Last December, French group Cauval, the largest bedding company in Europe, better known for its brand names Dunlopillo, Simmons and Treca, observed a sudden drop in orders. It was an unusual time of the year for such a trend given the imminent winter cut-price sales when furniture and bedding stores prepare for a particularly busy period.

For the first time, none of Cauval’s three brand names – which are among the most popular in France – were included in the winter catalogue of the major French furniture chain store But. For Cauval, the inexplicable event was of serious concern, for But is one of the company’s top two clients - along with another leading French retail chain, Conforama - and represents 25% of its annual 400 million-euro turnover.

While Cauval’s sales to Conforama were up 36% year-on-year for the winter sales period, they were down by 26% at But.

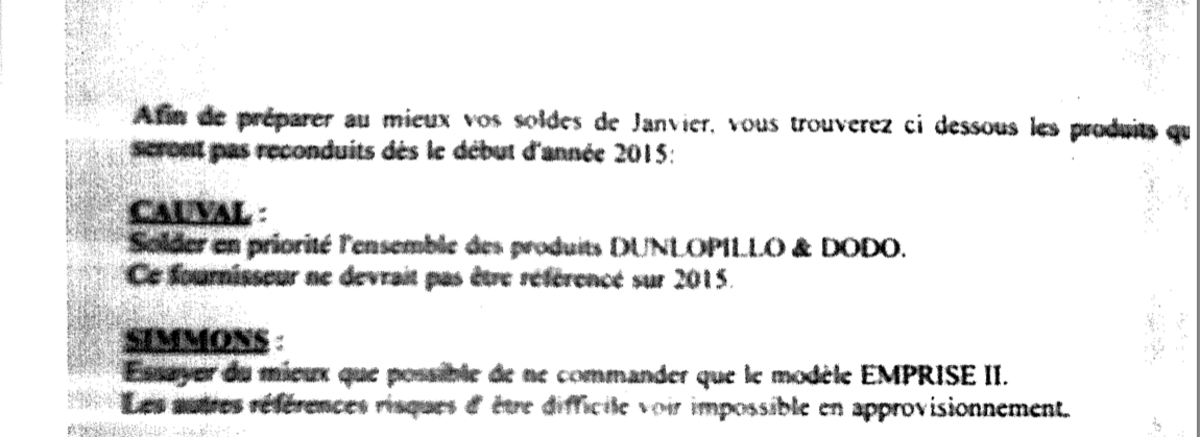

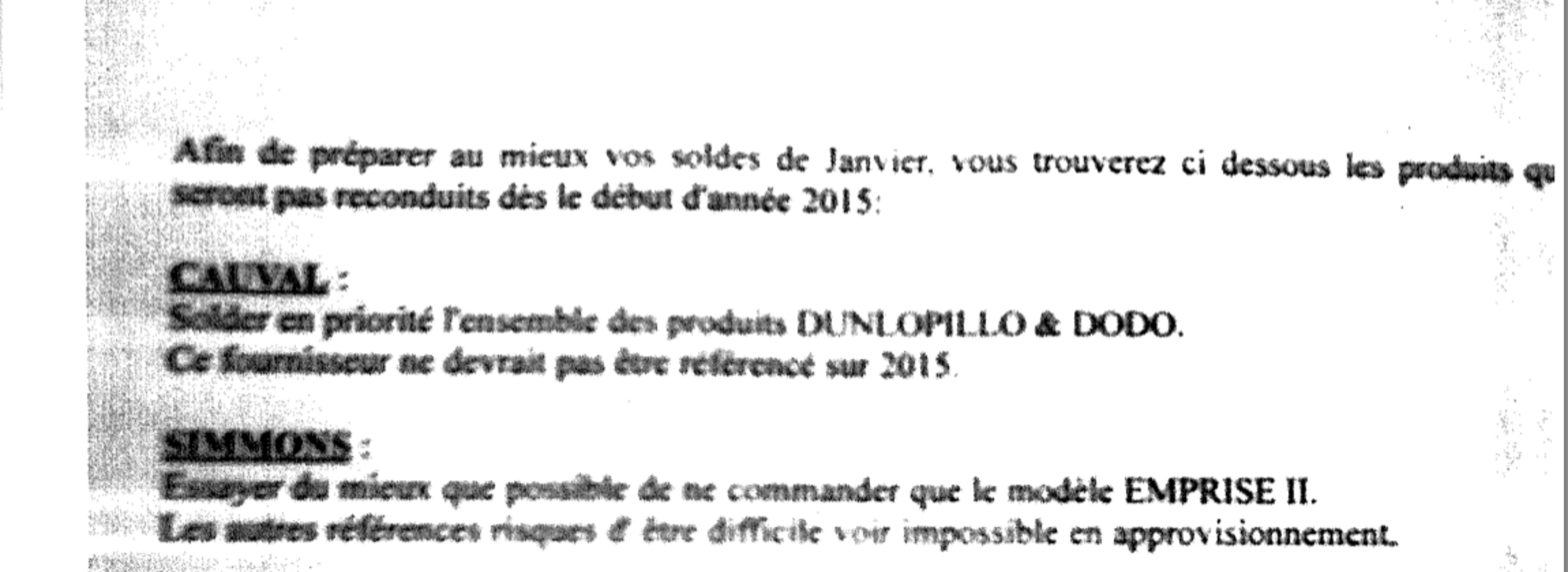

Cauval soon learnt that But was in the process of ending its commercial relationship with the bedding firm, but without informing it of the move. Cauvel learnt that But’s management had sent out an internal message (see below) on “products that will not be continued as of the beginning of 2015” to its franchise stores, listing Cauvel trademarks and telling the franchisers to “make a priority of price-cutting the totality of Dunlopillo and DoDo products”, adding: “This supplier should not be referenced for 2015.”

Enlargement : Illustration 1

Cauval vice-president Gilles Silberman, who is also its major shareholder, has recounted to Mediapart a version of events which, backed by other witnesses, presents a disturbing story about the opaque worlds of mass-market retailing and private equity businesses.

Since the events began last December, the bedding group, which employs 3,000 people, has been hit by a wave of cancelled orders and demands for cash-on-delivery from its suppliers who refuse to give the company a period of credit. Others have asked the company directly whether the rumours circulating that it is about to declare bankruptcy are true. They were not, in fact.

However, the rumours were lent credence given the past difficulties the group has found itself in due to the slump in the furniture retail business since the beginning of the financial and economic crisis in 2008. In 2009, the group was forced to negotiate a business safeguard plan with the Meaux commercial court, when half of its staff was laid off. The company remains under the surveillance of a receiver. In the summer of 2014, it was unable to pay an 8 million-euro backpayment demand from the tax administration, and succeeded in negotiating a staggered refund of the sum.

French law requires that retailers inform their suppliers about changes in their contractual relations. It recognizes that suppliers have a significant economic dependence on large retailers and should be given a reasonable amount of time to find new outlets in the event that the retailer no longer wants to continue with their products. Several large retail groups have in the past been sentenced by French courts for ending their dealings with suppliers without prior notice.

“Since November, relations with But’s management became strained,” said Gilles Silberman. In mid-December, But sent Cauval a letter on the subject of a 2 million-euro credit it gave Cauval in July 2013. “It was a financing system put in place to compensate an insufficient credit insurance by But regarding our factor,” said Silberman. “But we owe them nothing. But was reimbursed by the amounts on the bills to be paid. It’s they who owe us money.”

Mediapart attempted to contact But CEO Franck Maassen on several occasions but he never returned our calls.

Meanwhile, at the end of January this year, a manager with the French furniture retail chain La Halle au Sommeil sent out an alarming email to the company’s franchise stores. The message, which Mediapart has seen, read: “The Cauval group appears to be doing badly […] The national furniture federation has warned me of an imminent filing for bankruptcy. The large groups have also warned me. This group [Cauval] owes money to Conforama and to But who lent money (several millions, not refunded). Their [Cauval’s] suppliers are not paid. Neither are transporters […] Careful, it’s very serious."

'They want us bankrupt to get hold of the company'

Such a message, like others doing the rounds in the furniture sector, could only cause panic among retailers and suppliers, who naturally would refuse to offer credit to Cauval. On February 4th, one of Cauval’s principle suppliers sent one the company’s managers an alarming mobile phone text message. “Just a rumour spread by But to other mattress manufacturers,” it read, “Cauval has ceased payments since 15 days ago.”

The CEO of another French furniture chain store, La Maison de la Literie, has told Mediapart that on January 23rd his operational director received a phone call from Jean-Charles Vogley, delegate-general of the French furniture and household goods trade federation, the FNAEM, to inform her of rumours he had heard that Cauval was heading for bankrupty or receivership. Vogley reportedly said that he was tasked with warning all the members of the federation.

It appears a strange mission given that Vogley had not beforehand tried to establish the situation directly with Cauval. Mediapart attempted to interview Vogley on several occasions, and was finally passed on to his federation’s lawyer Jean-Marc Fedida. “I don’t have knowledge of this approach to La Maison de la Literie so I can’t confirm it to you,” said Fedida. “Mr Vogley has indicated that he was himself warned by a certain number of suppliers about tensions which could lead to believe that certain concerns about the financial situation of Cauval were justified, a situation that no-one takes pleasure from. As of that moment, it is normal that the federation concerns itself about a risk of default which can have consequences on the sector. But this information was given to the federation, it didn’t start from the federation.”

While the destabalisation of Cauval appeared to stem from the deteriorated commercial relations with But, there was no obvious reason for the persistent rumours.

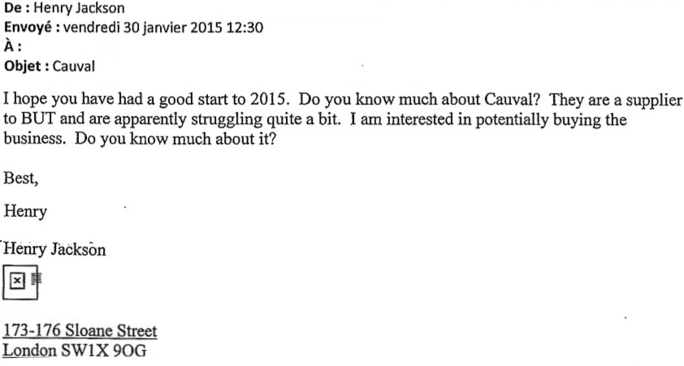

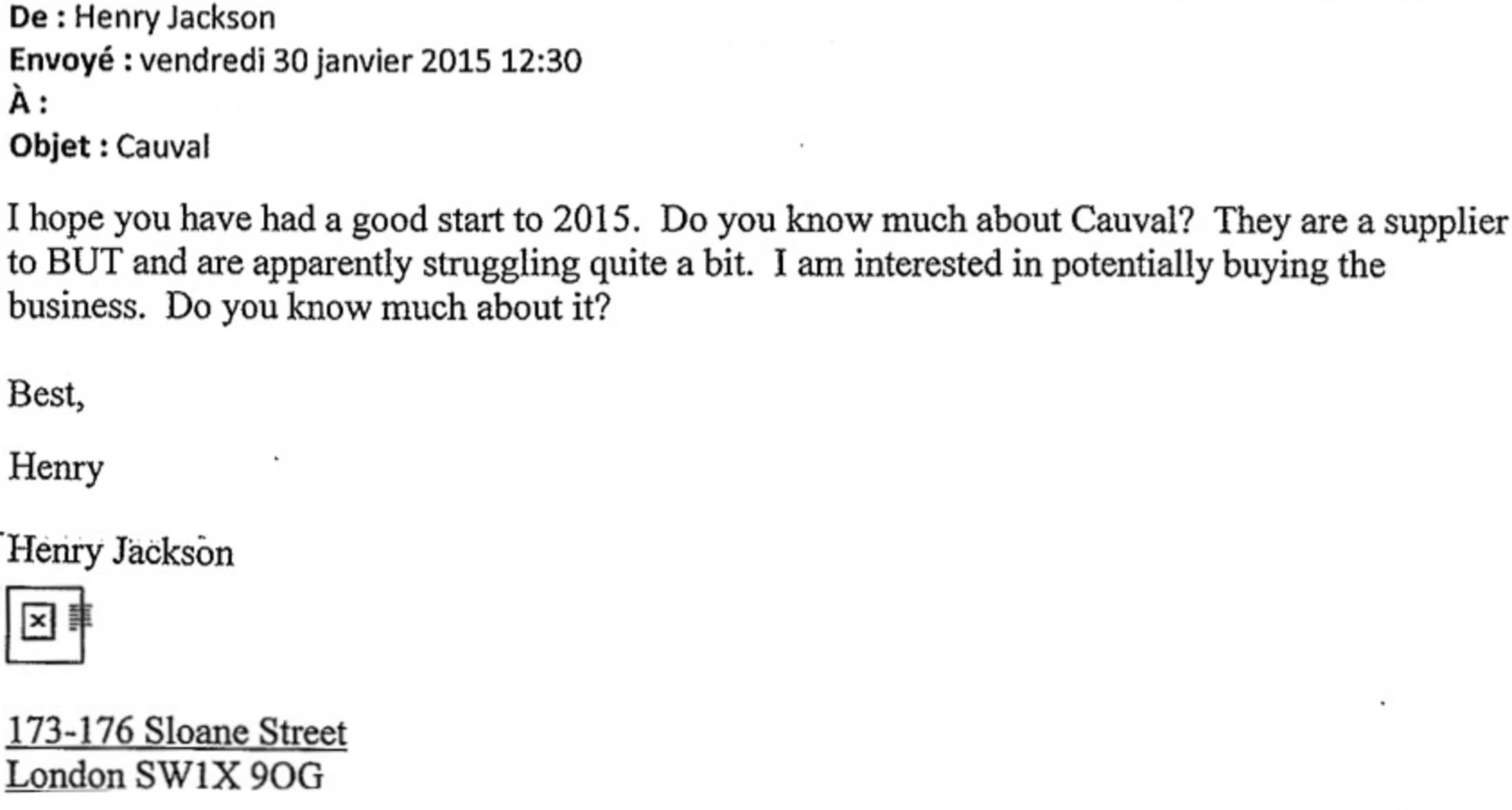

Meanwhile, the group discovered that a London-based American businessman and former banker, Henry Jackson, had expressed interest in buying it up. On January 30th, Jackson sent an email to the head of a French investment fund (see below) asking: “Do you know much about Cauval? They are a supplier to But and are apparently struggling quite a bit. I am interested in potentially buying [sic] the business. Do you know much about it?”

Enlargement : Illustration 2

Jackson’s correspondent said that he was unable to discuss the subject since this would place him in a potential conflict of interest because he is associated with one of Cauval’s shareholders, to whom he passed on Jackson’s email message.

Henry Jackson is the founder and CEO of London-based private equity business OpCapita. His business practices have come into question in Britain (see more here and here), notably over his firm’s purchase for £2 of nationwide electrical goods retailer Comet, which later went bust with the loss of 7,000 jobs but at a considerable profit for OpCapita. The equity firm is also one of But’s principle shareholders, alongside Colony Capital and the bank Goldman Sachs.

Jackson sits on the But board and is in charge for the shareholders of operational control of the retail business. In 2012, a number of But shareholders sought to sell off their stakes in the business, but they found no buyers. In the summer of 2014, But raised 170 million euros for refinancing, and of that sum 103 million euros was handed to its shareholders in the form of loan refunds and dividends.

“All of this campaign of destabilisation is done to push us into bankruptcy with a view to taking hold of the company or even simply its trademarks, in an auction, at a court,” said Gilles Silberman.

Earlier this week Mediapart sent a list of questions to Henry Jackson about his interest in Cauval. A reply was received from his PR manager who said the equity firm would not comment on "rumours” or “speculation".

-------------------------

- The French version of this article can be found here.

English version by Graham Tearse