If you believe the experts, 2013 was a much better year than expected. For many of them the upheavals caused by the 2008 economic crisis were now over. To back their interpretation of a return to normality, commentators turned to the “historic” performances of world stock markets. From New York to Tokyo, from Frankfurt to London, the markets soared to new records, eradicating all trace of 2008.

Another comforting indicator for the experts came from a rise in property prices, which have been in the doldrums for six consecutive years. Prices of houses and flats once again hit the heights that so many observers find reassuring. The British housing market surged in 2013 with the strongest growth coming in Manchester and London, while in New York prices are rising strongly again. In other words, everything is as it was before the crisis – at least for a handful of people.

Because what really characterised 2013 was a deepening of the gulf separating the rich from the rest, an increasingly vertiginous rise in inequality. In fact, the recovery benefited the top 1% to the detriment of the other 99%.

According to a ranking by Bloomberg published on January 2nd, the richest 300 billionaires increased their fortunes by 524 billion dollars last year. Together they are worth 3,700 billion dollars, as much as the combined gross domestic product (GDP) of France and Spain. Microsoft founder Bill Gates again became the world's wealthiest man with assets worth 78.5 billion dollars, 15.8 billion dollars more than a year before, essentially thanks to stock market speculation –Microsoft shares gained 40% during 2013.

But the middle and lower classes say they see no improvement in their lives. In the U.S., where the economy is said to have rebounded the most, general living conditions continue to worsen. Average annual income per person was 28,281 dollars in 2013, less than the average income in 1998 when adjusted for inflation.

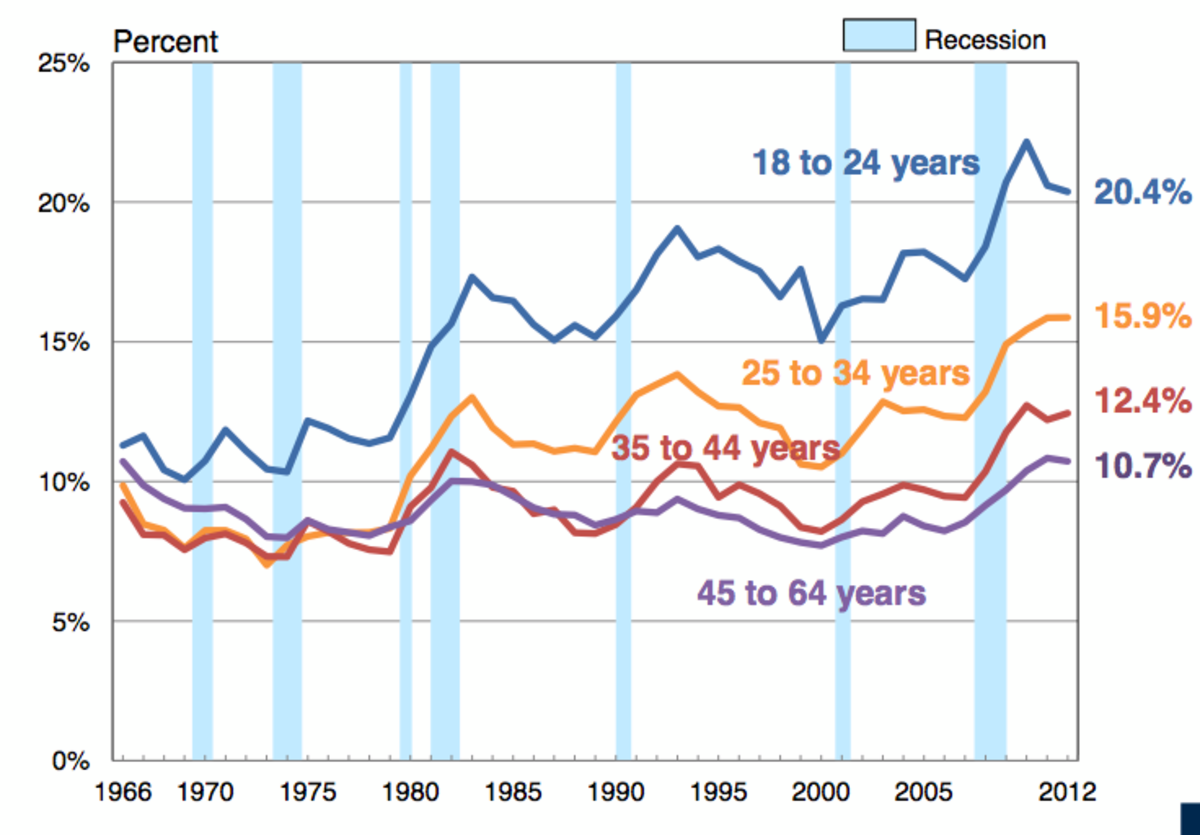

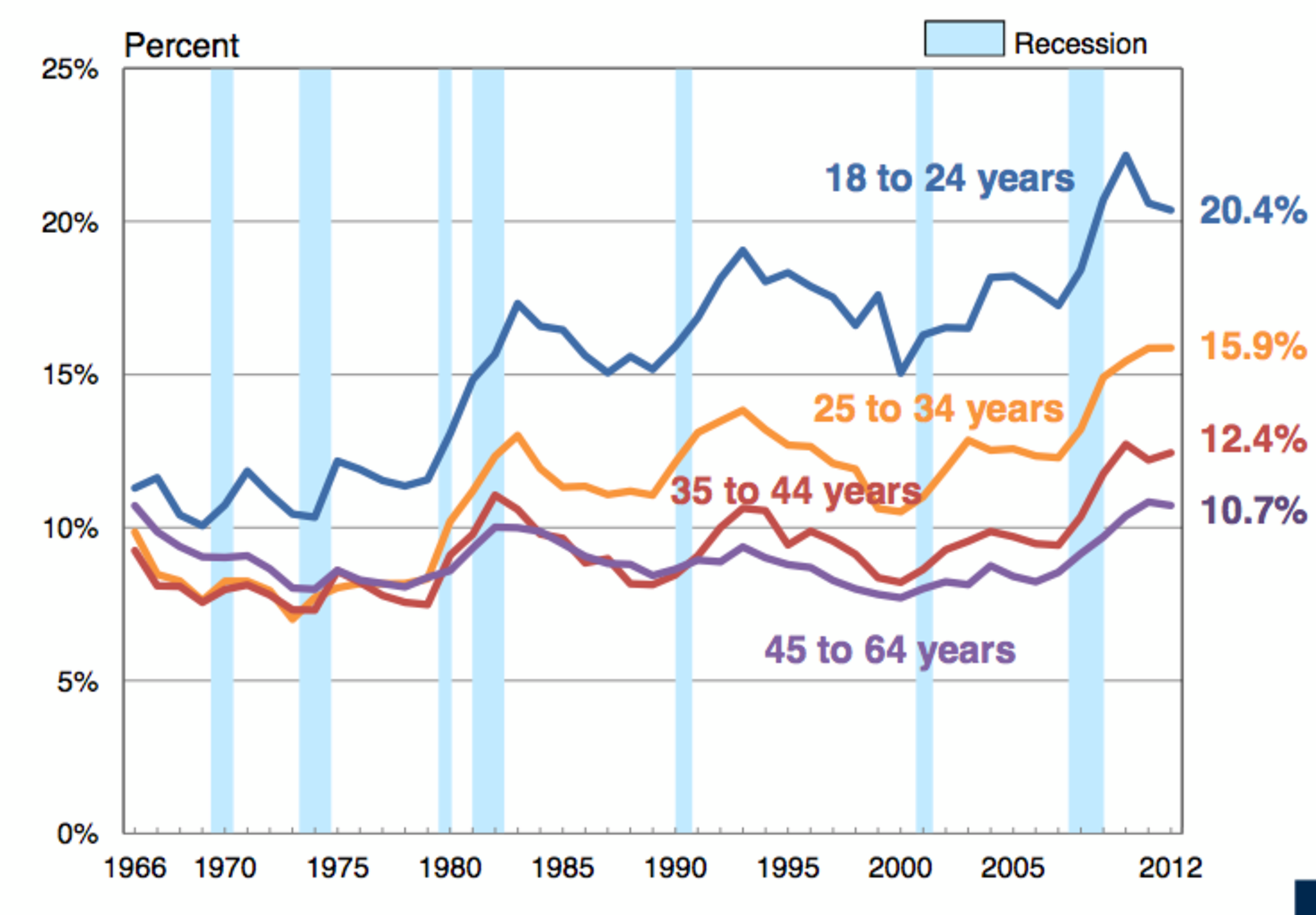

Officially, unemployment is only 7%, but millions of people have disappeared from the official statistics of the number of job seekers. More than 46 million Americans now live below the poverty line. Although poverty had fallen continuously since the mid-1960s, it has risen constantly since the mid-2000s, a trend that has been accentuated since the 2008 crisis. Now, 20% of young people aged between 18 and 24 live in poverty.

Enlargement : Illustration 1

In Europe, where austerity policies have been imposed in a context of economic weakness, the figures are even worse. Unemployment has reached record levels across southern Europe. More than half of young people are out of work in Greece and Spain.

Poverty has made a comeback across the whole continent. In France, more than eight million people live below the poverty line, which is set at 977 euros per month. In Germany 15% of the population also live below the defined minimum. According to Italian statistics agency ISTAT's most recent report, 12% of Italian families are currently living in poverty. In Britain, the Red Cross has opened centres to help those in need, while charities are increasingfood distribution to families, a situation they say they have not seen since the Second World War

Ben Bernanke, whose term as chairman of the Federal Reserve is drawing to a close, cautioned in a recent speech that despite progress attributable to the Fed's imposition of low interest rates and quantitative easing, “the recovery clearly remains incomplete”. The policy of monetary easing, or pumping money into the markets, would continue, he said.

Yet these thousands of billions of dollars, yens or euros have never found their way into the real economy. Instead, they have created an unprecedented economic distortion. Most of the money has flowed into financial markets, where it plays its usual role, engendering massive speculation by investing in the assets that appear to be the most profitable, from oil to property, from shares to bonds.

Last November, when the Fed announced it would continue to pump 85 billion dollars per month into the markets, a billionaire hedge fund manager, Stanley Druckenmiller, commented: “This is fantastic for every rich person. This is the biggest redistribution of wealth from the middle class and the poor to the rich ever. Who owns assets – the rich, the billionaires,” he went on, speaking the day after the Fed's announcement that it would delay a return to tighter money. “You think Warren Buffett hates this stuff? You think I hate this stuff? I had a very good day yesterday.

“I mean, maybe this trickle-down monetary policy that gives money to billionaires and hopefully we go spend it is going to work,” Druckenmiller, the founder of Duquesne Capital, told CNBC. “But it hasn't worked for five years.”

Post-war quest for greater equality grinds to halt

Druckenmiller's words also stand as a summary of economic policies elsewhere in the Western world since the crisis. They have resulted in a massive transfer of resources from the poorest and the middle classes to the very richest.

A study of U.S. incomes from 2009 to 2012 by economist Emmanuel Saez concluded that 95% of the gains from the economic recovery went to the richest 1%. The top 10%, those with annual revenues above 114,000 dollars, saw their income slide by 36.3% from the beginning of the crisis, essentially because of the fallout in stock and property markets. But, contrary to what happened during previous recessions, when the majority of people were relatively sheltered from the fall-out, this time 99% of the population saw their income fall by 11.6% during this period.

Since 2010 the wealthiest households have managed to recoup their crisis-induced losses. Saez notes that the incomes of the top 1% have risen by 31.4% since then, but for the remaining 99% the rise has been limited to a mere 0.4%. “Overall, these results suggest that the Great Recession has only depressed top income shares temporarily and will not undo any of the dramatic increase in top income shares that has taken place since the 1970s,” he says.

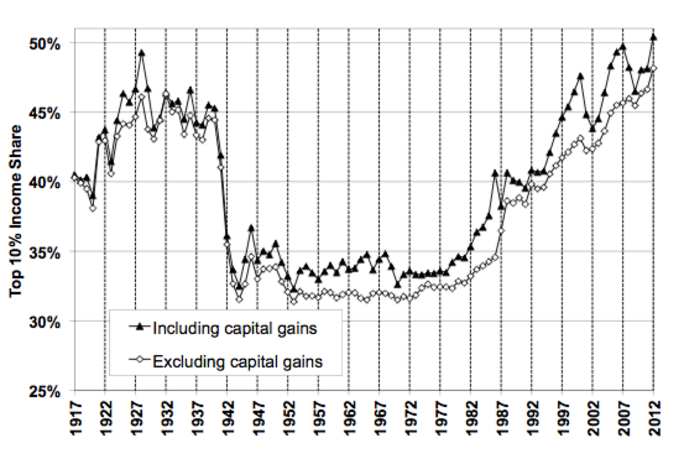

The quest to reduce inequalities that began after the Great Depression of 1929, but particularly after the Second World War, is clearly over. The richest Americans now pay half as much tax as the remainder because of lower tax rates on financial income.

According to Saez's study, the top 10% of the American population accounted for 50.4% of total income, a share that must have grown in 2013. Such a concentration of wealth in the hands of a few has not been seen since U.S. statistics on the subject were first collected in 1917, it says. Even just before 1929, the disparity was smaller.

In Europe the figures are perhaps not as extreme, but the trend is the same, as can be seen in reports from Insee, the French statistical institute, and the European Union's Eurostat. The gap between rich and poor is growing everywhere.

In the United States the rise in poverty and the decline of the middle classes have become issues on the political agenda, albeit only recently. In polls, the majority of the population say they do not believe their children will rise up the social ladder. In early December President Barack Obama talked about the end of the American Dream, saying he wanted to tackle inequality and give back hope to the middle classes, the pillar of American democracy.

Lawrence Summer, former economic advisor to President Bill Clinton who was a candidate to replace Ben Bernanke at the helm of the Fed, went even further in an article published in the The Financial Times on January 6th. He said there was a clear risk of the American economy falling into stagnation of a kind it has not known for a century. He also argued for a change in policy to promote investment, saying the problem was caused more by lack of demand than by the supply side.

Europe, however, has not even begun to think along these lines. In Britain, Spain, and to some extent France, policies are guided by austerity plans involving cutting public spending and taxes, driving down salaries and reducing redistribution. But Europe's wealthy have nothing to fear. This year should also be an excellent one for them.

----------------------------------------------

English version by Sue Landau