The European Commission revealed in December that more than 4.5 trillion euros of state aid was authorized to fund the rescue Europe's financial sector since October 2008. Martine Orange analyses the largely unreported figures and questions the logic of such an astronomical bail out set against the introduction of unprecedented austerity plans.

-------------------------

Over the two years since October 2008, European Union (EU) member states were authorized to hand over more than 4.5 trillion euros of public funds to rescue the financial sector, the European Commission has revealed.

This extraordinary sum set aside for the financial institutions is equivalent to the combined Gross National Product (GDP) of France and Germany.

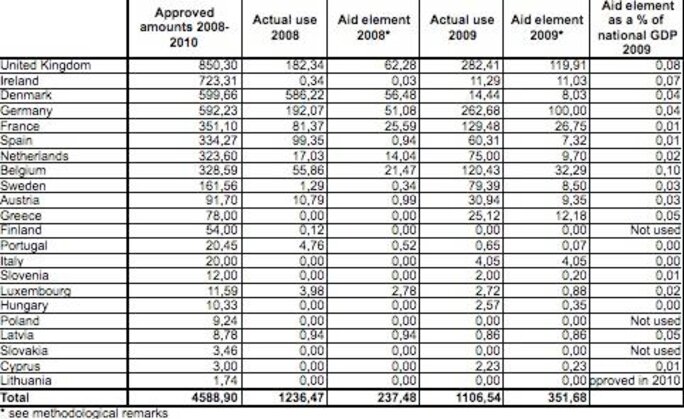

In a confusingly-formulated communiqué released earlier this month, the Commission said more than 1.1 trillion euros was actually used in 2009. The total used for the whole of 2008, (i.e. including 9 months prior to the period quoted for total authorizations), was more than 1.2 trillion (see table on page 2).

The upbeat press release, which emphasized a trend towards "less and better-targeted state aid", produced little reaction, even though it came as financial markets are demanding ever tighter austerity measures of euro zone countries gripped by the severe debt crisis.

Not least among these demands are massive public spending cuts in social welfare programmes, as is the case of Ireland, about to endure the harshest spending cuts in the nation's history. Within this context, the Commission's figures on the amount of state aid paid out to the financial institutions merits closer scrutiny.

"Between 2008 and September 2010, 4,588.9 billion euros of aid was made available to financial institutions," read the December 1st communiqué. "However, the amount of public support actually used in 2009 was much lower and stood at 1,106.6 billion euros. For 2008 it was 957 billion euros."

The Commission claimed the repercussions of the bail outs had only limited effects on public debt levels, suggesting that they have little, if anything, to do with the current agony within the euro zone. "The bulk (76%) of this support comes in the form of State loans or guarantees to maintain interbank financing which would only have an impact on public finances if they were called upon," insisted the Commission. This "bulk" percentage of 76% represents 840 billion euros paid out in loans and guarantees to maintain inter-bank credit.

In 2009, EU member states spent 132 billion in recapitalization of banking institutions (12% of aid) and some 100 billion euros (9% of aid) went on "impaired asset relief" - ad hoc financing of structures with toxic assets. It is worth noting that, in comparison, total public aid paid out to the rest of EU's economy in 2009 was 73 billion euros.

The Commission's position in minimizing the importance of the engagements made by member states in support of the banks should be taken with caution because, as Ireland has now discovered, they may well become financial time bombs. In autumn 2008, the guarantees offered to banks by the Irish government cost it 1.5 billion euros and, according to EU statistics, a further 11 billion euros in 2009. But since the recent height of the country's crisis was reached over the past few months, it has thrown in a further 50 billion euros. What is more, the bail out plan now worked out with the EU and the International Monetary Fund allows for a further 30 billion euros to be given to Irish financial institutions.

What have the banks cost France?

For some months now the French government has given public reassurances that the rescue of French banks has cost public finances next to nothing. Finance minister Christine Lagarde has even suggested that state coffers have prospered from the banks. Central to this interpretation of events is that a loan of 21 billion euros to the country's eight biggest banks was repaid at the end of 2009.

But other sums of aid have been hidden in silence. The French state recapitalized Dexia and the BPCE (created from the fusion between the Banque Populaire and the Caisse d'Epargne) to the tune of 3 billion euros and 5 billion euros respectively. Meanwhile, a structure called the French Economy Financing Company (the Sfef) was especially created to raise funds on the markets, against state guarantees, and destined for financial institutions.

The Sfef was authorised to raise up to 260 billion euros, and it had collected 77 billion euros by the time it was wound down on December 31st, 2009. The debt created, however, will run on until 2015. A further 22 billion euros was accorded to French banks, raised from the surplus collected on Livret A savings accounts, for use for business credit loans.

According to the available figures in France, the rescue of the French financial system cost public funds a total of 128 billion euros. But the figures provided by the EU show the French government requested authorization to provide 351 billion euros in aid for the financial sector, (which was however notably less than the 592 billion euros that Germany set aside, and significantly less than the United Kingdom's 850 billion euros). Between 2008 and 2009, according to the EU, France actually spent 210 billion euros in guarantees and recapitalization.

Mediapart contacted the French Ministry of Finance for an explanation on the divergence of its own figures and those of the EU. Not for the first time, it offered no reply (please refer to our regular ''Black Box' record bottom of page). This raises questions both about the solidity of the French financial system and about the true amount of public funds that have been engaged to help it - funds which in part are added to the public deficit.

The orthodox financial view would appear to view social welfare deficits as outrageous, but that created to bail out banks as quite acceptable - and even invisible to BNP Paribas bank Chief Executive Officer Baudoin Prot. He recently repeated that the aid given to French banks, which he claimed "did not at all contribute to the origins of the crisis," has cost nothing to the taxpayer.

-------------------------

English version: Graham Tearse