“I always liked being number one,” Bernard Arnault told the Financial Times in June 2019. He has achieved that ambition beyond his wildest dreams after climbing through the ranks of the world's biggest fortunes to reach the top.

For the second year running Forbes magazine has crowned the French businessman the richest man in the world. The wealth of the chair and chief executive officer of luxury goods group LVMH is now estimated at 243 billion dollars (220 billion euros), the equivalent of the gross domestic product (GDP) of New Zealand or Portugal. And he is far ahead of his rivals. The next on the list is American Elon Musk, with a gap of more than 50 billion dollars between the pair.

Bernard Arnault is now able to savour this long-coveted top spot which earns him plaudits among his peers. Indeed, during his group's general assembly on April 20th he could not stop himself from sharing his triumph with shareholders, who are increasingly hand-picked as the group's share price climbs. “A LVMH share is a luxury product,” he declared. No one would deny that: at 900 euros a unit it is a stock that is only within the reach of a handful of shareholders, the very wealthy and the funds and institutions that are used to trading in billions. In other words, his world.

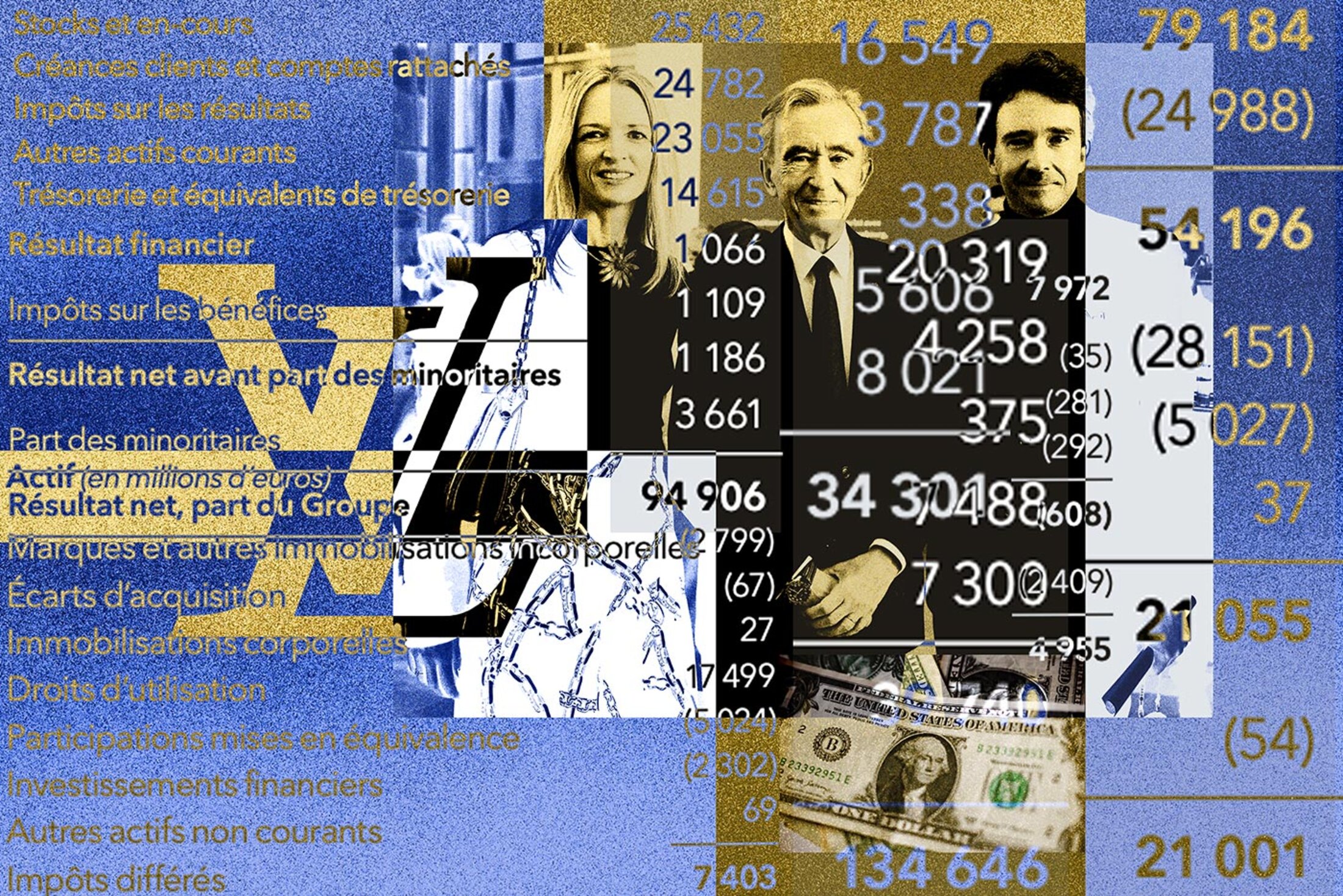

Enlargement : Illustration 1

But there is always the flip side to any coin. Try as he might, Bernard Arnault has not got used to becoming the symbol of the 0.1% richest people in the world, a pin-up for the inequality that has grown around the world in the last two decades, and which has been condemned in reports from non-governmental organisations and even the United Nations. To those who question the sense of this accumulation of wealth among so few people - a sign perhaps of the profound malfunction of a global capitalism that has no brakes or limits - Bernard Arnault responds with silence. But that does not mean he doesn't have a view about such people.

Perhaps he sees them as 'Marxists', to use the term that Arnault himself employed during a hearing of the French Senate in 2022 about media ownership. Or ignoramuses in any case, people who understand nothing about the greatness of capitalism, who cannot even recognise his value and talent as a financier, his abilities to turn lead into gold, to run at full tilt a machine that sells dreams of luxury.

Faced with such criticism, there are always those ready to spring to Bernard Arnault's defence, praising his merits and visionary views. How dare one complain about having such a powerful billionaire in France, one who creates wealth and jobs? On the contrary, we need more of them, these supporters insist, even if France already has the highest number of billionaires in Europe. Indeed, they argue, Bernard Arnault should be held up as a model for all current and future entrepreneurs.

Others point to the pointlessness of these lists, even if the wealthiest are very fond of them as a way of measuring and evaluating themselves against others. They remind us that these vast fortunes, which run into the hundreds of billions, are essentially made up of financial assets, capital tied up in large groups, and investments. They fluctuate according to the fortunes of the stock market, rising and falling with the moving of share prices.

These is something in this argument. In 2021, as the pandemic ended, and when high-tech stocks were seen as the big winners of the constant lockdowns, Amazon boss Jeff Bezos was top of the list of the world's wealthiest with total assets estimated at more than 209 billion dollars. Two years later, the appetite for digital giants has fallen and Jeff Bezos's fortune has dropped to 127 billion dollars. This leaves him as the third richest person in the world.

Very recently Elon Musk saw his fortune fall by nearly 13 billion dollars in a single day. This occurred on April 21st after his Starship rocket exploded soon after take-off, and after a slump in the share price of Tesla.

But while the majority of billionaires do not have their amassed fortunes at their instant disposal, they do enjoy the income from this accumulated capital, on top of the power and influence that this great wealth gives them. This income increases their overall assets each year and is then reinvested to produce yet more profits. Bernard Arnault falls perfectly into this category.

Salary as pocket money

How much does the LVMH boss earn each year from the income that comes from his accumulated capital? While it is tempting to give a figure, in practice it is impossible because of the lack of reliable public data and the lack of information over decisions made about assets both inside and outside the luxury goods group. An attempt to piece it together solely on the basis of reports published by the group simply allows ones a partial glimpse: even so, the sums involved are astonishing.

Bernard Arnault receives a salary as CEO of LVMH. While the salaries of bosses of companies listed on France's CAC 40 stock exchange continue to cause controversy – such as the 17 million euros paid to Carlos Tavares as the head of car maker Stellantis – Bernard Arnault has for a long time been careful not to open himself up to criticism on this front. According to the group's universal. registration document (URD) – the only means by which it is possible to get details of the pay awarded to LVMH's executives and board members – his pay is around average for a CAC 40 boss.

In 2022 Bernard Arnault's total financial package (which has a fixed component, a variable part, directors' fees as chair of the LVMH board and fringe benefits) came to 3.45 million euros. This is close to three times more that he received in 2021; the LVMH boss did not take any pay performance-related pay for 2020 because of the pandemic.

Even if this is still a colossal sum, he does not appear to be the highest-paid executive in his group. Since taking control of LVMH Arnault has always taken care to surround himself with a small handful of executives in whom he has total confidence and who are paid a great deal; this both ties them to his own success and ensures their loyalty and commitment. The managing director of LVMH, Antonio Belloni, definitely falls into this category. He is in fact the leading figure among this tight-knit group of executives after the death in 2018 of Pierre Godé, who had worked with Bernard Arnault since the mid-1980s. In 2022 Antonio Belloni received a total remuneration package of more than six million euros, well above that of Bernard Arnault himself.

But the pay package is just the visible, official part of Bernard Arnault's income; in a way it's his pocket money. For the richest person in the world no longer operates in the world of the 99% of people whose wages make up most if not all of their income. What interests and drives him is capital. This also enables him to escape the progressive nature of income tax and instead benefit from the much more advantageous taxation on capital that was introduced in the summer of 2017 by Emmanuel Macron.

Securities transactions

Bernard Arnault does not take any chances over the accumulation of capital. In 2009 LVMH got rid of all stock options because of the enduring risk that these options may, at the moment when they are realised, be worth less than their assigned value. Instead the luxury goods firm hands out free shares, known as performance shares; as their assigned cost is zero, there is bound to be a profit even if these shares are in reality not handed over until after a set period of five years.

Bernard Arnault has benefited from these free share schemes for year after year. He has acquired some 6,300 shares in this way, with a value of 3.96 million euros. So from the stated income of 3.4 million euros, Bernard Arnault's overall remuneration rises to 7.3 million euros.

The group's board has also very generously decided to award him 7,163 additional performance shares with a total value estimated at 4.5 million euros. In all, between 2018 and 2022 the group gave 37,871 free shares to Bernard Arnault, 8,966 to his daughter Delphine, who is CEO of Dior Couture, and 2,543 shares to his son Antoine, president of Dior SE, one of the companies that holds the family shares in LVMH. This total of 49,380 shares represents a deferred profit of 30.7 million euros, on the basis of the board's valuation.

The benefits of wealth do not stop there. Like the great majority of groups on the CAC 40, LVMH has become keen on share buybacks. One reason for its popularity is that this practice allows the group to strengthen its control over the group, to accumulate even more capital and to increase its wealth. Between 2020 and 2022 the group spent more than a billion euros buying back 1.62 million shares and cancelling them.

The Arnault family has profited directly from this. It increased its stake by more than a million shares between 2021 and 2022. Put into figures this increase represents a profit of more than 650 million euros. The family's stake is now over 48% of the capital and is set to increase further: the group's management has committed to continuing its policy of buying back shares in the months and years to come.

More than 6 billion euros in dividends in three years

As owners of more than 252 million LVMH shares, the family's companies naturally receive a yield from them. The group has been very generous in this respect: in three years the dividend paid out has gone from 6, then 10 and now to 12 euros a share. The total amount of dividends the family's holdings have received over three years has reached more than 6.3 billion euros.

Not all of this money is paid out to family members. The family holdings keep some to increase their reserves, which given them extra financial firepower in the event of an acquisition attempt. Part of this income is also reinvested in financial schemes and property, investments which in turn generate further income and profits. The Louis Vuitton Foundation also benefits from gifts from the family holdings, which allows part of this income to be offset against tax. Finally, a part of the money – it is impossible to know how much because there is no public data – is given to various members of the family.

Bernard Arnault sees no reason to end this system of capital accumulation which flourishes and grows almost spontaneously. In any case, he has no desire to redistribute any part of his wealth, not even small amounts of it in comparison with the value that is being created. A few years ago the board adopted the principle of having an employee share scheme. But it was never implemented. Although the group has more than 190,000 employees, the shares held by staff represent less than 0.5% of LVMH's total capital.

---------------------------------------------------------------------------

- The original French version of this article can be found here.

English version by Michael Streeter