in the French press about a collection of watches stolen from Cahuzac’s home in October last year. Cahuzac was then living in an apartment situated on the Avenue Pierre 1er de Serbie, close to the Champs-Elysées. French daily Le Parisien reported that among the objects taken by thieves who broke into the apartment was a collection of watches valued at 100,000 euros. At the time, Cahuzac’s entourage claimed the stolen items were above all of sentimental value.

“The press has mentioned the theft in 2012 of valuable watches,” Ranchon continued. “These watches, even if collector’s items, should normally have figured in the ISF [wealth tax] statement.”

Disowned tax inspector

Ranchon suggests that, if the minister is in agreement, “we can naturally establish rectified statements of which the impact will be relatively weak”, adding that the process of their sending “will be confidential”. He then mentions further questions that were asked by the tax inspectors, beginning with another of Cahuzac’s properties on the Avenue de Breteuil. “How was the purchase of the small Breteuil apartment financed? Price = 400K euros. Loan, 280K euros. The remainder of 120K euros?”, he wrote.

Another question concerned Cahuzac’s house in Pujols, in the Lot-et-Garonne département (equivalent to a county) in south-west France. “Would it be possible to have an evaluation made of the house in Pujols (by an estate agent for example)?” he asks.

Contacted by Mediapart, Gérard Ranchon refused to comment on his email, citing the constraints imposed by his professional code of confidentiality.

As Mediapart reported last December, suspicion of the existence of Cahuzac’s secret Swiss account was the subject of an internal report prepared in June 2008 by tax inspector Rémy Garnier, who was based with a regional tax office in south-west France.

Garnier, who is now retired, was subsequently reprimanded by his departmental managers, to whom he addressed the report, for having consulted Cahuzac’s tax details without proper justification. He did so by entering an internal tax authority computer programme called Adonis.

Garnier contested the reprimand which he sought to have overturned at a hearing of the Bordeaux administrative tribunal, when he lost the case. He has since lodged an appeal, which is yet to be heard by the same tribunal.

Garnier has also had access to the email written by Gérard Ranchon, and in a document he has prepared and sent to the Bordeaux tribunal in support of his case, the former tax inspector has calculated the amount Cahuzac may have to pay back to the tax authorities. In the document, dated January 28th and which Mediapart publishes in its entirety below, Garnier wrote: “Given the fictive [loan] liability and the forgotten watches, the tax adjustment would amount to about 1,000,000 euros each year, and the corresponding taxes would be 20,000 euros for the three years that are not lapsed [no longer prosecutable], or about 72,000 euros over ten years.”

In his document, Garnier argued that the email demonstrated “in blatant manner” that his consultation of Cahuzac’s tax records “presented a moral, deontological and financial interest for the state treasury”.

-------------------------

See more articles on the issues raised in this report:

The French budget minister and his secret Swiss bank account

French budget minister caught on tape discussing his secret Swiss account

Revealed: the man who handles the budget minister's own personal fortune

The budget minister and his Swiss bank account – the unanswered questions

Swiss bank account affair - the budget minister's lies

The French budget minister, the Swiss account and the judicial inertia that begs major reform

French budget minister and Swiss bank account affair: police open investigation

-------------------------

English version: Graham Tearse