The French National Institute of Statistics and Economic Studies (INSEE) in December released its update of key economic facts and trends in France.Mediapart's Laurent Mauduit has been studying the figures and says coordinated European austerity plans are stifling French growth, with households rather than businesses bearing the brunt of the effort.

------------------------

While unemployment levels remain high and purchasing power is reduced, households are paying the high price of the recession, while businesses saw their financial situations recover quickly, reveals INSEE's report, 'Conjoncture in France', published on December 16th.

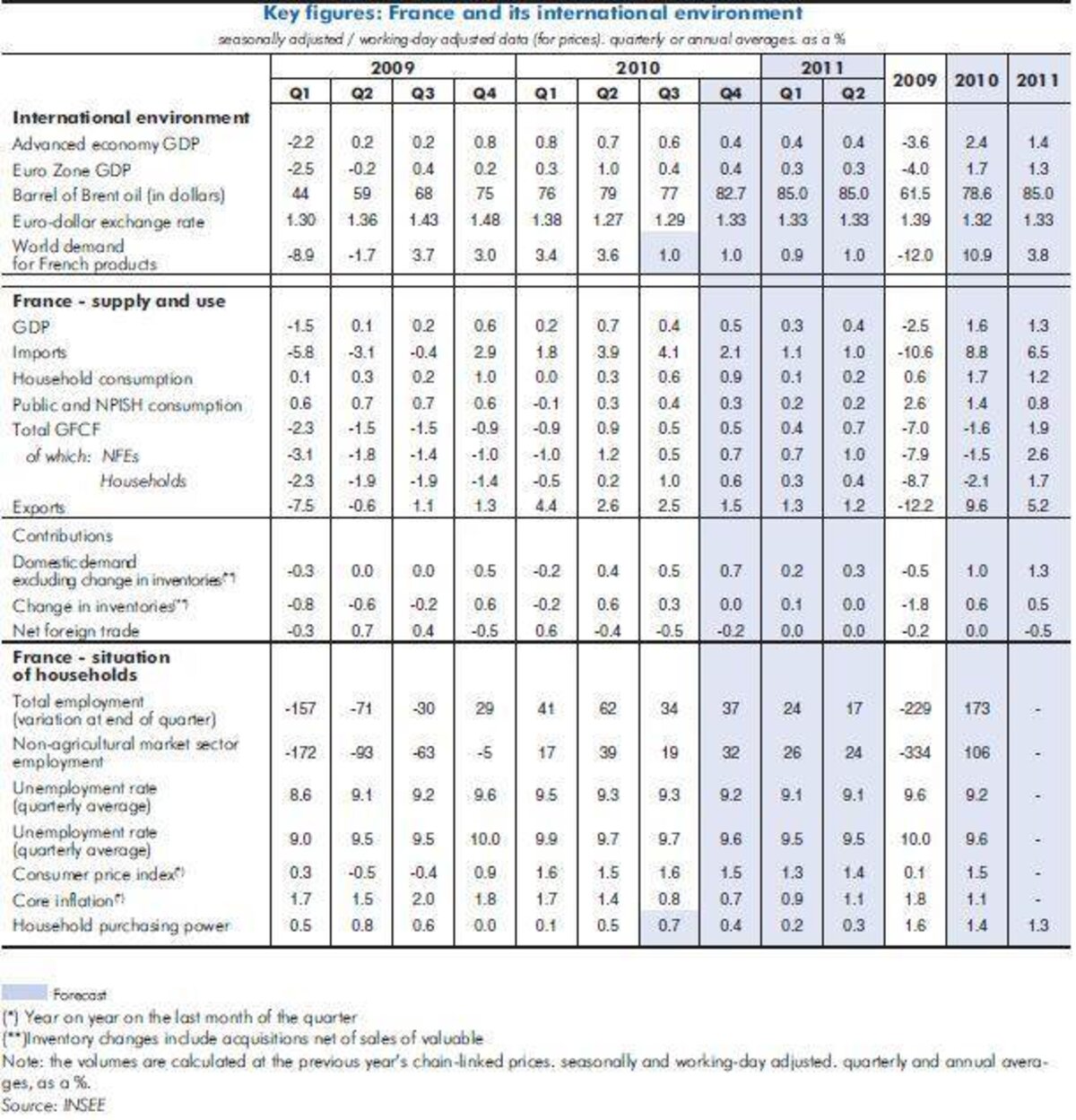

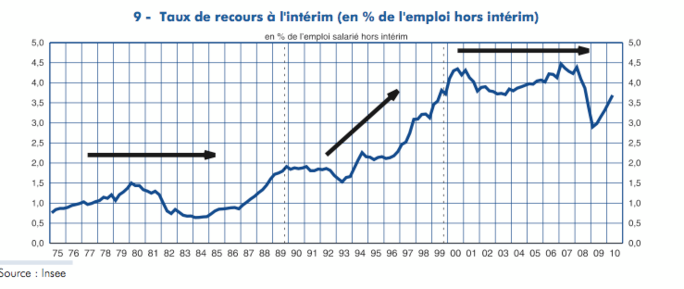

Enlargement : Illustration 1

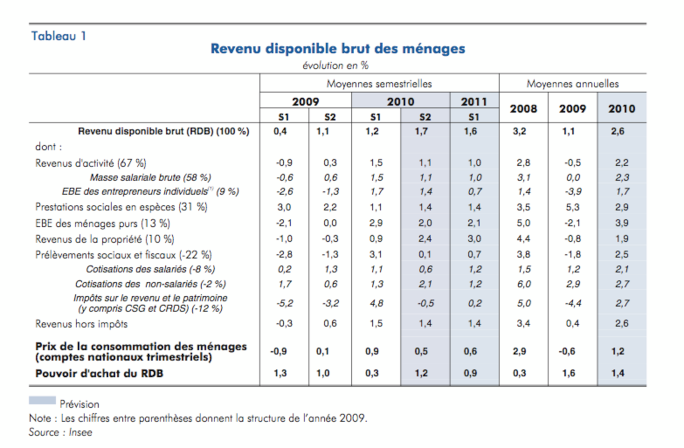

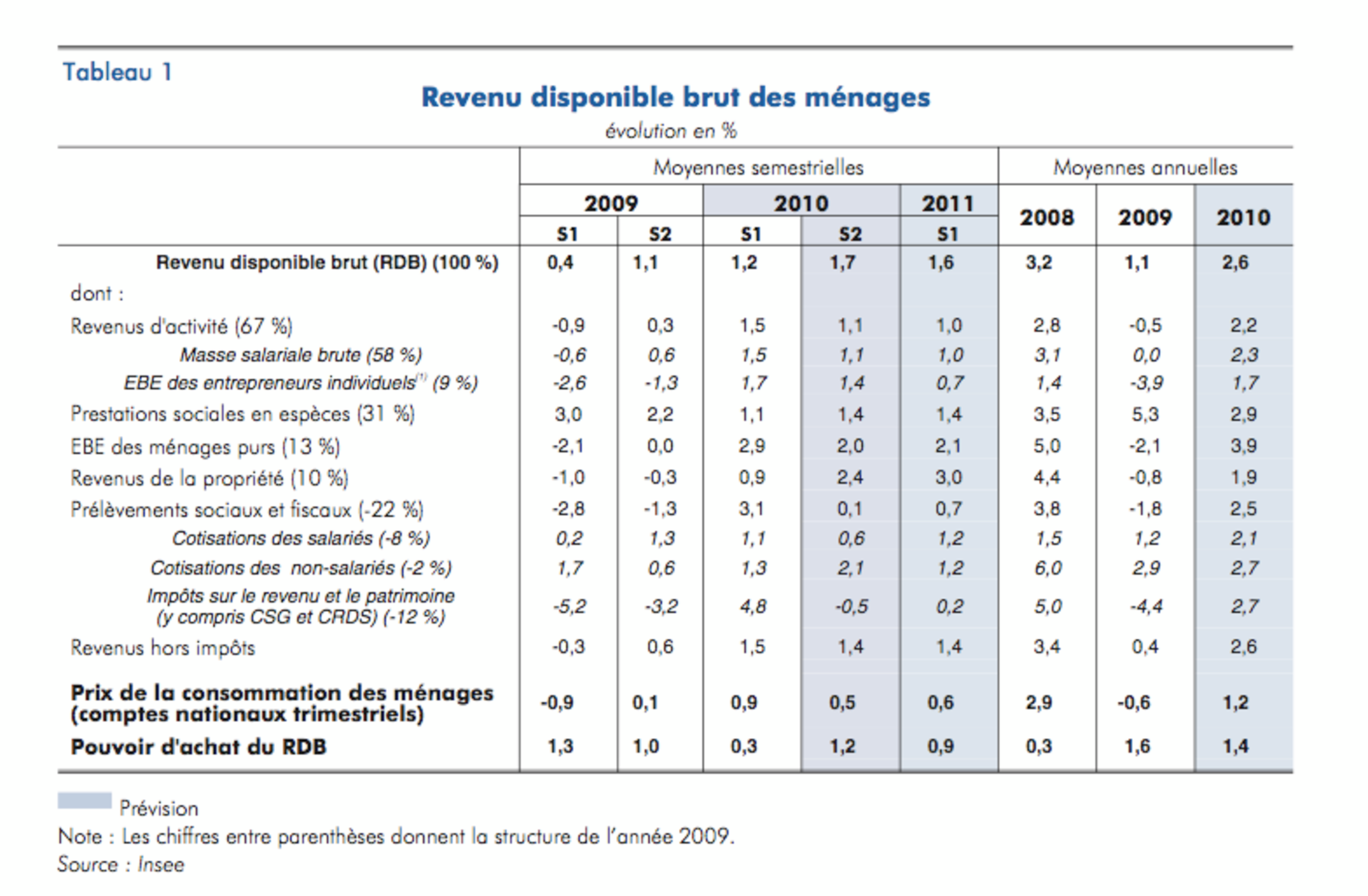

The report, which takes stock of France's economic situation in 2010 and looks ahead to the first half of 2011, forecasts that French economic growth in the coming months will be sluggish. The table above gives the main trends expected (click on table to enlarge).

Austerity measures are impeding recovery

Foreign demand for French goods and services declined from a quarterly rise of +3.7% in mid-2009 to a quarterly rise of only +1% in the third quarter 2010 and is expected to stagnate at 0% in the first quarter of 2011. This is the first brake on French growth forecast by INSEE. Another significant figure found on the above table is the foreign trade balance which is expected to contribute negatively to French growth by -0.5 points in the first half of 2011.

But the restrictive policies adopted by the government of French Prime Minister François Fillion are reducing domestic demand and this is another factor slowing economic growth. For decades a major component of economic growth, domestic demand is currently very weak and is forecast to rise by a mere +0.2% in the first quarter 2011 and by only +0.3% in the second quarter. Should this forecast be accurate, it will not come as a major surprise since household consumption is expected to stagnate, according to INSEE, and rise by only +0.1% in the first quarter and by +0.2% in the second.

Restrictive European and French policies are behind the expected result. French growth will be constrained and is forecast to increase by +0.3% in the first quarter of 2011 and by +0.4% in the following quarter. INSEE forecasts are for the first half of the year only.

In short, if French growth continues at the same sluggish pace of +0.4% per quarter in the third and fourth quarters, total growth for 2011 will be no better than the dire +1.6% expected for 2010. Growth this year was affected by recession in 2009 when growth collapsed by -2.5%. In addition, austerity measures are impeding recovery all over Europe and especially in France.

Business on road to recovery while households struggle

Looking beyond the figures presented by INSEE in the report's overview and studying more closely the details of the forecast, it's easier to see the mechanisms in play. The government is following policies that almost completely spare businesses from the weight of the crisis while making households pay a high toll.

This is hardly a revelation given that at the height of the recession, in 2009, the government adopted a number of measures to aid various industries (automobile, banks, reform of business taxes, lower VAT for restaurants) but did nothing to favour households. Or rather, it implemented a number of measures detrimental to households such as freezing minimum wage and slashing civil service jobs.

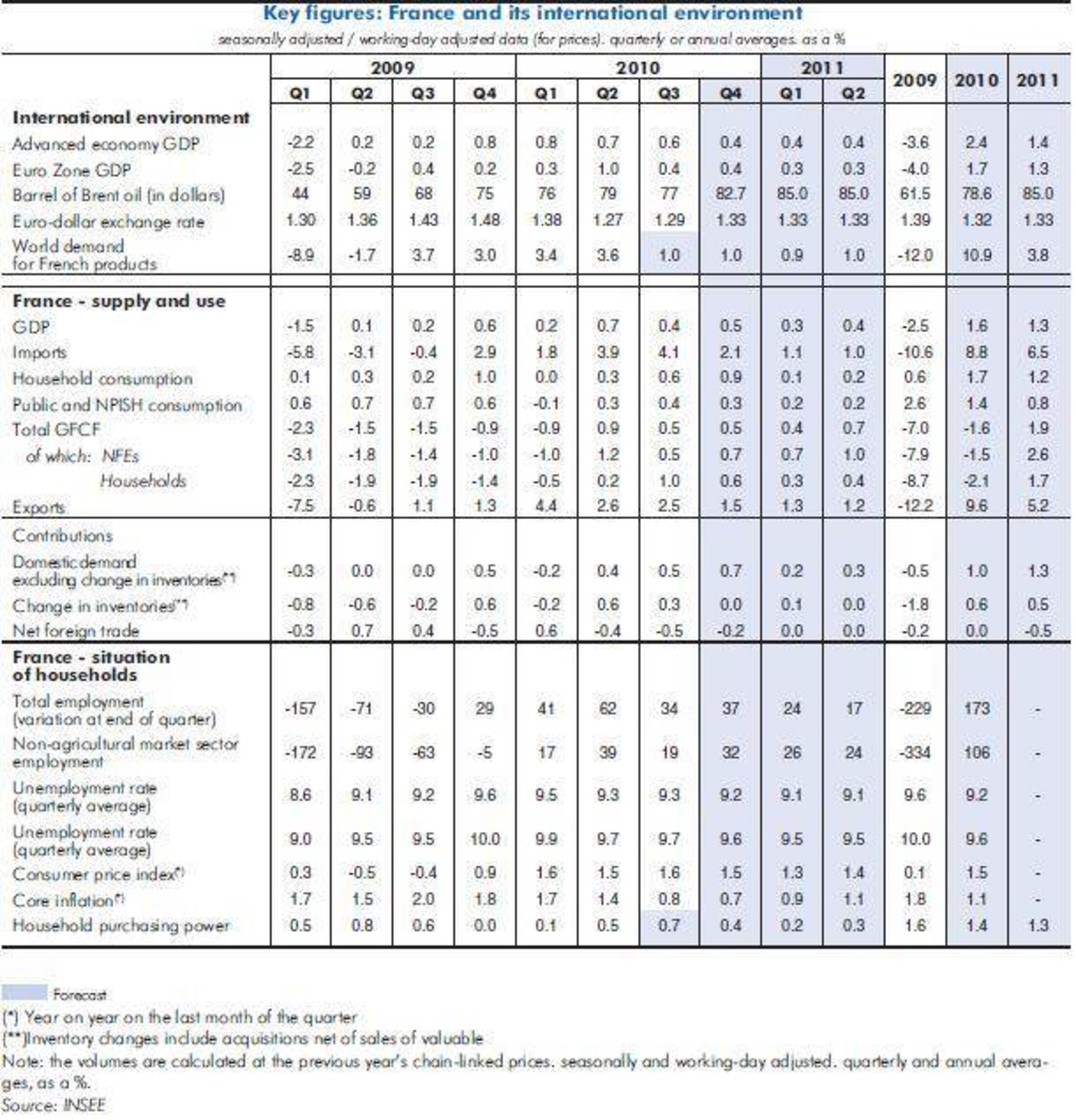

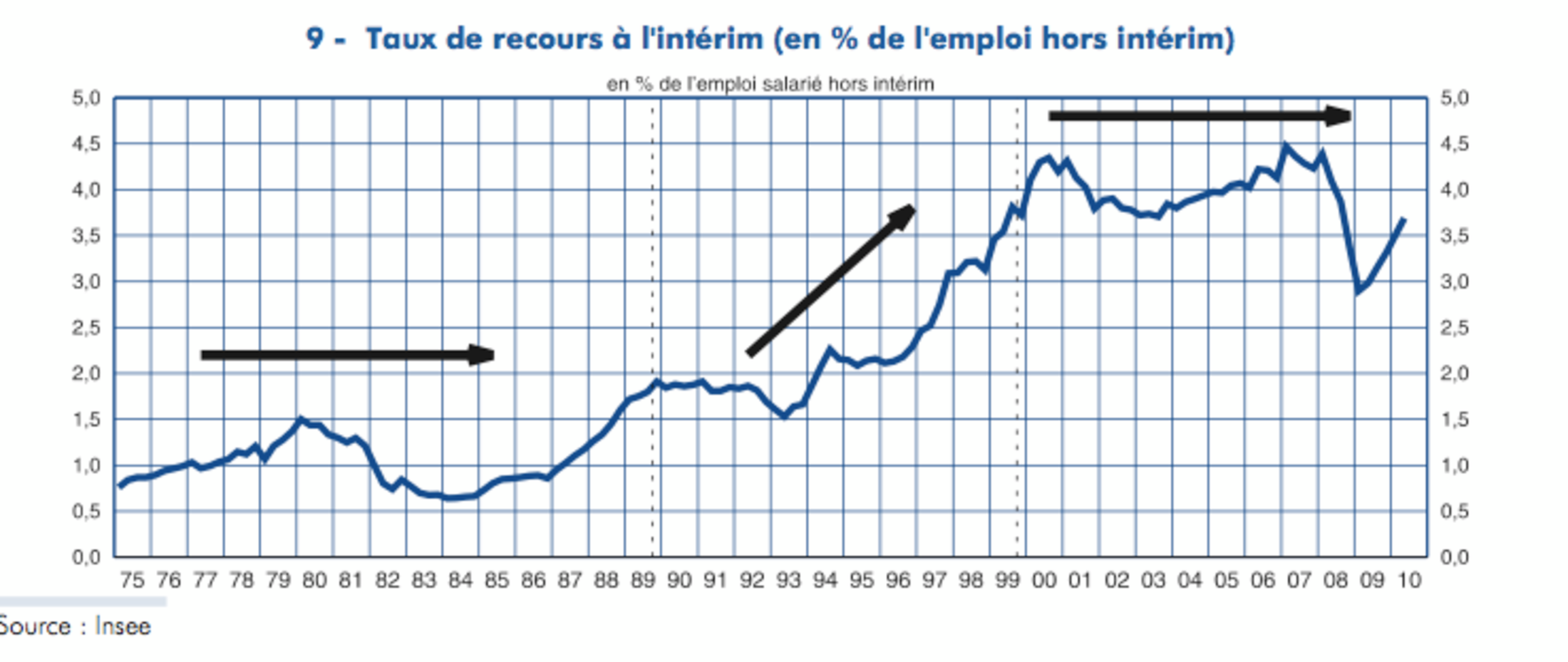

The INSEE figures show that France opted for social adjustments in response to the crisis. The graph below shows that for businesses the margin rate (ratio of gross operating margin to added value) fell sharply during the recession. But it also shows that that it rapidly rose again and that if it isn't quite at the same level as before the crisis, it's not far from it.

Graph below shows margin rate for non-financial companies as a % of added value (available in French only: click to enlarge).

Enlargement : Illustration 2

It's a different story for households. They have become the sacrificed of the crisis, paying the price in terms of employment (and thus of unemployment) and in terms of purchasing power.

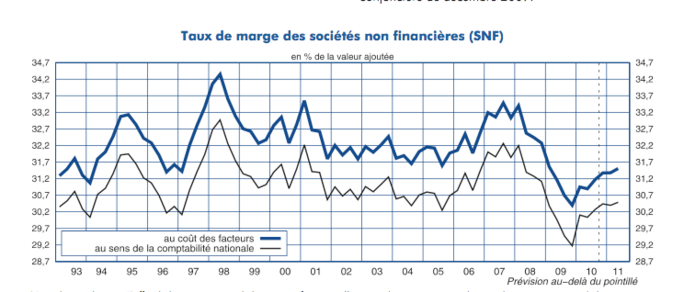

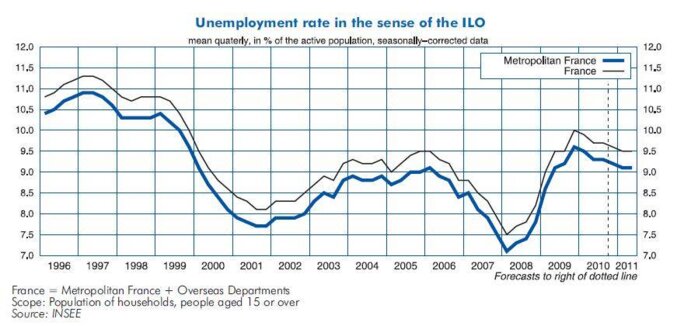

Considering employment first, the effects of deregulation of the labour market for the past two decades by governments of both the Right and the Left has led to an increase in short-term and part-time employment, particularly temporary jobs. Because of this, when the recession hit, the adjustment was abrupt: temporary employment melted away. That is one of the consequences of job flexibility. Employee protection measures such as obligatory retraining, severance pay commensurate with time on the job and other troublesome complexities of labour law can be bypassed. Companies can simply cancel temporary contracts when activity falls and reactivate them when it picks up again.

Graph below shows rate of recourse to temporary employment (as a % of non-temporary employment).Available in French only: click to enlarge.

Enlargement : Illustration 3

Disposable income forecast to shrink

The figures show that in the first half of 2010, job creation in the service sector rose with 103,000 jobs created, but most of those (57,000) are temporary jobs. In short, the 2009 recovery favoured casual employment and low-wage jobs.

In addition the government's austerity budget measures led to a reduction in assisted job contracts1 which fell from 88,000 new jobs in 2009 to 57,000 in 2010. According to INSEE, non-market jobs should be cut by 14,000 in the first half of 2011. Furthermore, the restrictive climate, combined with the rise in temporary jobs, makes companies less willing to take on permanent hires.

The result is overwhelming. Total employment is expected to rise by no more than +41,000 in the first half of 2011 compared to a rise of +71,000 in the second half of 2010 and an increase of +103,000 in the first half of the year. Diminishing job creation is clearly the result of the austerity plans which have, in addition, slowed the recovery.

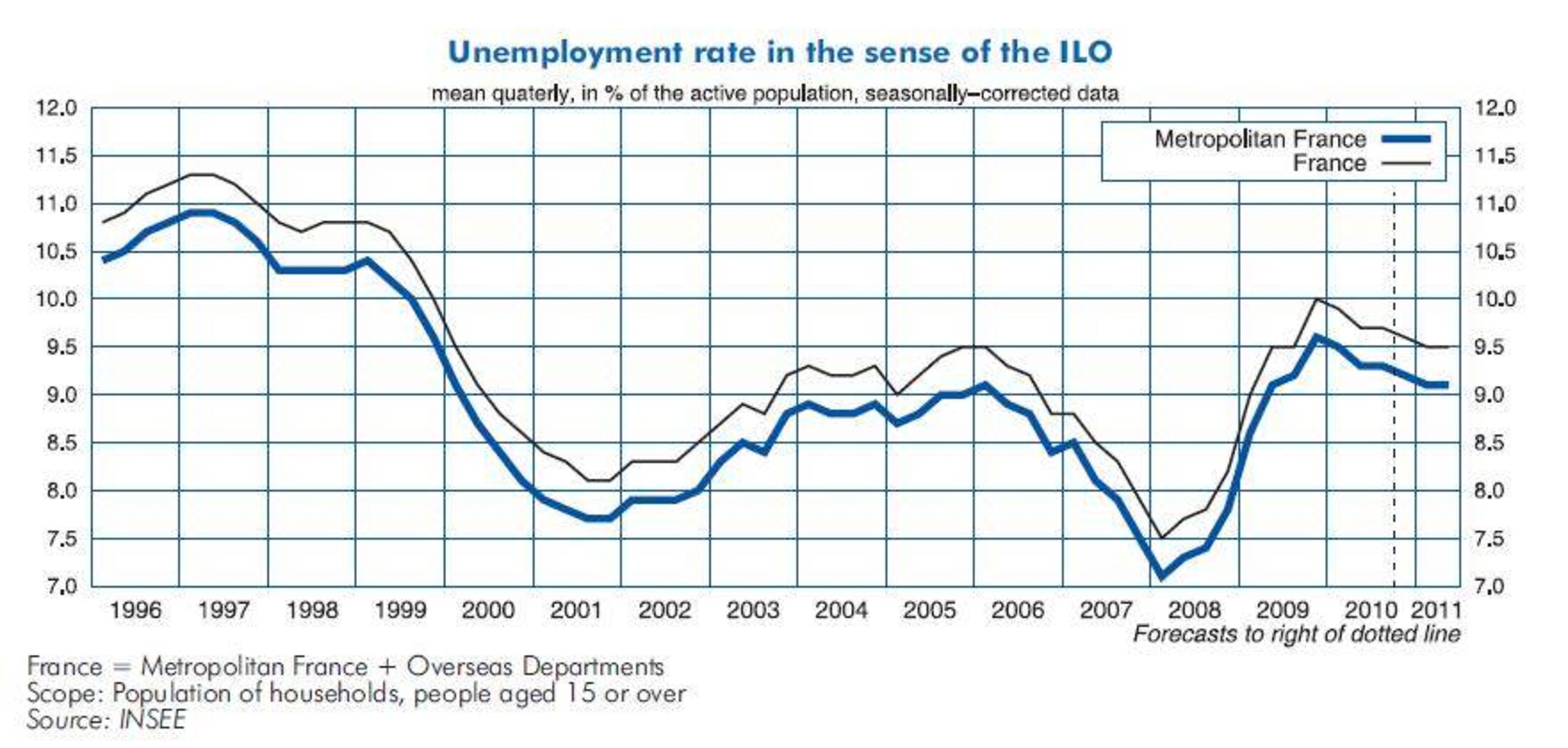

Enlargement : Illustration 4

(Click on graph to enlarge)

At the same time, a combination of events will ensure that France's unemployment rate remains at a high level. With an unemployment rate of 9.5% of the workforce (including overseas départements2) expected in the second quarter 2011, it clearly will be below the 10% level attained in the last quarter of 2009. But the reduction in unemployment remains minimal because, once again, if businesses benefited from government policies, households did not and employment incentives were the first to be sacrificed.

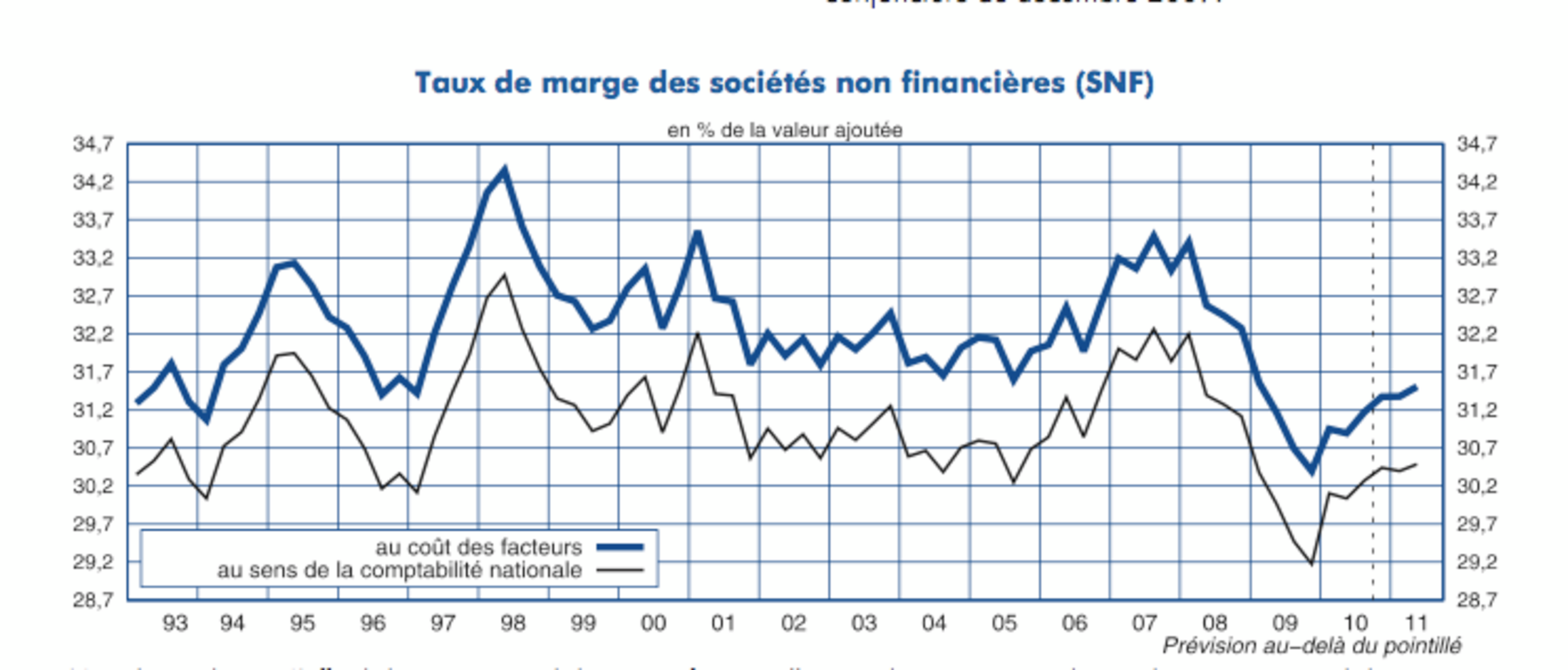

A reading of the table below (available in French only) could lead to believe that changes in purchasing power, at least, have been more favourable for households. INSEE data shows a rise of +1.4% in gross disposable income in 2010 and forecasts a rise of +0.9% in the first half of 2011.

(Click on table to enlarge)

Enlargement : Illustration 5

However, INSEE notes that the unit of measure of purchasing power of disposable income is misleading because it doesn't take into account demographic changes. It is thus not a proper reflection of what the French experience on the ground. INSEE therefore, proposes a different method of measuring purchasing power. "In 2010, the purchasing power of each consumption unit3 rose at the same rate as in 2009 (+0.8%). Per resident, the increase was of +0.4% while the purchasing power per household fell by -0.4%," INSEE said.

This explanation is not found in the body of the INSEE survey but is buried in a footnote on methodology. Yet this is an important piece of data: purchasing power is contracting.

This is due to a recession whose effects are still being felt. It is equally caused by the accumulation of European austerity plans and restrictive economic policies within France.

------------------------

1: Job contracts which directly or indirectly reduce an employer's costs. These can, for example, take the form of recruitment subsidies, lower payroll charges or exemptions from payroll charges.

2: Martinique, Guadeloupe, French Guiana and Reunion Island.

3: A member of a household. Different weights are attributed to adults and to children. For INSEE's detailed definiton click here.

English version: Patricia Brett