Earlier this month, the French finance ministry presented the final arrangements to raise 4.5 billion euros of state funds to settle the debts left by the collapse of defunct state-owned bank Crédit Lyonnais, which collapsed following a high-risk lending scandal in 1993. The crash of the bank has ended up costing the public purse more than 15 billion euros, without counting the massive damages paid out in the US over the Executive Life affair and the more than 400 million euros paid to French tycoon Bernard Tapie in a controversial compensation award for assets spoliated by the bank.

In 2005 and after 12 years of legal proceedings, the bank’s former chairman, Jean-Yves Haberer, was finally given a suspended 18-month prison sentence and a symbolic 1-euro fine for his responsibility in the bank’s collapse. The only financial penalty he ever paid – beyond that 1 euro – was a fine of 59,000 euros decided by the French Court of Budgetary Discipline (the 'Cour de discipline budgétaire').

The judicial outcome of those responsible for that major banking disaster compare starkly with the case of former Société Générale trader Jérôme Kerviel , who was sentenced in 2010 to five years in prison – two of them suspended - and a staggering fine of 4.9 billion euros for having lost the bank the same sum in reckless trading bets during 2007 which his superiors said they had suddenly discovered in January 2008. The bank has consistently claimed that Kerviel, now aged 36, was a rogue trader who acted alone and who kept his high-risk bets secret from his superiors.

That position is hotly contested by Kerviel, who maintains that not only were his superiors aware of his activities, but high-risk trading was common to a number of his colleagues. He lodged an unsuccessful appeal in 2012, when his sentence was confirmed along with the fine.

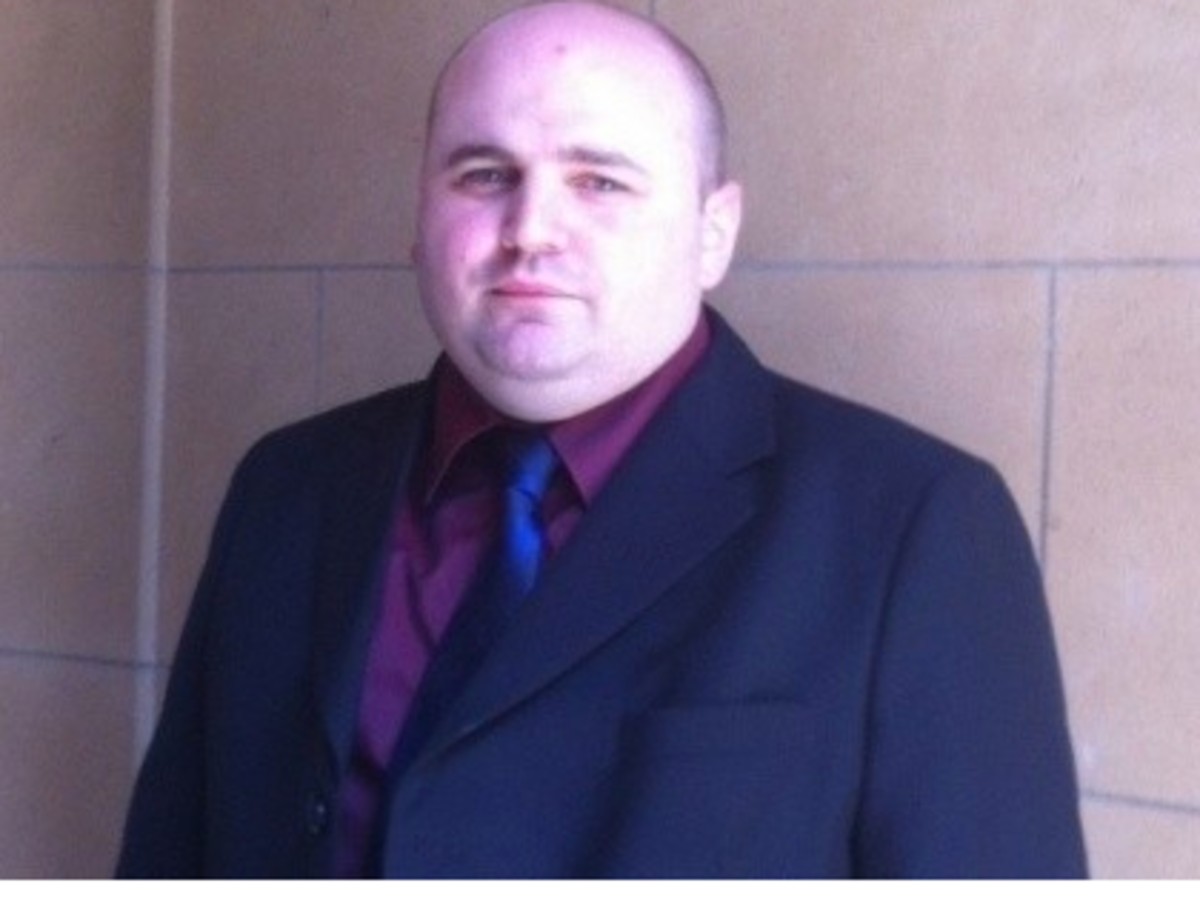

Sylvain Passemar has intimate knowledge of the Société Générale’s trading activities at the time Kerviel was its employee, and he says it is out of a sense of outrage and injustice at the ex-trader’s treatment that he has he decided to speak out in this interview with Mediapart. Passemar worked from December 2003 until April 2010 at the Société Générale’s brokerage arm Fimat (now merged into a firm called Newedge) which was involved in all the transactions on Eurex, the German derivatives exchange which was the main market used by Kerviel.

After Kerviel’s arrest in 2008, Passemar followed with a certain distance the developments of the judicial investigation and Kerviel’s subsequent first trial in 2010. “I had been too confident in our institutions,” he says now.

But after the sentence handed down on Kerviel in 2010, when he was found guilty of forgery, breach of trust and unauthorized computer use, Passemar was enraged. “I could not continue to remain silent,” recalled Passemar. “I feared fresh lies and new dysfunctions during the appeal case. How can one accept such an intellectual fraud as that of accusing Jérôme Kerviel of damaging the international financial order bang in the middle of a financial crisis?”

Passemar, acting as a witness for the defence, was questioned by the French police’s financial crimes investigation unit, the Brigade financière, in which he gave detailed and recorded statements. During the appeal court hearings, from June 4th to June 28th 2012, Passemar turned up every day at the courthouse, expecting, in vain, to be called upon to testify. In this interview with Mediapart, he offers the essential detail of what he would have told the court.

“As head of the IT department, I was not required to be informed about the transactions linked to the Société Générale," he explained. "My role was to manage the flows, the volumes.” He said that as of July 2007, he observed significant changes in the volumes, describing this as if all of a sudden teeming holiday traffic at a motorway toll booth was suddenly diverted onto a b-road. “That continued up until the end of 2007,” he said.

The amount was so vast that it caused daily delays in the functioning of data treatment to the order of two to three hours. “The delays had a knock-on effect everywhere, in the back office services but also in financial accounts, billing and management control,” Passemar recalled. “We were sometimes in the dark during operations for several hours, which was very dangerous. The traffic had exploded to the point that the machine handling Eurex had to be replaced.”

During this period, Passemar did not know Kerviel by name, but as the operator of account number SF581. The account was so busy that, Passemar said, “an independent process” had to be created to be able to manage the volume of transactions it generated.

Despite such events, the Société Générale has claimed throughout that it was kept in the dark about what was going on. “But that is totally impossible,” Passemar insisted. “Everyone knew.” At the end of 2007, the head of Fimat sent an email out to all his staff to tell them that the brokerage firm had, that same day, broken its record of transactions handled.

“In October 2007, a member of the ‘operational risk’ [department] insistently asked me to ‘raise’ the trading limits of one trader operating on Eurex. Of course I refused. It’s not for a technical service to look after risk-taking, that’s forbidden by regulations, but rather for the risk management department to look after such an operation. Together with a colleague, we just looked at the configuration of limits for these traders who were dealing with derivative products on Eurex, and we noted that some of them had no limits!” By implication, Jérôme Kerviel was not the only trader who was left uncontrolled, despite the bank’s claims.

When the Kerviel scandal was first revealed, Passemar said he was outraged at how the management of the Société Générale publicly accused Kerviel of acting secretly and behind the backs of his hierarchy. “When you listenend to [Bank of France governor and head of the French banking control authorities] Christian Noyer, he adopted, right from the first day, the theory of a lone man. [Former French President] Nicolas Sarkozy took up the argument for himself. The tale appeared particularly well put together, creating a consensus. Jérôme Kerviel had his picture everywhere, on all the TV news bulletins on the very evening the affair was revealed in public. He was designated as the scapegoat.”

Passemar was especially surprised at the manner with which the subsequent investigation into Kerviel’s actions was carried out. “For sure, it was an outsized case for the Brigade financière,” he said; “They are not used to handling this type of case. But there was an obvious lack of understanding by the investigators of practices on the financial market. Even if they were very well intended, they didn’t know where to look, or what to look for.”

He was surprised at the length of time it took the investigators to decide to look for evidence at Fimat. “They only arrived on February 15th,” Passemar recalled. "For a period of one month, the crime scene, if one can call it that, had been left totally free. There were several of us among the Fimat staff who were astonished to see the Brigade financière inspectors arrive so late.”

'French justice had all the means to discover the truth'

During the police investigation, the head of the Fimat’s messaging services insisted that he could not remember destroying email correspondence between the brokerage firm and the Société Générale. But a police detective asked him whether one of his superiors had requested, in 2007 or 2008, for messages to be deleted. “His reply was, all the same, very intriguing,” said Passemar. “He said ‘yes, that request had been made - more exactly, if it was possible to delete messages in a way that it would not be possible to find any trace’.”

“The request was made by one of his superiors, and that was three weeks before the Kerviel affair began," Passemar added. "How is it that the [investigating] magistrates did not ask themselves questions about this revelation recorded in a witness statement?”

After the appeal case ended, Passemar obtained a copy of all the witness testimony given during the hearings. “Before the court, managers of the Société Générale explained that the computer files of Fimat [detailing all the daily transactions of the banks traders] did not arrive at the bank’s back office,” he said. “I don’t see how that’s possible. I sent files - the positions opened, the financial results, the account statements, operating instructions – of the Société Générale’s accounts with Fimat towards the computing services of the bank which should necessarily monitor them and subsequently redistribute them to the different services in charge of following the activities of the traders, including those of Jérôme Kerviel.”

“It is a basic rule in our professions. The operating staff, meaning employees in the back office and other services, are not supposed to have access to the files, for reasons that are both technical and for the security and authenticity of the data. I don’t see why my colleagues at the Société Générale would have done differently to me, that is to say informing the back office, the financial accounts department and management control. Otherwise, these services wouldn’t have had the means with which to work. Not to mention the lack of control, which could be very dangerous. Losses can happen very quickly on the markets.”

During 2007, Kerviel’s trading involved sums amounting to 28 billion euros. “How can a bank not see such an amount of money?” asked Passemar. “If it saw nothing, it should be closed down immediately because it’s a public danger.”

“If French justice really wanted to know the truth of what happened, it had every means to do so. The Société Générale says that internal emails are no longer available, which [otherwise] would have made it possible to know the extent of the knowledge of Jérôme Kerviel’s superiors. But there is a place where they are still stocked. There is a conversation base in Chicago. Also, why wasn’t any question put to Eurex? It is the compensation bureau, which has the role of notary in this regulated market. It has all the proof, the traces of all the movements. Why wasn’t it asked for the list of numbers of its clients who had quite significant positions? That would have thrown light on the way the positions were divided up, to know if Jérôme Kerviel played alone against the market or whether he had sellers in front of him. Why did the justice system not ask all of that?”

“Evidence still exists, but there should be no delay," warned Passemar. "The messages stocked in Chicago are kept for seven years, the operations at Eurex are kept for ten years. There will come a time when it will no longer be possible to throw light on this case. At stake is a man’s life.”

-------------------------

English version by Graham Tearse