From 2008 and over a period of seven years, Portuguese footballer Cristiano Ronaldo used a system elaborated by his agent Jorge Mendes to send into tax havens a total of 149.5 million euros he earned from commercial deals, according to documents from the Football Leaks whistle-blowing platform, accessed by German weekly magazine Der Spiegel and jointly analysed by the European Investigative Collaborations (EIC), a consortium of European investigative media that includes Mediapart.

The Real Madrid star, 31, paid a total of just 5.6 million euros in taxes on the entire sum.

Enlargement : Illustration 1

Meanwhile, other players in the Spanish top flight league, including Barcelona’s Lionel Messi and Cameroon international Samuel Eto’o, who is currently with Turkish side Antalyaspor, have been brought to trial over their dissimulation of sums well inferior to those concerning Ronaldo.

In an ongoing trial, Spanish prosecutors last month recommended that Samuel Eto’o, who is accused of defrauding the Spanish tax authorities of a comparatively modest 3.9 million euros while playing with Barcelona, should be given a sentence of more than ten years in prison.

In July this year, a court in Catalonia handed Barcelona forward Lionel Messi and his father a 21-month suspended prison sentence each, and fines of 1.7 million euros and 1.5 million euros respectively, after they were found guilty of evading 4.1 million euros in tax payments on Messi’s image rights earnings, via a system of tax haven and shell companies.

Between 2009 and 2014, Ronaldo received 74.8 million euros via an offshore company based in the British Virgin Islands. He failed to declare that sum to the Spanish tax authorities, but subsequently did declare a part of it, which prompted an investigation. However, his legal team succeeded in avoiding penalty fines for the tardy declaration and, according to information obtained by the EIC, he also escaped interest payments on the sums due.

But the investigations by the EIC also reveal a second operation. On December 20th 2014, Ronaldo sold his image rights for the period 2015-2020 for a total of 74.7 million euros. The move was made just 12 days before he was due to lose the benefit of a highly advantageous tax status in Spain, and which allowed him to escape a tax payment of 31 million euros.

The documents obtained by the EIC suggest that lawyers acting for him at Madrid-based practice Senn Ferrero Asociados became concerned that this will now lead to further tax investigations. Questioned by the EIC, the legal practice commented that “an inspection is ongoing”, adding: “Apparently, the most probable [outcome] is that the Spanish tax authorities will find very few things.”

But Senn Ferrero appears in fact to be less assured of the outcome than it suggested. On November 24th last, just 24 hours after the EIC made contact with it, Senn Ferrero obtained an injunction to prevent Spanish daily El Mundo, one of the EIC partners, from publishing any articles on the subject of Ronaldo’s secreted wealth. The lawyers also obtained a court order for the return to them of all the documents obtained by the EIC, and the identity of the source or sources through which they were obtained, arguing that they were stolen. El Mundo has appealed the ruling.

On November 25th, the EIC received a letter from Senn Ferrero threatening legal action against all the members of the journalistic consortium in the event that any of the partners published articles on the subject. None of the EIC partners, including El Mundo and Mediapart, have agreed to submit to the censorship which represents a serious attack against the right to inform.

On December 1st, Gestifute, the company run by Ronaldo’s Portuguese agent Jorge Mendes, published a statement on its website in which it too threatened legal action against any media organization that questioned Ronaldo’s honesty in his dealings with the tax authorities. The company also represents José Mourinho, former Real Madrid manager and currently manager of Manchester United, who is also the subject of an investigation by the EIC. “Both Cristiano Ronaldo and José Mourinho are fully compliant with their tax obligations with the Spanish and British tax authorities,” read the statement.

Football fans the world over spend important sums on tickets and items such as a player’s shirt, and on subscriptions to paywall TV stations which broadcast games, all to a backdrop of exorbitant remunerations for the game’s stars and eye-popping transfer fees.

A pair of Nike boots stamped with Ronaldo’s “CR 7” logo – short for “Cristiano Ronaldo” and his team number, “7” – costs about 325 euros, of which the player receives 13 euros via a company registered in the British Virgin Islands. The sums that escape the tax authorities, and therefore the state’s coffers, represents missing funds for public investment connected to the game, such as new stadiums and transport infrastructures to serve them.

Whether or not Cristiano Ronaldo is, as often argued, the most talented football player in the world, what is not in doubt is that he is the game’s biggest star, with some 200 million fans who follow him on the social media. He has accumulated a personal wealth of 209 million euros, most of which is placed in Switzerland and Luxembourg. He has a residence in Madrid worth 4.5 million euros, another 15 properties in his native Portugual, and a collection of seven supercars costing a total of about 1.25 million euros, including a McLaren MP4-12C, Lamborghini Aventador, Ferrari 599 and a Porsche Panamera.

In 2014, the Real Madrid forward was paid a yearly salary of exactly 34,672,988.31 euros. On top of that sum, he received payments for the use of his image by his club and numerous multinational companies. More easily hidden than a salary, Ronaldo has placed remunerations from such deals in a shell company in the Caribbean tax haven of the British Virgin Islands.

The hurry to escape Spanish tax hike

Sportswear firm Nike pays the Portuguese star an annual fee of 1.6 million euros, plus bonuses, such as an extra 250,000 euros if he finishes a season as top goalscorer in the Spanish La Liga division (similarly, his annual fee is less if he fails to play). Every year, Nike produces a new line of “CR7” sportswear, and Ronaldo receives 5% of the sales value, a share which in 2011 was worth 2.6 million euros.

But his appeal spreads well beyond sports products alone. In June 2013, the Real Madrid star was paid 1.9 million dollars by Japanese carmaker Toyota to appear in a video advert that took 6 hours and 45 minutes of his time, a fee equivalent to 4,691 dollars per minute. The advert could only be used in the Middle East, Algeria, Morocco and Afghanistan, allowing Ronaldo to appear in another advert, this time for Toyota’s rival Honda, for the Chinese market. For six hours of filming, the footballer was paid 2 million euros, and his contract stipulated that if the shoot went over six hours he would be paid a bonus of 600,000 euros.

He also appears in adverts for shampoo, for watches, for food (he has a four-year contract with US company Herbalife worth 15 million dollars), banks and airlines (he received 1.1 million dollars for promoting the airline Emirates).

In 2005, the Spanish government introduced a law allowing for tax breaks for high-earning foreign individuals newly arrived in Spain, which was justified as a measure to attract senior foreign business managers. But it became nicknamed the “Beckham law”, a reference to British footballer David Beckham who is reportedly one of the first to take advantage of the scheme when he joined Real Madrid. The law allowed for wealthy expatriates to pay taxes only on their income and assets in Spain, and not on their income from abroad. The system was overhauled at the beginning of 2015.

For footballers, the scheme allowed marketing deals signed outside Spain to escape tax in the country. In Ronaldo’s case, it is estimated that 80% of his image rights sales were made outside Spain, while the remaining 20% that concerned Spain was taxed at 24.75%. Concerning the almost 75 million euros he earned from his total image rights sales between 2009 and 2014, Ronaldo paid 2.7 million euros in tax to the Spanish authorities.

Ronaldo’s agent, Jorge Mendes, is one of the most powerful in the world, often described as a “super-agent”. The two men are personally very close: Ronaldo was best man at the agent’s marriage in Porto last year, when he reportedly offered Mendes a Greek island as a wedding present, and the footballer hired Mendes’s daughter as his social media “community manager”.

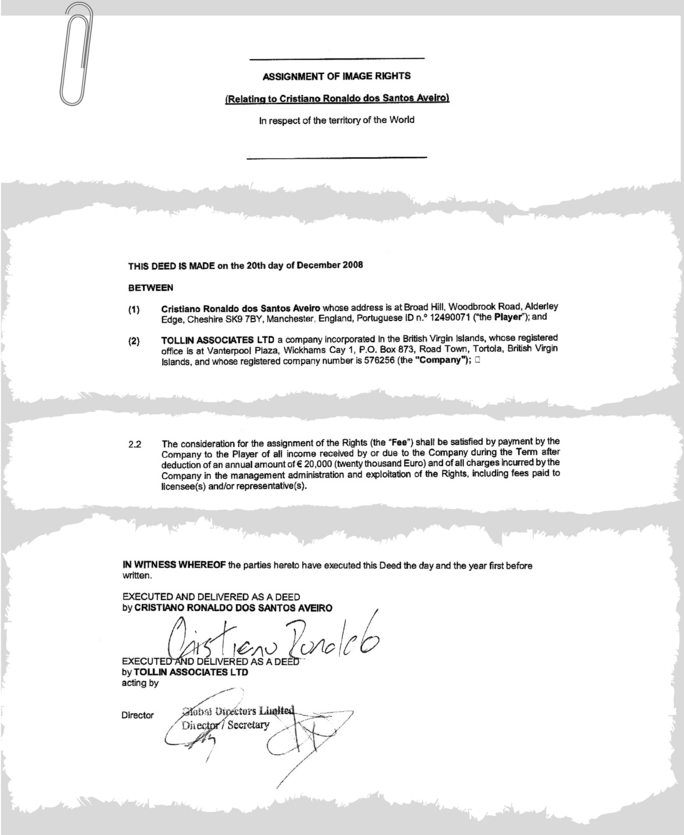

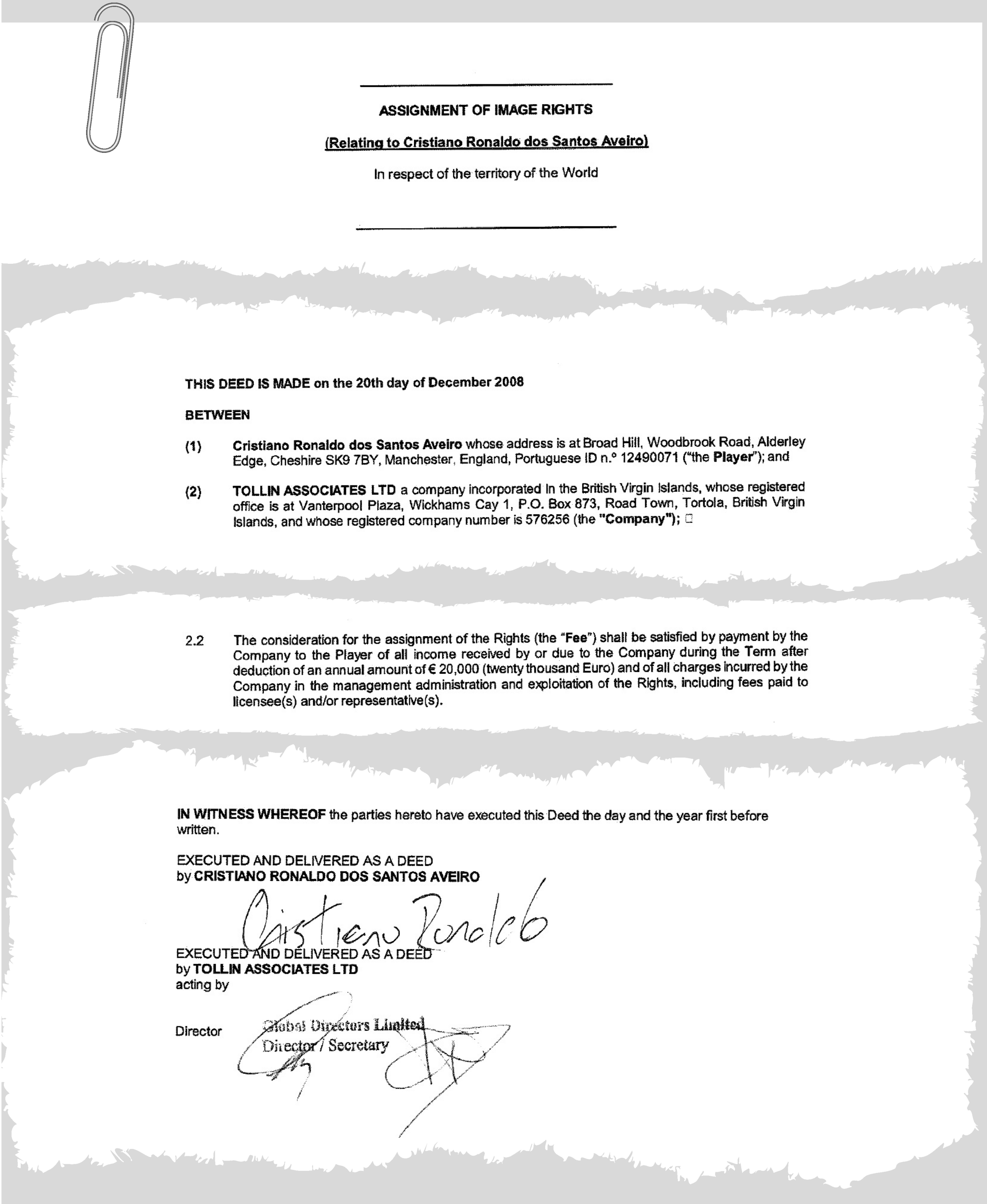

In 2004, Mendes created an offshore structure to alleviate the taxes paid by his illustrious clients, who include José Mourinho. In 2008, shortly before Ronaldo joined Real Madrid from Manchester United, Mendes transferred management of the player’s image rights to a shell company called Tollin Associates (see contract below), which was registered in the British Virgin Islands. Tollin Associates then gave two companies registered in Ireland, Multisports Image & Management (MIM) and Polaris (managed by a nephew of Mendes), the task of establishing deals for the image rights. Ireland certainly appears as a more respectable company domiciliation for potential clients than a Caribbean tax haven.

Enlargement : Illustration 3

Ronaldo’s fees were invoiced by MIM, which received a 6% commission, while it handed a 20% commission to Polaris. The remainder was transferred to Tollin Associates which then placed the sums in bank accounts in Switzerland. Between 2009 and 2014, and unknown to the Spanish tax authorities, Tollin received just less than 75 million euros. A small part of that sum was eventually declared in tax returns filed in 2015.

In September 2014, the Spanish tax authorities launched an audit of José Mourinho’s earnings, raising the possibility that audits of other clients of Mendes, notably his star footballers, would follow, when the existence of Tollin Associates could be discovered. Mendes hired the Madrid-based Senn Ferrero legal practice to assist his longstanding lawyer Carlos Osório de Castro, who apparently played a role in establishing the offshore structure, which he denies (see page 3).

Earnings from Ronaldo’s image rights represented about 60% of all the image rights sales managed by Mendes’s group. The contract that bound Ronaldo to Tollin was to expire at the end of 2014, and as of January 1st 2015, when the reform of the so-called “Beckham law” was introduced, the footballer faced being taxed on all his earnings at the normal rate of 45% (as applied to those individuals earning more than 60,000 euros per year).

Spanish tax audit clears Ronaldo of Tollin ownership

Ronaldo was therefore keen to sell his image rights for the period 2015-2020 before December 31st 2015. Mendes interested Singaporean billionaire businessman and investor Peter Lim, who the agent had previously helped to buy a controlling stake in Spanish club Valencia. While Lim agreed to a deal, time was running out, and complicating things further was the fact that Ronaldo and his Real Madrid teammates were playing in the Fifa Club World Cup tournament in Morocco in December 2014. Mendes’s staff hired a Moroccan notary to draw up, in French, the contract papers for the deal between Ronaldo and Lim, which was signed by Ronaldo in Marrakesh on December 20th 2014.

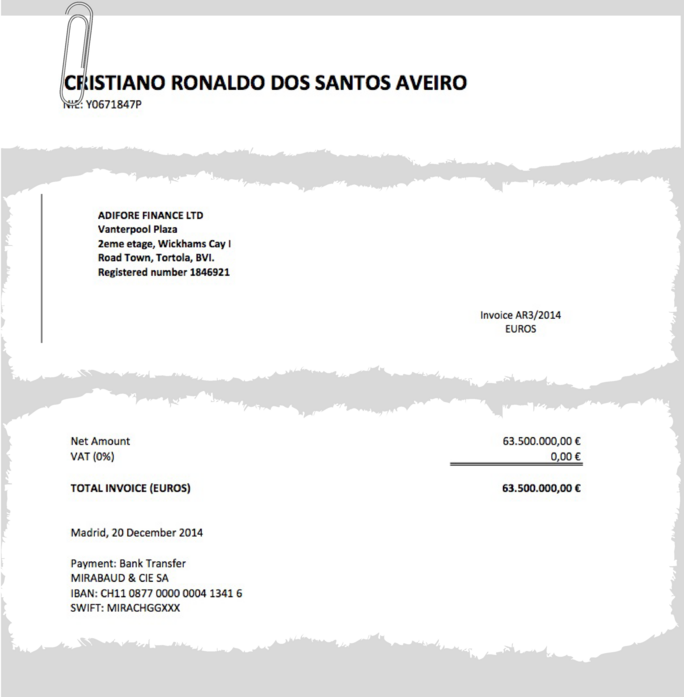

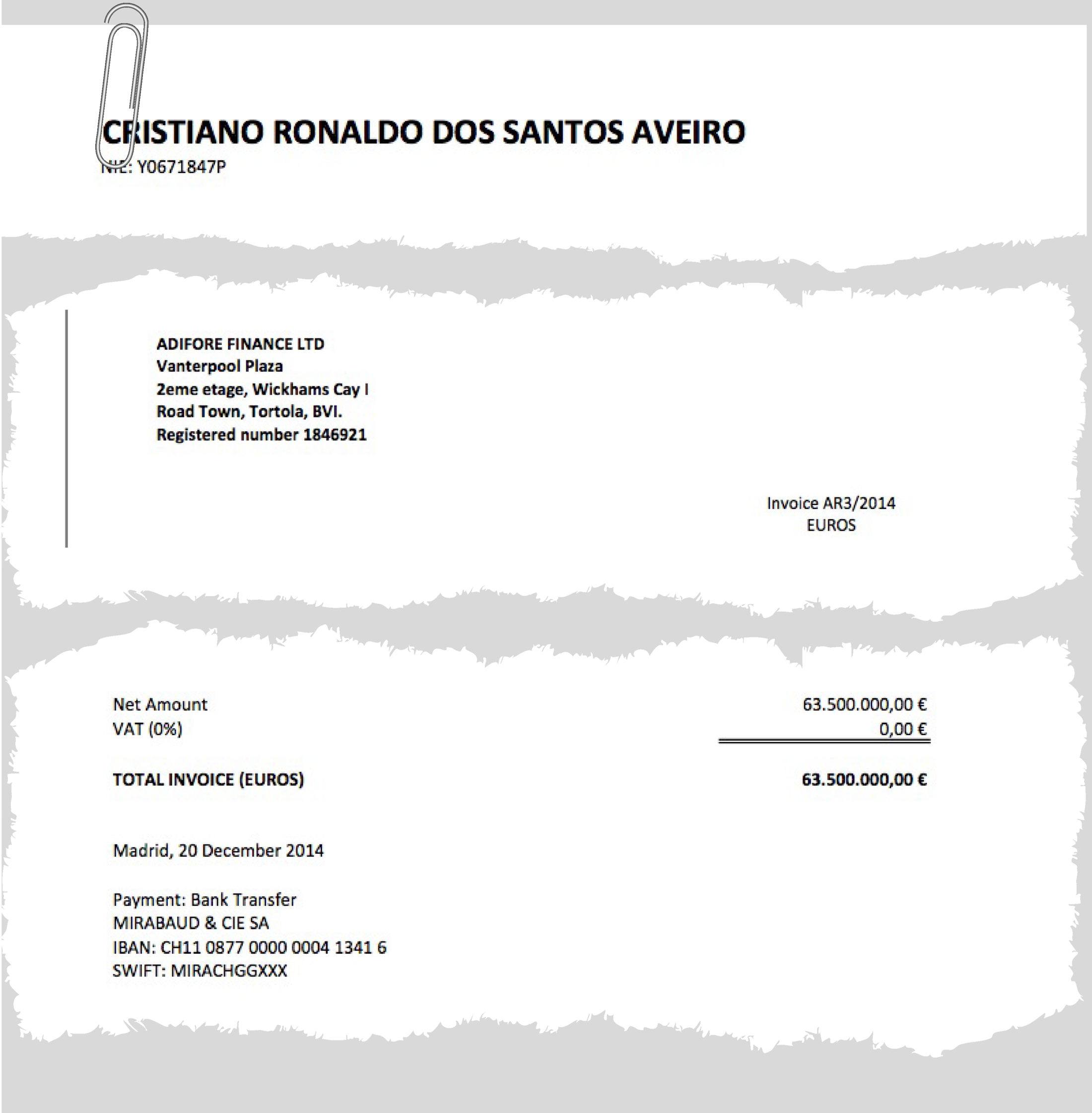

The agreement gave Lim ownership of Ronaldo’s image rights until 2020, for which he paid the player 74.7 million euros, via two companies registered in the British Virgin Islands called Arnel and Adifore Finance Ltd. Arnel paid 11.2 million euros for Ronaldo’s image rights in Spain, while Ardifore paid 63.5 million euros for the rights in the rest of the world. The sums were paid into Ronaldo’s account (number 413416) with the small private bank Mirabaud & Cie in Geneva on December 24th 2014 (see bank transfer order below). Meanwhile, Tollin Associates was immediately wound down.

Enlargement : Illustration 4

In his 2014 Spanish tax returns, filed on the deadline date of June 30th 2015, Ronaldo declared the 11.2 million euros received from Arnel, and another 11.5 million euros, which corresponded with what was previously paid to him by Tollin Associates for his rights deals in Spain between 2009 and 2014 - although no explanation was given as to the origin of the sum.

Documents from the Football Leaks platform indicate that the lawyers at Senn Ferrero were keen to hide from the tax authorities the existence of Tollin and the 74.8 million euros that were paid into it. Rafael Villena, a German-Spanish lawyer specialized in taxation issues, told the EIC that Ronaldo should by law have declared the sums received through Tollin on a yearly basis and not only in 2014. As a result, Ronaldo ran the risk of being ordered to pay interest on the sums that should have been declared annually, as well as penalty fines.

The Senn Ferrero lawyers were worried that the player’s tax statement would prompt further enquiries by the authorities. They distanced themselves from Carlos Osório de Castro, stating that they had not themselves participated in the construction or management of the offshore structure.

In December 2015, the Madrid office of the Spanish tax authorities, the Agencia Tributaria, launched a tax audit of Ronaldo’s income concerning the period 2011-2013. The lawyers at Senn Ferrero were required to supply numerous documents concerning contracts signed with the player. Carlos Osório de Castro demanded that the practice should not offer any information about the beneficiaries of Tollin Associates without first consulting him.

Thanks to Ronaldo’s lawyers, the Spanish tax authorities concluded that Tollin Associates did not belong to him. In fact, the contract between Ronaldo and Tollin makes clear that all the money held by the offshore company belonged to him in person.

Ronaldo’s tax audit was headed by the same tax inspector who led the audit into José Mourinho’s earnings, when the manager was ordered to pay 4.4 million euros in a tax adjustment over the use of a system identical to that used in the case of Tollin.

On October 22nd 2015, two months before the tax audit was launched, a meeting was held at the Senn Ferrero practice to discuss the potential consequences of the 2014 deal with Peter Lim, which allowed Ronaldo to escape paying 31 million euros in taxes on image rights sales. During the meeting, the lawyers warned that the deal would most likely lead to a fresh tax audit. They cited an identical operation concerning Columbian midfielder James Rodriguez, another client of Jorge Mendes. Their concern was to avoid a link being made between the sale of Ronaldo’s future image rights and the end of the generous tax breaks on foreign earnings.

Questioned by the EIC, lawyer Carlos Osório de Castro, speaking in Portuguese, denied being behind the creation of the offshore system involving Tollin. “I had nothing to do with the creation of image rights structures for the people mentioned in the questions,” he said. “I categorically deny the accusations made against me, directly or covertly.” Echoing his Spanish colleagues at Senn Ferrero, representatives of Mendes’s company Gestifute, and Ronaldo’s lawyers, Osorio said he “regretted” that the EIC based its information on what he described as stolen documents “in a way that distorts and manipulates the collected data”.

Approached by the EIC, Cristiano Ronaldo, José Mourinho and Jorge Mendes did not respond to an invitation to comment on the information presented here, as was also the case with James Rodriguez, Peter Lim, the companies MIM and Polaris, and Mendes’s Ireland-based accountant Andy Quinn. Real Madrid refused to answer any questions, arguing that this was because the stealing of documents is illegal.

-------------------------

Mediapart's report in French, on which this article is based, can be found here.

English version by Graham Tearse