On October 21st last year, during Chinese President Xi Jinping’s official visit to Britain, it was announced that the China General Nuclear Power Corporation was taking a 33.5% stake in the project led by French utilities giant EDF to build two new reactors at the Hinkley Point nuclear energy plant in south-west England.

The deal finally launched the construction, first announced in 2010, of the two European Pressurized Reactors (EPRs) at the Bristol Channel plant in Somerset, and which are due to begin operating, managed by EDF Energy (formerly British Energy), in 2023.

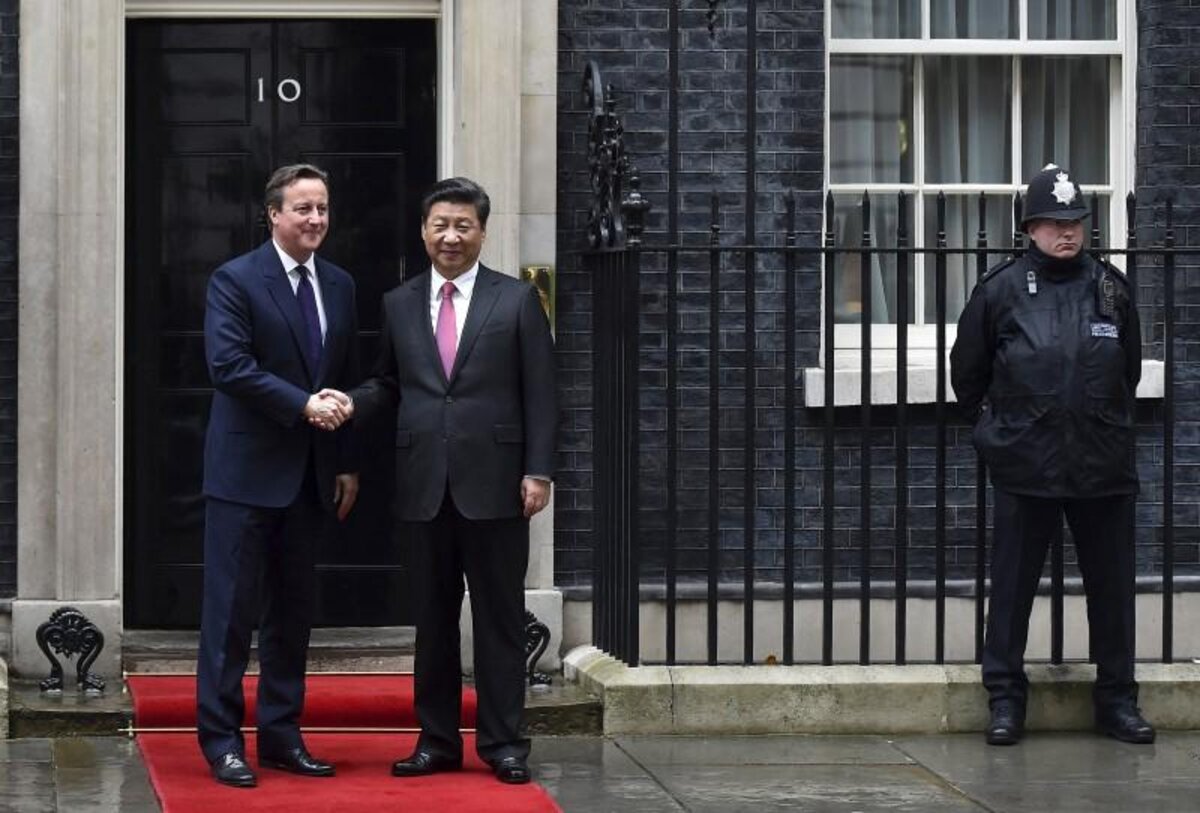

EDF chief executive and chairman Jean-Bernard Lévy joined British Prime Minister David Cameron and Xi Jinping in London for the signature of the deal. No French minister, ambassador or other official accompanied him, despite the fact that the Hinkley Point C project, as it is named, represents for the largely state-owned EDF a massive investment, officially to total 25 billion euros but which observers estimate could reach between 30-35 billion euros.

Enlargement : Illustration 1

Back across the Channel, the name Hinkley Point is a sensitive issue within EDF in France; from the groundforce to senior management, and including staff unions, the large numbers of opponents to the project are growing, fearful that the huge costs involved will prove to be fatal for EDF. Earlier this month French weekly JDD reported on the deep malaise within the company, citing a warning from one management staff union that “Hinkley Point threatens to kill EDF”.

EDF has already experienced calamitous ventures and losses abroad; its stake beginning in 2001 of Italian energy firm Edison has left it with a subsidiary that continues to lose money, while the 15.8-billion-euro price tag of its purchase of British Energy in 2008 was so overinflated that the value of the subsidiary is continuously depreciating. In the United States, it lost 5 billion euros in its purchase of stock in the now-defunct Constellation Energy Group, a move made in its battle for pre-eminence with French energy group Areva. In EDF’s operations in 2015, not one of its international operations showed a profit.

“Hinkley Point is a nightmare,” said one former EDF director, speaking on condition his name was withheld. “This quagmire must be exited as quickly as possible. EDF risks being killed off by it.”

A current member of management, also speaking on condition his name was withheld, agreed: “There is an urgent need to halt everything. The thing is too badly set up. There are only blows waiting to be had.” Another management figure observed: “It is the first time in EDF’s history that an industrial project faces unanimous opposition from the staff unions. All of them are against Hinkley Point. Even the [large French union] CGT, which traditionally supports this type of programme, is up in arms against the project.”

Hinkley point has created clear divisions amongst the EDF executive committee. A statement by the CGT union on January 26th gave a raw account of the power battle being fought among senior management. “The EDF senior management is much divided over the continuation of the project [Hinkley Point],” read the statement. “Hesitations which are in contrast with the argument of the chairman and chief executive [Jean-Bernard Lévy]. He is among the camp in favour, just like the be-medalled one [a reference to EDF Energy chief Vincent de Rivaz, who was made Commander of the British Empire in 2012], and those who are a bit, very much, responsible for, and guilty of, the failures of Flamanville 3; reassuring.”

The construction of a new EPR reactor at the EDF’s nuclear plant at Flamanville, on the north French coast, has been fraught by a catalogue of problems, notably spiraling costs, technical failures and delayed completion.

The CGT statement continued: “On the side of the [Hinkley Point] opponents is, without surprise, the financial services management and those who, let’s say, see a bit beyond the end of their noses.” Mediapart contacted several management figures who confirmed the divisions described by the CGT statement.

Enlargement : Illustration 2

The movement within the group against the project in England is centred on the difficulties surrounding the EPRs to be built. The experiences at Flamanville have been traumatizing for EDF, with the Areva-designed third generation reactor proving to be a major work of complexity which is proving difficult for engineers and managers to master. The delays, accidents and mistakes have made them realize that they have lost the competence to seamlessly manage the building of a reactor - a serious setback for a group that presented itself as the leading nuclear player. Originally due to be operational in 2012, the Flamanville 3 plant is now expected to launch in 2018, while its cost has shot up from an original estimation of 3.3 billion euros to a latest forecast of 10.5 billion euros.

“At one point, some in senior management even asked themselves whether it would not be best to halt everything,” said a source close to the Flamanville project. “But so much money had been put into it that it was decided best to continue the construction. But in the minds of numerous EDF directors, there must be no other EPR modeled on that built in Flamanville. There is urgent need to draw on the lessons of the experience, to rethink the conception.”

A research and development team was set up in recent months for a complete re-evaluation of the EPR. The aim is to build a nuclear reactor to maximum safety standards which is capable of producing electricity at a cost of 60 euros per MWh. “The whole conception leads from the price,” said an EDF manager. Meanwhile, Areva NP, the reactor design arm in which EDF took a majority stake after Areva’s near collapse in 2015 from massive losses, is undergoing reorganization. Its newly-appointed boss Bernard Fontana, predicts it will take two years for the unit to return to proper operations and to work in coordination with EDF.

Hinkley Point could almost double EDF’s debt

Enlargement : Illustration 3

“The state asks us to put the entire nuclear branch back in order then, without waiting for the launch of operations of the EPR in Flamanville, without knowing how it’s going to function, without waiting for the design to be put in order, we launch the EPR project at Hinkley Point,” commented an EDF manager. “It is pure madness.”

Several sources close to the project told Mediapart that if EDF does launch the construction of two reactors for Hinkley Point, it will have to design an intermediary EPR, a one-off that has no lasting future.

In the deal signed with the British government, EDF has pledged the reactors will begin operations at the end of 2023, a deadline which a number of observers consider most unlikely. “Realistically, Hinkley cannot be onstream before 2025 even under the most optimistic assumptions,” wrote Financial Times energy correspondent Nick Butler on his blog last October, detailing the need for a “plan B”.

“If the project suffers the same delays as the existing EPR projects the relevant date would be beyond 2030. That would be a devastating blow to EDF - destroying the potential future market for the reactors worldwide. But more immediately it would leave the UK with a big gap in its power-generating capacity. The old nuclear stations have had their lives extended but for plants built 40 years ago there must be a limit.”

Butler’s analysis is shared by a former EDF director. “All the conditions are met to head for a major industrial failure,” he warned. “And it is EDF alone which will have to pay for the consequences.”

For the internal opponents of the project, the financial conditions of the deal with the British government appear highly dangerous for EDF. When the bilateral discussions began in 2013, a somewhat unusual financial model was put forward. One structure, existing on its own, was envisaged regarding the whole of the EPR construction project, so that EDF did not have to consolidate the debts of the British venture into its accounts. Parallel to this, EDF obtained a guarantee from the British government that the electricity produced by the two EPRs would be bought at a price of £92 pounds (about 120 euros) per MWh, a rate open to review, over a period of 35 years. Along with this guaranteed price, the British government also gave a guarantee concerning the debt incurred by the project.

But the whole financial structure was renegotiated with the arrival of the China General Nuclear Power Corporation into the project. EDF has a 66.5% stake in the project, leaving the Chinese with 33.5%. But it is the French utility giant that will have to consolidate all of the debt linked to Hinkley Point in its annual accounts. “The previous structure was just an accounting device,” said an EDF manager. “But you need to return to reality, it’s EDF that will bear the whole of the debt if Hinkley Point sees the light of day.”

The project is estimated to cost 25 billion euros, which well-informed observers consider more likely to become 30 billion euros – and that is if it is not hit by the same delays as the Areva-designed EPR in Finland. Hinkley Point could almost double EDF’s existing debt which, at 37.4 billion euros, already equals its equity. EDF staff are worried that it will be the jobs and activities of the group in France that will pay the price, and management decisions already announced on future job shedding and asset sales leave little doubt about that.

The project’s opponents foresee that Hinkley Point, which might never be profitable for EDF, will prove to be the final reason for the dismantling of the group. They argue that with the current development of electricity exchange links between France and Britain, it would be a far more sensible and sound proposition – and also a profitable one – to export electricity from France to Britain to meet the latter’s production deficit. At the least, this could be a temporary solution while waiting to see whether the EPR at Flamanville can function properly - something no-one is at present able to be certain of - and if not during the time it will take for a new design.

During a board meeting on January 26th, EDF chief executive Jean-Bernard Lévy referred to a report on the Hinkley Point project completed by Yannik Escatha, a former director of EDF and the French atomic energy commission, the CEA. Lévy, however, did not make the report available to those present nor even, according to sources contacted by Mediapart, to the executive board. Mediapart understands that the report is critical of the project, the ability to meet the deadline and Areva’s capacity to fulfill its requirements, and underlines the vast industrial and financial risks for the group.

-------------------------

- The French version of this article can be found here.

English version by Graham Tearse