If tax evasion prospers the dishonest wealthy the world over, it is thanks to hundreds of banks, lawyers’ practices and accountancy firms which ensure the financial secrecy of the operations, often operating in the light of day and in all legality. That is the conclusion of a report into the process of tax evasion published this week by the Greens-European Free Alliance (EFA) group in the European Parliament.

The report is largely based on a study of information available through the Offshore Leaks database created by the International Consortium of Investigative Journalists (ICIJ), and which contains the disclosures, since 2013, of the first Offshore Leaks platform, followed by the Panama Papers revelations and Bahamas Leaks.

The Greens, who sit on the cross-party European Parliament committee of inquiry into moneylaundering, tax avoidance and tax evasion, created last June in the wake of the Panama Papers scandal, studied almost information made available by the ICIJ to establish who had created the hundreds of thousands of offshore financial structures that allow companies and individuals to hide their wealth.

“These intermediaries are often unknown to the public but play a key role in the existence of shell companies in tax havens,” noted the report. “They are banks, law firms, accountancy firms and corporate service providers, acting alone or together depending on the country to provide their clients with advice and/or establish complex tax schemes for their clients, who could rarely come with these ideas on their own. In other words, they are instrumental to the tax dodging business.”

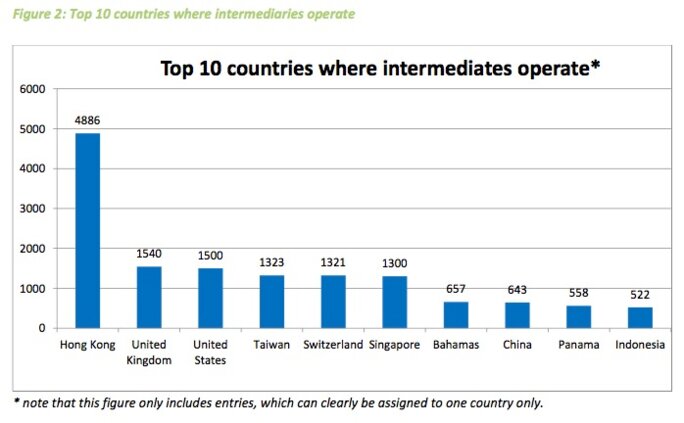

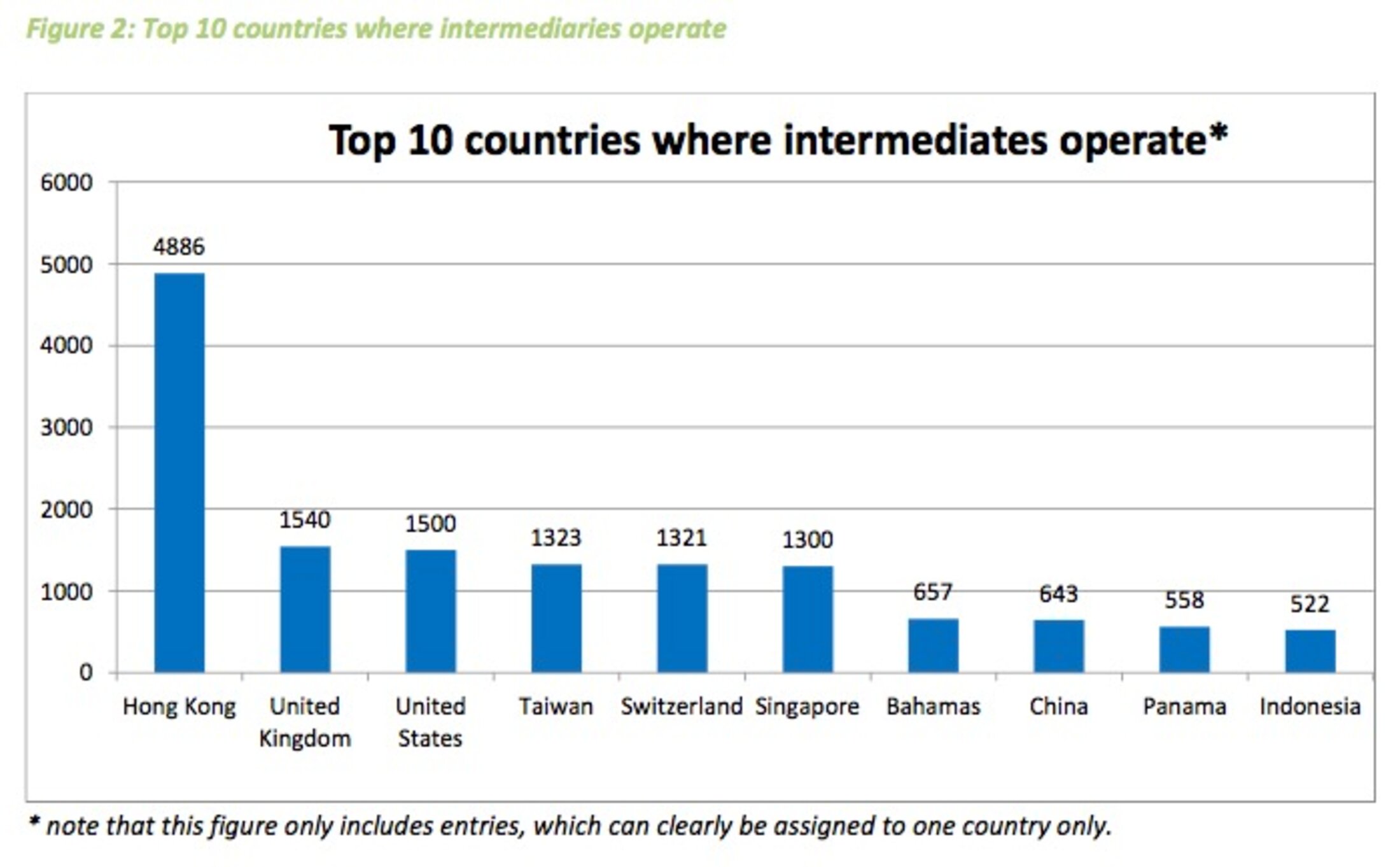

The report underlines that the large majority of such intermediaries have subsidiaries or other dependent agencies that are active in Europe. The United Kingdom is by far their preferred European base, and the country also ranks as their second choice worldwide. The most popular base worldwide for the intermediaries (see table below) is Hong Kong, followed by the UK, and the US.

While in popular perception tax evasion centres on tiny countries or dependencies in exotic climes, the Bahamas and Panama are, respectively, seventh and ninth most popular bases for secreting wealth, separated by China, and behind Switzerland, Taiwan and Singapore.

Enlargement : Illustration 2

As for the ranking of the preferred countries in Europe for intermediaries to operate their businesses for tax evasion, behind the top-listed UK and Switzerland comes Luxembourg, Spain, Cyprus, Germany and France.

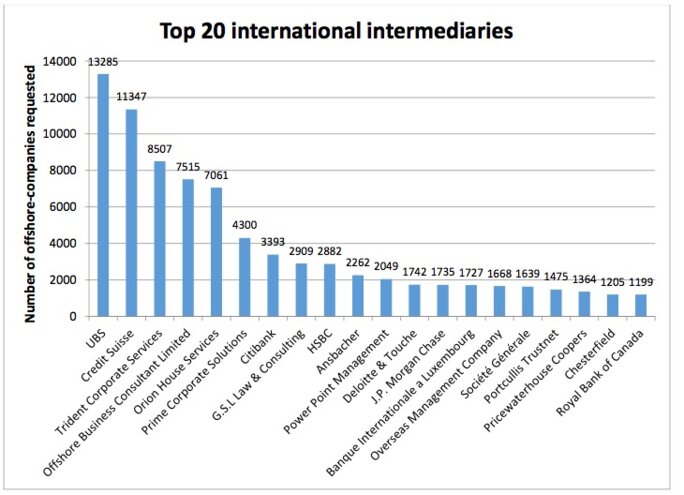

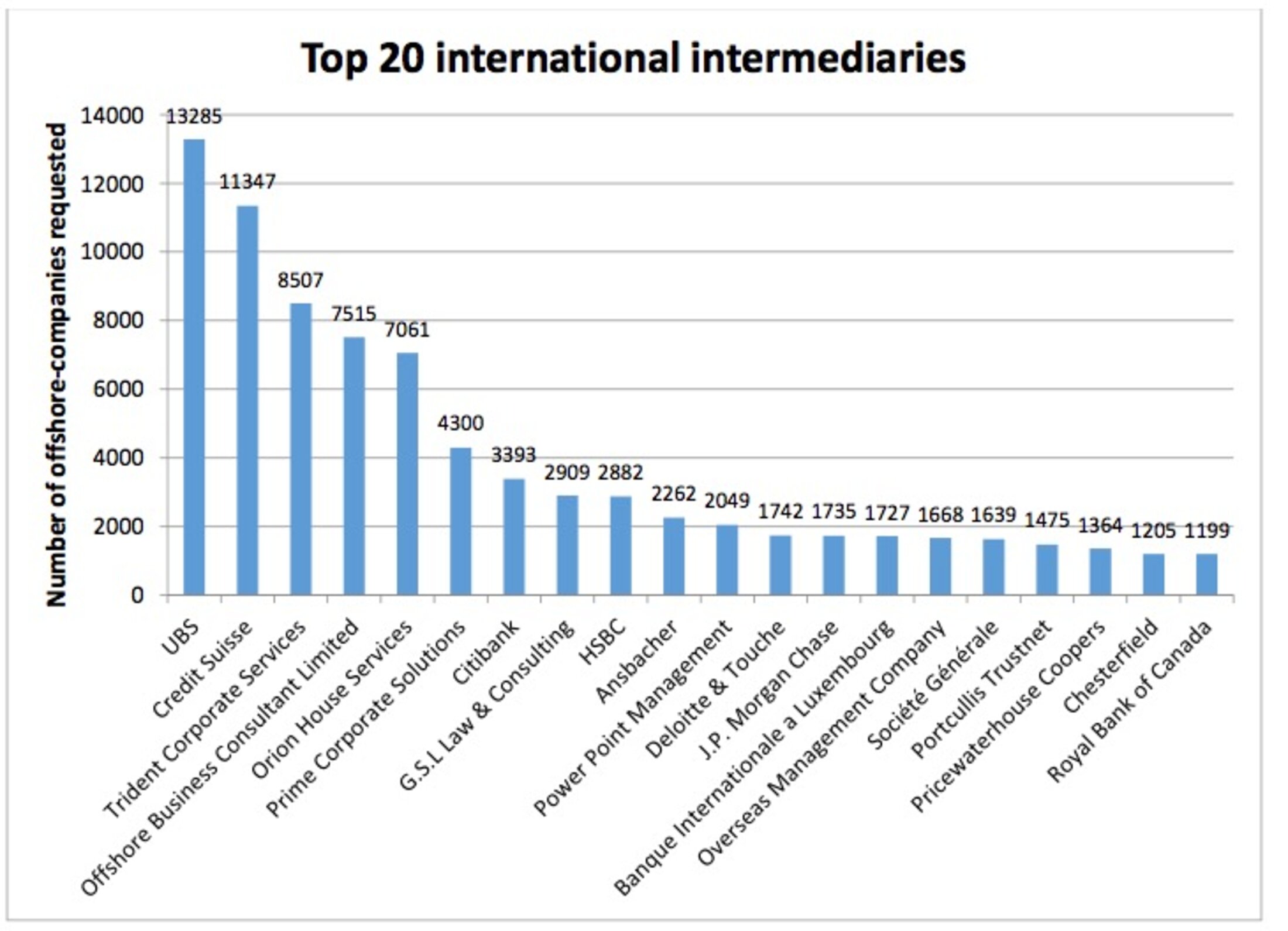

The report says that 140 of the intermediaries identified in the study had created multiple offshore structures in at least three different countries. Perhaps not surprisingly, it found that among the 20 largest intermediaries in tax evasion operations (see table below) were large banking and financial institutions. At the top of the pile are two Swiss banks, UBS, and Crédit Suisse, while the list includes the well-known names of Citibank, HSBC, J.P. Morgan Chase, Deloitte & Touche, Société Générale and the Royal Bank of Canada. The others listed among the top 20 are companies that are dedicated uniquely to creating shell companies in which to funnel secret funds.

Enlargement : Illustration 3

“Unsurprisingly, banks from Switzerland and Luxembourg are at the heart of the business of offshore company intermediation,” said the report. “But major French banks seem to have been very involved as well, since three of the main French banks (Société Générale, Crédit Agricole and BNP Paribas) rank among the Top 10 European banks. and have requested more offshore companies for their clients than the likes of the Deutsche Bank, GoldmanSachs and Banco Santander.”

The president of the Green party group in the European Parliament, Belgian MEP Philippe Lamberts, commenting on the report’s findings, said: “We could continue to think that tax havens are the result of dubious states in the Caribbean. The truth is that without the intermediaries based within the European Union these techniques for tax avoidance and evasion would be quite simply impossible.”

The report concluded with a list of seven recommendations, notably that EU member states contact the named intermediaries to ask whether they “helped their clients to breach European and national laws against tax evasion and money laundering”, the creation of “a European Financial Intelligence Unit in charge of coordinating its national counterparts and promoting best practices for better cooperation among the member states”, and the introduction of increased sanctions against intermediaries helping any “individual or entities” involved in tax fraud.

Finally, the report issued an appeal that the ICIJ and other parties in posession of further information on how the intermediaries created offshore companies for their clients should contact the European Parliament PANA committee of inquiry.

-------------------------

- The French version of this article can be found here.

English version by Graham Tearse