WikiLeaks divulged the draft text of the TISA Financial Services Annex last month (see document below), revealing a raft of proposed deregulation measures that would snuff out all action to rein in the financial sector’s practices following the financial and economic crisis that burst in 2008.

The negotiations are being largely steered by the US and the EU in discussions with Australia, Canada, Chile, Taiwan, Colombia, Costa Rica, Hong Kong, Iceland, Israel, Japan, Liechtenstein, Mexico, New Zealand, Norway, Pakistan, Panama, Paraguay, Peru, South Korea, Switzerland, Turkey.

The documents revealed by WikiLeaks concerning the deregulation of the financial services sector, which would also see an unprecedented cross-border access of private data, is cloaked in such secrecy that participants to the talks are ordered to make no photocopies nor use any unsecured computers in their work on the treaty – the details of which, it is stipulated, will only be declassified five years after it is implemented.

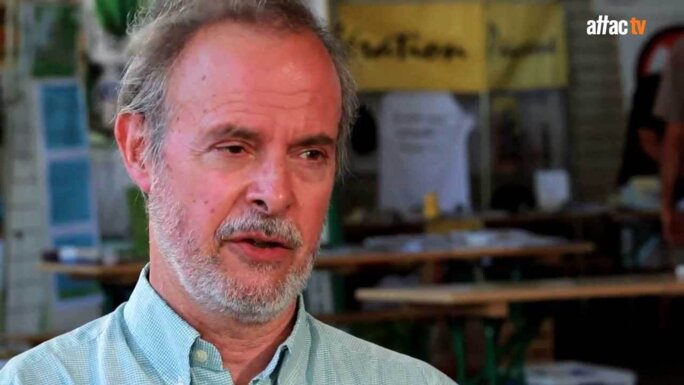

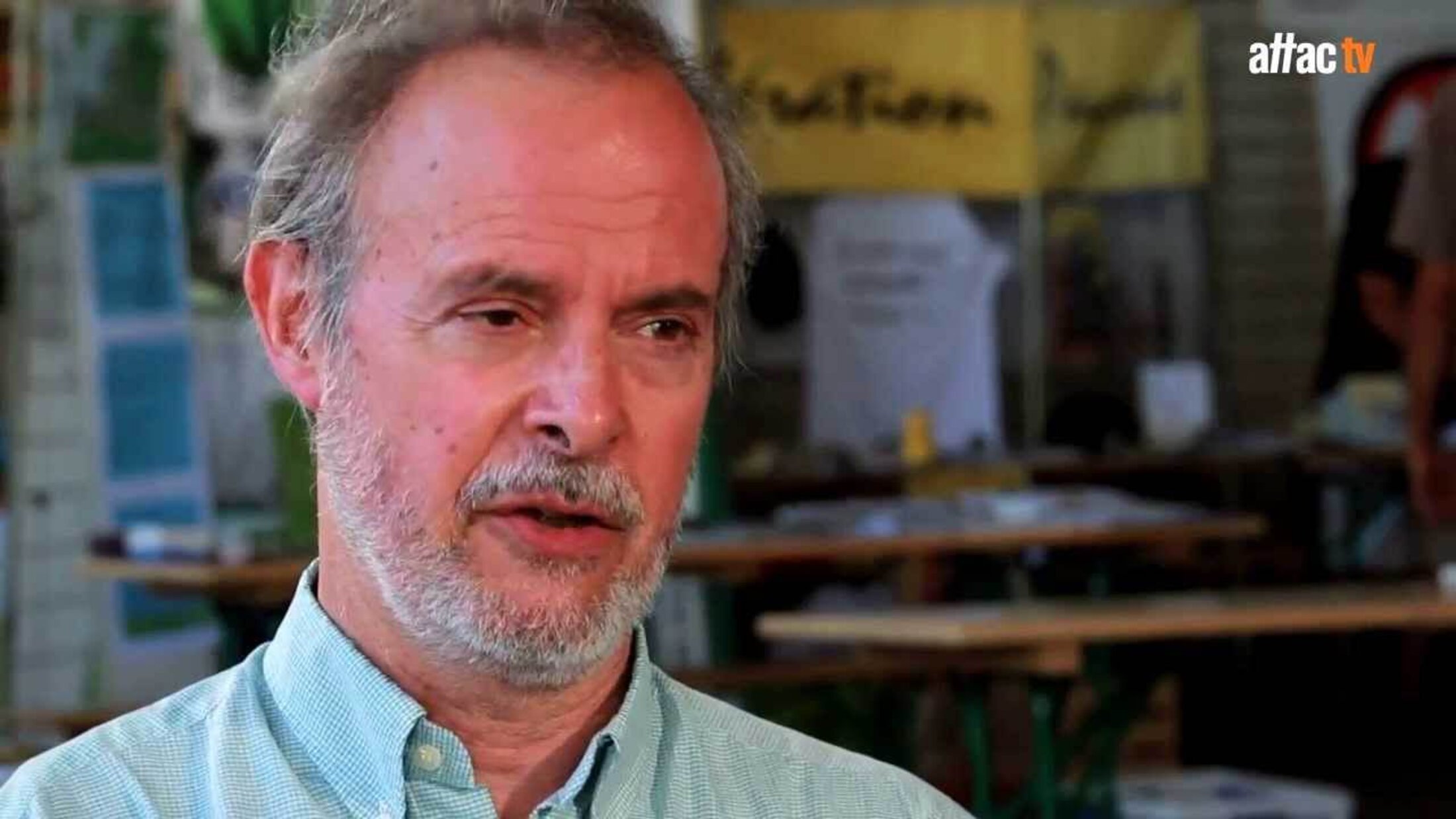

In the interview below, economist Dominique Plihon, an outspoken critic of deregulation of the financial sector and a leading member of the alter-globalization movement ATTAC, argues that the "staggering" TISA deal even threatens state-run pension and social security guarantees, and illustrates how governments "are disconnected from the rest of society".

-------------------------

Mediapart: Without the revelations by WikiLeaks, the details of the international negotiations for the deregulation of financial services would have remained unknown. What are the objectives of these secret talks?

Dominique Plihon: What we have now discovered is hardly surprising. All the negotiations within the framework of the World Trade Organization are at an impasse. A certain number of states decided, under pressure from the financial lobbies, to pick up with the discussions on financial services. Countries like Brazil and India don’t want to hear about this. But the others, led by the United States and the European Union, along with 22 [other] countries, hope to create a movement and reach an agreement that will end up binding everyone.

The paradox is that the United States refuses to discuss financial services in the framework of the [EU-US] transatlantic [free trade] treaty. Whereas here, it appears to be fully engaged in discussions. This contradiction seems to indicate that the points of view between different American bodies diverge. Likewise, the International Monetary Fund appears in disagreement with this deal project, if one puts faith in the positions it’s taken. Indeed, according to the international institution, it is not desirable to go back on the guiding structures decided since [the financial crisis of] 2008 to reinstall deregulation.

But the financial lobbies are powerful. They want this treaty in order to have the means of countering new financial regulations. An agreement on financial services, adopted at an international level, would for them be the best guarantee for the future. That would place the principles of a global deregulation and would prevent, like a wheel-blocking mechanism, any turning back, any attempt to control finance. That is the aim of this project of agreement – to prohibit with a treaty any financial regulation.

BELOW: the draft text of the TISA Financial Services Annex as published by WikiLeaks on June 19th. The interview with Dominique Plihon continues on page 2.

Mediapart: According to the documents revealed by WikiLeaks, the draft of the deal allows for a wide liberalization of all financial services. Which are the sectors most under threat?

D.P.: The text is complicated on a legal front and full of ambiguities. But it appears, clearly, that everything can be placed into question. From maritime insurance to sovereign funds, from the livret A [savings account] to the financing of social [subsidized] housing, everything that carries the mark of the state is under threat. There are dangers of dismantlement everywhere. Everything could be opened up to competition, everything will be called upon to no longer include either state control or guarantees. In this project, there is not one market segment that appears due to escape the grip of the financial world.

Even our pension and social security systems appear threatened. The text uses the Anglo-Saxon model of public pension schemes as its reference. What is obvious is that the authors refuse any public monopoly on pensions and social [welfare] insurance. For them, that constitutes an unacceptable competition for pension funds and private insurance.

From this we can fear that our pay-as-you-go pension system is under threat, like our social security system. That, at any rate, is what can be deduced from the broad base of the agreement. Even if there are numerous ambiguities in the wording, the aim is to remove all obstructions for the financial players, to hand them everything. On the opposite, freedom will be given to innovating financial products, like the Credit Default Swaps, which were at the origins of the financial crisis.

Enlargement : Illustration 2

Mediapart: How can one explain that governments, after all the engagements made since the financial and economic crisis, have agreed to discuss such a treaty project?

D.P.: It is obvious that states have turned their coats. They appear to be once again ready to hand everything over to the banks. This project is a monster. If it sees the light of day, it will remove any capacity for the state to regulate finance. The thin progress that has been obtained these past few years - the problems regarding stability of the financial system, a control of the banks – everything will be abandoned. Whereas the crisis has demonstrated the importance of states, which are solely capable to rush in aid of the banks, the project is to deny them any power.

They have begun [behaving] again as before, re-adopting the same dangerous behaviour. The banks have learnt nothing and our political leaders let them get on with it. One can only note the enormous gap between them and us. The authorities are disconnected from the rest of society.

Mediapart: Can this treaty be followed through all the way?

D.P.: The negotiators manifestly hoped that there would be no leak, to be able to continue to negotiate in secret. That has become a habit. The [EU-US] transatlantic [free trade] treaty is also being negotiated in secrecy and we still don’t know the text of the [previously concluded EU trade] treaty signed with Canada.

In the case of TISA, the negotiators are so attached to secrecy that the draft agreement allows for the deal to remain secret for five years after its adoption. This clause is staggering. There you have an agreement which is to be enacted, to serve as a reference point for all other treaties, but without being made known.

The WikiLeaks revelations are a stroke of bad luck for them. They no longer have the benefit of discretion. I think it will become very difficult, but every vigilance must be kept.

-------------------------

- The original French text of this interview can be found here.

English version by Graham Tearse