Part one of Mediapart's investigation into the boss of Free showed how Xavier Niel had begun to amass the beginnings of a fortune thanks, in part, to his investment in sex shops in Paris and Strasbourg. At their peak these shops were earning Niel around 15,000 euros a month in cash.

But this was only the start of the entrepreneur’s money-making success story. The big money – the kind of money that has made him France's 12th wealthiest man - was to come not from the sex shop industry but from new technology, and most importantly from his stewardship of Free, which is today France's second biggest interest service provider and now a successful mobile phone operator too.

As with the rest of his early professional career, Niel, who is an indirect shareholder in Mediapart (see box marked boîte noire at the foot of this page), is not keen on discussing how he came to have almost total control of the company that spawned Free and made the businessman’s fortune. But thanks to court documents from the time, Mediapart has been able to piece together some of the most important details. The story behind how he became a billionaire goes back to one crucial day, March 13th 2002.

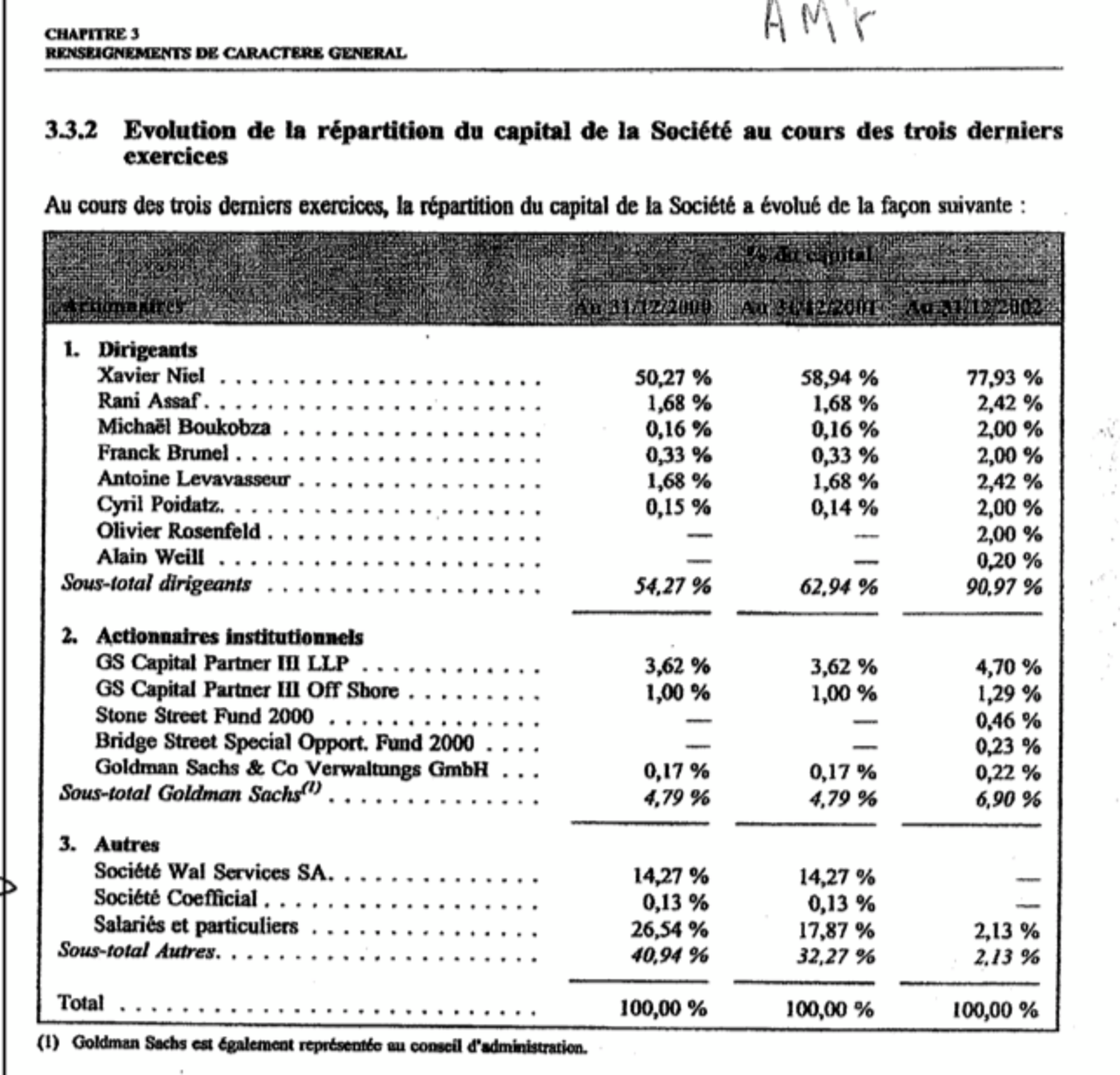

It was on that landmark day that Xavier Niel went from owning an already sizeable 58.94% controlling share of the company Iliad, the parent company of Free, to a huge 77.93%. To put this into context and to underline the dominance of Niel's position after the transfer of shares, the next biggest individual shareholder had just a 2.42% stake while all the institutional investors put together mustered only 6.9% between them.

Niel's stake in Iliad gave him near-total control and a chance to develop the business further in the future, to become the success story that it is today. But not everyone was to prove satisfied over the transfer of shares that took place on March 13th 2002. One man who became disgruntled was Xavier Niel's former business associate, Fernand Develter.

It was Develter who had introduced Niel to the world of sex shop investment back in the early 1990s. It was Develter, too, who had set up Fermic, the company that in 2000 was to be rechristened Iliad. Fermic had been created by Fernand Develter and his old colleague from banking days Michel Artaud - the company name came from the first letters of their names. However by 1990 Fermic, which offered a mixture of stock price information services and dating services on the Minitel network, was performing poorly and losing money. Xavier Niel was thus able to buy a 50% stake in it for a nominal fee, and began to develop the firm. After 1993, when business in dating services began to decline, he focussed Fermic on other areas, such as producing a reverse telephone directory service.

Supplementary payment for shares

Yet even after the company became Iliad in 2000 and Develter's old name for the firm had vanished, he still had a stake in it. Through the Belgian company Wal Services Develter possessed 14.27% of Iliad's shares up to March 2002. But on the 13th of that month he parted with those shares. The price for all the transactions on this date was 4.67 euros a share, a figure which valued Iliad at 32 million euros. The precise reasons why Develter chose to sell at this time are not clear. However, 2002 was a difficult year for internet-related companies. The Dot Com bubble that began in 1997 had burst in 2000 and 2001. Moreover Iliad had, to this point, never paid any dividends to its shareholders.

Whatever the reasons, Develter agreed to sell his shares. Nor did he walk away empty-handed. For under an agreement reached on February 28th 2002 – two weeks before the share transfer – Niel agreed to pay his old business associate a monthly fee of 9,200 euros for 30 years. This was on top of the 4.67 euros per share that Develter received. When questioned by an examining magistrate two years later over an unrelated matter Xavier Niel said of this arrangement: “[The payment] is a supplementary price for the buying of his Iliad shares...” Niel also noted: “It was Fernand who asked me to make these payments in cash.”

However, despite this sizeable monthly “supplementary” money paid to him, Develter and some other Iliad shareholders who sold out in March 2002 were to become unhappy with the deal. What may have irked some of those shareholders was that on March 28th, just two weeks after getting rid of their stocks, Iliad paid its remaining shareholders a handsome dividend of 0.84 euros per share. It was the first time the company had ever paid a dividend. The payout netted the main shareholder Xavier Niel 3,117,484.44 euros.

Another potential source of their dismay, perhaps, was the fact that in January 2004, just under two years after the share transaction, Iliad was floated on the the Bourse, the French stock exchange. It was now valued at 800 million euros, or 25 times greater than it had been in March 2002. It should also be pointed out that in 2000, just before the Dot Com bubble began to deflate and at the time when investment bankers Goldman Sachs invested 15 million euros in the firm, Iliad was valued at 300 million euros.

Whatever the precise trigger, what is known is that in April 2006 Fernand Develter and his son Jean-Christophe filed a formal complaint for fraud in relation to the share transfer of March 13th 2002. Specifically they alleged conspiracy to commit fraud, breach of trust, and the receipt of the proceeds of those alleged crimes on the part of the management of Iliad. The criminal allegations were investigated by examining magistrate Thomas Cassuto.

Legal action for damages

However, the case did not quite turn out as Develter and his son must have hoped. For judge Cassuto quickly became particularly interested in a document dated September 24th 2004 and which purported to bear the signature of Xavier Niel and Fernand Develter. The judge ordered expert analysis of this document and came to the conclusion that Xavier Niel's signature on it resulted from a copy “involving the photocopying or scanning” of Niel's real signature. As a result Develter and his son were pursued in the courts. On September 10th 2008 at the 11th chamber of the Paris law courts Fernand Develter was found guilty of forgery, use of forged documents, reporting a false crime to a judicial or administrative authority resulting in unnecessary investigations and complicity to attempted fraud. He was given a ten-month suspended prison sentence and fined 10,000 euros.

At the same time he and his son Jean-Christophe were ordered to pay 105,000 euros in civil damages to Iliad and company executives.

In the meantime, on May 25th 2007, examining magistrate Thomas Cassuto had officially ended his investigation into the original allegations made by Develter about the 2002 Iliad share transfer. In his ruling judge Cassuto referred to the share price of 4.67 euros in 2002, valuing the company then at 32 million euros, contrasting that with the 800 million euro valuation at flotation two years later. But the judge only did so to make it clear that there was no merit in investigating the issue further. Of the 2002 valuation he said: “It can be noted that in the opinion of financial experts the factors allowing the shares to be valued were multiple and uncertain.” And the judge ruled that “no concrete fact was put forward to criticise this value at this date”.

Enlargement : Illustration 2

The same issue was also discussed in the court proceedings that found Develter guilty of forgery in 2008. Here the court noted that: “It seems evident that no under-valuation of Iliad shares in the month of March 2002 can be deduced from a simple comparison between the price offered at the time of the capital reduction (4.67 euros or a valuation of the company at 32 million euros in March 2002) and the valuation of the company at the time when Goldman Sachs bought into its shares in March 2000 more than two years before the collapse of the markets (300 million euros) or again the valuation of the company during its flotation on the stock exchange in January 2004 (800 million euros).”

In other words, as far as the judicial system was concerned there was absolutely no reason to question the valuation of Iliad at 32 million euros in March 2002.

However, Fernand Develter was not the only person to challenge the March 2002 share transfers. Many employees or former employees of Iliad had sold their involvement in the company at the going rate of 4.67 euros a share. Indeed, in 2000 some 26.54% of the shares were owned by staff and 'individuals' - not including senior management. After the March 2002 'capital reduction' this figure had fallen to just 2.13%. Two of those who sold, former employees Olivier Chami and Pierre Gohon, had subsequently heard about the “supplementary” payment that Fernand Develter was continuing to receive for the Iliad shares he had sold, and they were reportedly furious about it.

In February 2007 the two men files claims for civil damages against Iliad and some of its senior managers including Xavier Niel. The claim was under contract law, with the plaintiffs complaining of “misrepresentation and undue influence (1) at the time of the acquisition of their shares in March 2002 by the company Iliad and Mr Niel”. Wal Services - controlled by Fernand Develter – also joined this civil action.

---------------------------------------

1: The French legal terms used are 'dol' and 'violence'. For a discussion of their meanings see here and here.

KPMG's valuation of Iliad

According to Iliad's own 2008 financial report (see here and scroll down to page 16) the plaintiffs were seeking “the recovery of their shares, and if recovery proves impossible, compensation from Iliad and its senior managers amounting to €102 million each for Messrs. Chami and Gohon and €802 million for Wal Services.” The report added that Iliad considered that the “claims filed by Wal Services and Messrs. Chami and Gohan are unfounded and that despite their allegations the plaintiffs were subject neither to fraud not to any form of duress”.

The claims by Chami and Gohon were not resolved in court, however. According to information received by Mediapart the affair ended in an amicable out-of-court settlement in which Olivier Chami and Pierre Gohon each walked away with 1.3 million euros as a supplementary payment for the Iliad shares they had sold in 2002.

An interesting footnote to the issue of the valuation of Iliad came in January 2008. This was when the accountants KPMG produced a report, commissioned some months earlier by Fernand Develter, on what would have been considered a fair valuation of Iliad on March 13th 2002. By the time KPMG delivered their report, the examining magistrate Thomas Cassuto had already ruled that there was no case to answer for Iliad or its senior managers over the March 2002 valuation of 32 million euros. So the report became simply an intellectual exercise.

Nonetheless its conclusions make interesting and surprising reading. For on page 29 of the document the accountancy firm concludes that: “On these grounds we estimate that the value of 100% of the shares of the Iliad group on the date of February 28th 2002 in all likelihood comes to between 227 and 586 million euros. Within this range we consider that the most pertinent values are between 227 and 259 million euros.”

This last range of between 227 and 259 million euros would mean that Iliad was, in KPMG's view, worth seven to eight times the 32 million euro valuation given to the firm in March 2002. Of course, by the time KPMG came out with their report in January 2008, Iliad had grown massively and was by then valued at 3.7 billion euros. And Xavier Niel was already well on the way to the estimated 3.6 billion euro fortune he has today, making him the 12th wealthiest man in France.

------------------------------------

English version by Michael Streeter