Barclays bank agreed a multi-million-euro loan to a Lebanese arms dealer now at the centre of a major French political corruption scandal despite its knowledge that his vast personal fortune was hidden from the tax authorities in money-laundering offshore companies, Mediapart can reveal.

In a confidential document published exclusively here, a senior manager with the bank's private client arm, Barclays Wealth, recommended the 13.6 million-euro loan to Ziad Takieddine while suggesting the latter would act as a business partner to help the banking giant further its activities with the now-deposed regime of late Libyan dictator Muammar Gaddafi.

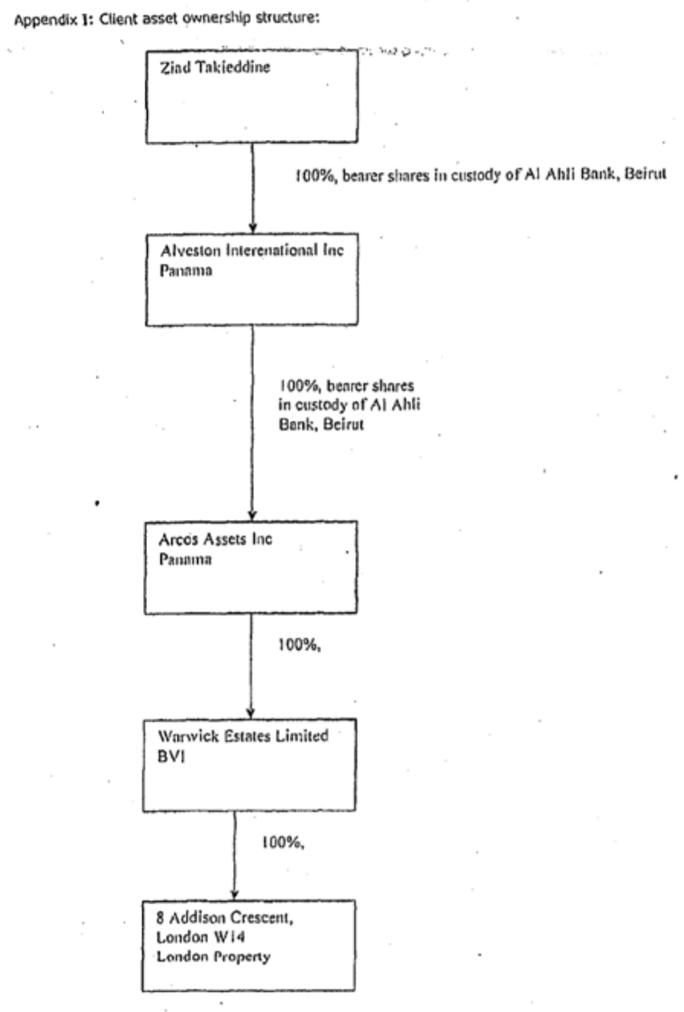

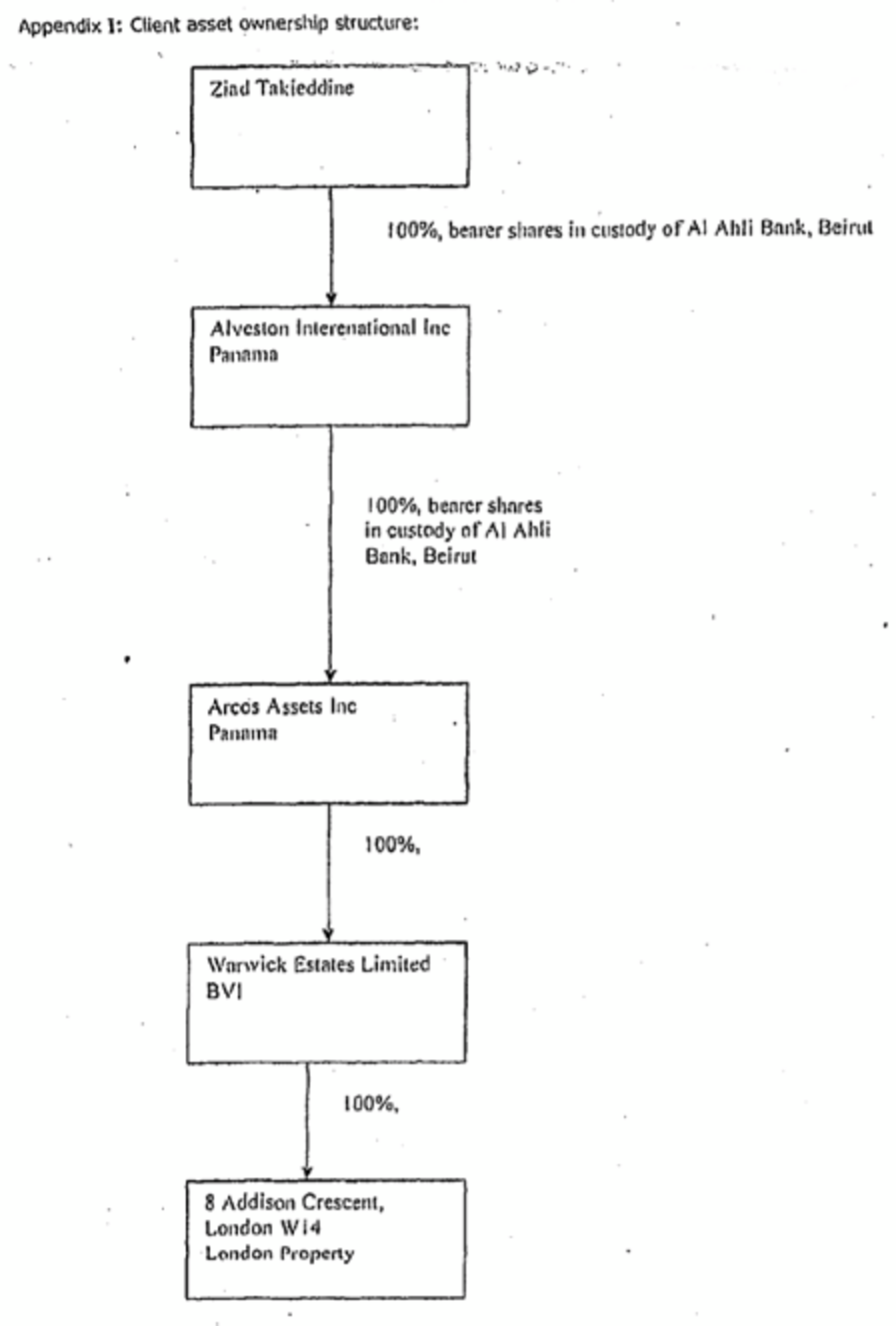

The loan to arms dealer and business intermediary Takieddine was made by Barclays in February 2009 after a detailed investigation by the bank had established that his income and assets, including his luxurious Paris apartment, French Riviera villa and a mansion in London, were managed by a series of offshore companies based in tax havens, including Panama, the British Virgin Islands and Luxembourg. The sum was transferred into accounts belonging to Takieddine in London and Monaco.

Takieddine, 62, is a key suspect in an ongoing French judicial investigation into a suspected high-level money laundering and illegal political financing scam, notably via commissions siphoned off from French weapons sales abroad, over a 19-year period from 1993 to 2012. He is suspected of playing a leading role in establishing a shady international financial network to handle secret cash transfers of funds from the deals back to Paris.

Takieddine, a business intermediary with close professional and personal ties to former French President Nicolas Sarkozy’s senior staff, is currently under investigation on a total of three separate counts of financial corruption and offering false statements, all in relation to the investigations into illegal political funding.

In April this year the magistrates in charge of the investigation, judges Renaud van Ruymbeke and Roger Le Loire, placed Takieddine under formal investigation – a French legal status one step short of being charged – for “having organized [his] insolvency, since 1995” through a process of money laundering via “a structure” of companies in Luxembourg.

The Paris-based judges have now frozen Takieddine’s assets in France, where his wealth is estimated to total more than 40 million euros and upon which, as Mediapart has previously revealed, he avoided any tax payments.

“Given the client’s political connections in France, and the nature of his business, it appears clear that he should be designated a PEP,” – an acronym for ‘politically exposed person’ -, wrote William Harford, a manager of the Barclays’ private client arm, Barclays Wealth, in a report recommending the loan and dated November 18th 2008.

“As is to be expected of a client of Ziad’s nature, his assets are owned by way of offshore SPV structures, although he, and not a Trust, is the direct beneficial owner of all of them,” approved Harford. 'SPV' is an acronym for a company set up to serve a particular role and known as a 'special purpose vehicle'.

“Due to the client’s [Takieddine’s] residence in Paris, his asset-holding structure is quite complex…a diagram of the structure as it related to our relationship is included in the appendix to this report,” Harford reported. In a clear reference to Takieddine's tax situation in France, Harford later added that “it is highly likely" that the income Takieddine declared to the bank was a "conservative" estimate, "as this only represents income from disclosed assets."

"It is probable," the wealth manager underlined, "that the client has cash/investment assets further to the declared position, but he is reluctant to discuss his full cash balances with 3rd parties at this stage in the relationship. His French residency, and associated tax regime, means he is cautious when discussing taxable income and assets.”

The loan was destined for the acquisition by the arms dealer of a 40-seat, converted Boeing 727-200 and the re-financing of his £14 million-pound London property, the ownership of which, as Barclays noted, was listed under a British Virgin Islands company belonging to Takieddine.

Takieddine used one of his offshore companies for the payment of commissions on a deal he brokered to sell the Gaddafi regime a French-engineered internet surveillance system for spying on its opponents. That contract, involving French company Amesys, now part of IT group Bull, is now the subject of a Paris-based judicial investigation for “complicity in acts of torture” by the former regime in Tripoli.

Another company, Athanor Securities, based in in Luxembourg, served for commissions Takieddine earned as intermediary in a deal between Libya and French oil company Total. As part security for the loan, Takieddine offered Barclays custody of his shares in Athanor, estimated to be worth 20 million euros.

Takieddine’s connections with the Gaddafi regime so impressed the bank that Harford’s report concluded “there are significant business development opportunities from this client” whose contacts in Libya were described as “of the highest order”.

Harford and his colleague Alfred Shurky, head of the London desk of the Barclays Wealth Middle East and North Africa Team (MENAT) met with Takieddine in Paris before recommending that the arms dealer should become one of the bank’s privileged private clients.

“His contacts and influence in Libya are significant, and we are actively pursuing business in that country,” noted Harford. “A subsequent meeting between Ziad and Alfred Shukry confirmed our expectations of his influence in Libya and identified significant potential opportunities for partnership between him and the Barclays group in the country.”

“He has impeccable business, personal and official contacts in France, Libya and Lebanon, and has significant influence with a number of them,” noted Harford. "It could prove extremely beneficial, should we be able to provide the facility requested, to have a man such as Ziad speak well of the bank to his acquaintances.”

At the end of his report, Harford added that "I was much encouraged by Ziad’s understanding of our desire to avoid lending-only relationships."

Mediapart has previously published a series of investigations revealing how Takieddine served as the principle intermediary both in a series of business deals mounted by Sarkozy’s aides with several Arab countries, and also as the organizer of Sarkozy’s introduction, before he became president, to Colonel Gaddafi (see links to these at the end of page 2). Mediapart’s revelations, together with compelling evidence collected by Van Ruymbeke and Le Loire, have raised grave questions over the purpose of Takieddine’s dealings on behalf of Sarkozy’s office with Libya, Syria and Saudi Arabia.

Barclays signed loan deal with Takieddine's butler

“Ziad’s business is primarily derived from arranging contracts between the French government and the Middle East, specifically Libya and Lebanon,” Harford wrote in his November 2008 report which is now held as evidence in Van Ruymbeke and Le Loire’s investigation. “He is a personal acquaintance of the French Premier [sic], Nicolas Sarkozy, and was responsible for introducing him to the Libyan government.”

“His current income is derived from a contract he negotiated - for the provision of electronic surveillance equipment for monitoring email and Internet traffic – between the French and Libyan governments,” Harford continued. "This contract has EUR 5M to pay over the next 2 years.”

"His latest, and most significant, venture has been the facilitation of a deal between the French energy company, Total, and the Libyan government for the provision of electricity to the country. The services will provided [sic] via a floated Luxembourg SICAR, Athanor, of which Ziad owns 6.5%."

Harford detailed that “our lending relationship will be with the BVI [British Virgin Islands’] SPV that owns the London property.”

He set out a list of the offshore companies Takieddine used as a front ownership of a number of his assets, and their worth:

"London Property: ownership via Panamanian SPV [special purpose vehicle], Arcoss Assets Inc, value GBP 14M

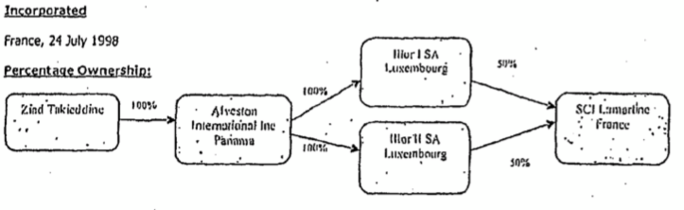

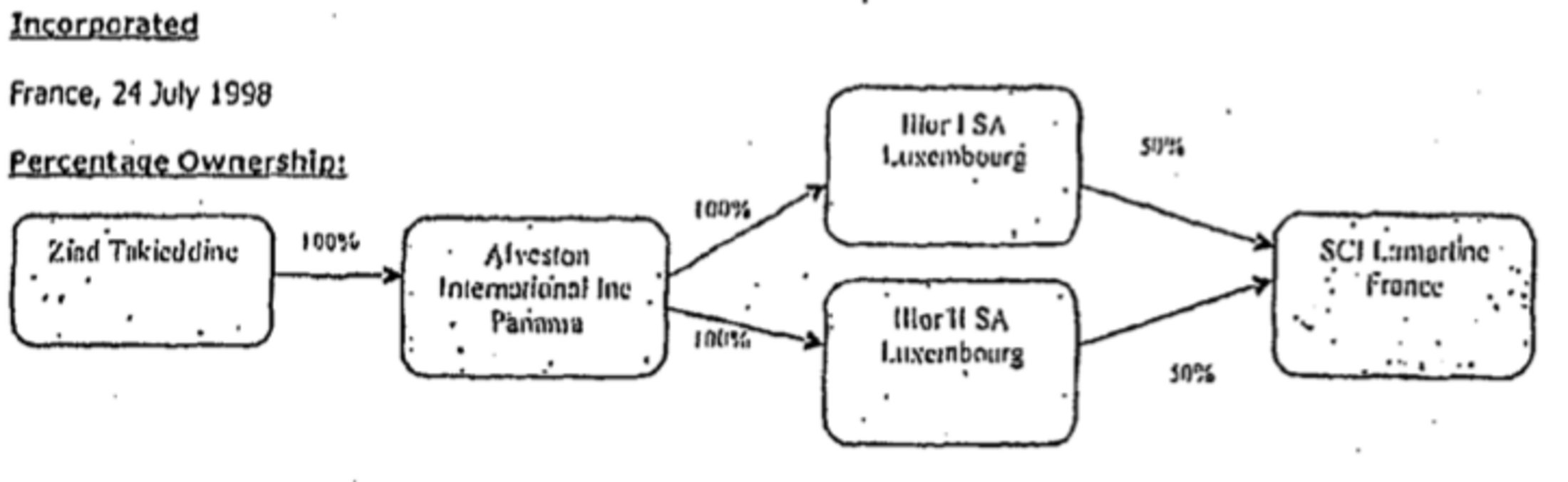

Paris property – ownership via Luxembourg SPVs, Illor 1 and Illor 2, value EUR 10M

Paris office: owned via Luxembourg SPV, Immobilière Rivoli SA, value EUR 2M

Cap d’Antibes property, ; owned via Luxembourg SPV, Riviera Property SA, value EUR 19M

Lebanon property – direct ownership, value EUR 7M

Yachts – owned via Immobilière Rivoli and Arcoss Assets, value EUR 6M."

In an appendix, Harford presented the ownership structure of Takieddine's offshore companies (see below).

Enlargement : Illustration 6

Enlargement : Illustration 7

In the top diagram above, Harford illustrated how a French company called Lamartine, which he described as “an investment vehicle for a property in Paris”, is owned by Takieddine through a complex structure of companies in Luxembourg, Panama and Lebanon. Harford noted that he had gained confirmation that Takieddine was “the ultimate sole beneficiary and owner” of Lamartine, whose “sole significant assets” was Takieddine’s luxury apartment in Paris, for which the arms dealer was also seeking a short-term re-financing loan from Barclays.

“The signatory and gerant of SCI Lamartine is M. Alain France, who holds the position in a purely professional category,” assured Harford in his report.

In fact, Alain France was none other than Takieddine’s Paris butler, used as a front man in the deal. Questioned by French police in March last year, France gave a statement saying: “I signed the loan request in the presence of Monsieur Takieddine and the Barclays director […] I am aware that I was the legal manager whereas Monsieur Takieddine was the real manager.”

Contacted by Mediapart, Barclays declined to comment.

William Harford has left Barclays and is now the General Secretary of Khashoggi Holding, a ‘private family office’ of Saudi Arabian arms dealer Adnan Khashoggi. Alfred Shukry left his position with Barclays Wealth in April 2009.

-------------------------

For more about the issues raised in this article, click on the links to Mediapart's investigations below:

Mediapart lawyers call for key Sarkozy-Gaddafi election payment witness to be heard by French judge

French government stalls Interpol call for arrest of Gaddafi funding chief

Sarkozy attacks Mediapart over Gaddafi funding revelations

Gaddafi funding of Sarkozy election campaign: the proof

Exclusive: secret report describes Gaddafi funding of Sarkozy's 2007 election campaig

French IT group Bull horned by Libyan internet espionage deal

French judge finds key evidence in illegal funding probe

Net closes in on French presidency after funding 'scam' arrests

Arms dealer probe brings illegal funding scandal closer to Sarkozy

The secret financier who brings danger to the Sarkozy clan

Sarkozy, the arms dealer, and a secret 350 million-euro commission

Exclusive: how Sarkozy's team sought grace for Gaddafi's murderous henchman

Exlusive: how President Sarkozy's team dealt with Gaddafi

When Total paid the bill for the Elysée's secret emissary

The French-built stealth offroader that may be hiding Gaddafi

-------------------------

English version: Graham Tearse