French utility giant Electricité de France (EDF) has suffered a major setback in its plans to export European Pressurized Reactors (EPRs) to the United States, while development of its EPR projects in the United Kingdom have become bogged down in a row over the subsidies to be paid for the energy they produce.

On August 30th, the US Nuclear Regulatory Commission (NRC) rejected an EDF subsidiary’s application for a licence to build and operate an EPR reactor in Calvert Cliffs, Maryland (the full text of the decision is available here). The refusal invokes the Atomic Energy Act, which prohibits foreign operators from owning and operating nuclear reactors in the US - and the would-be licensee, US company UniStar Nuclear, is a wholly-owned subsidiary of the French utility.

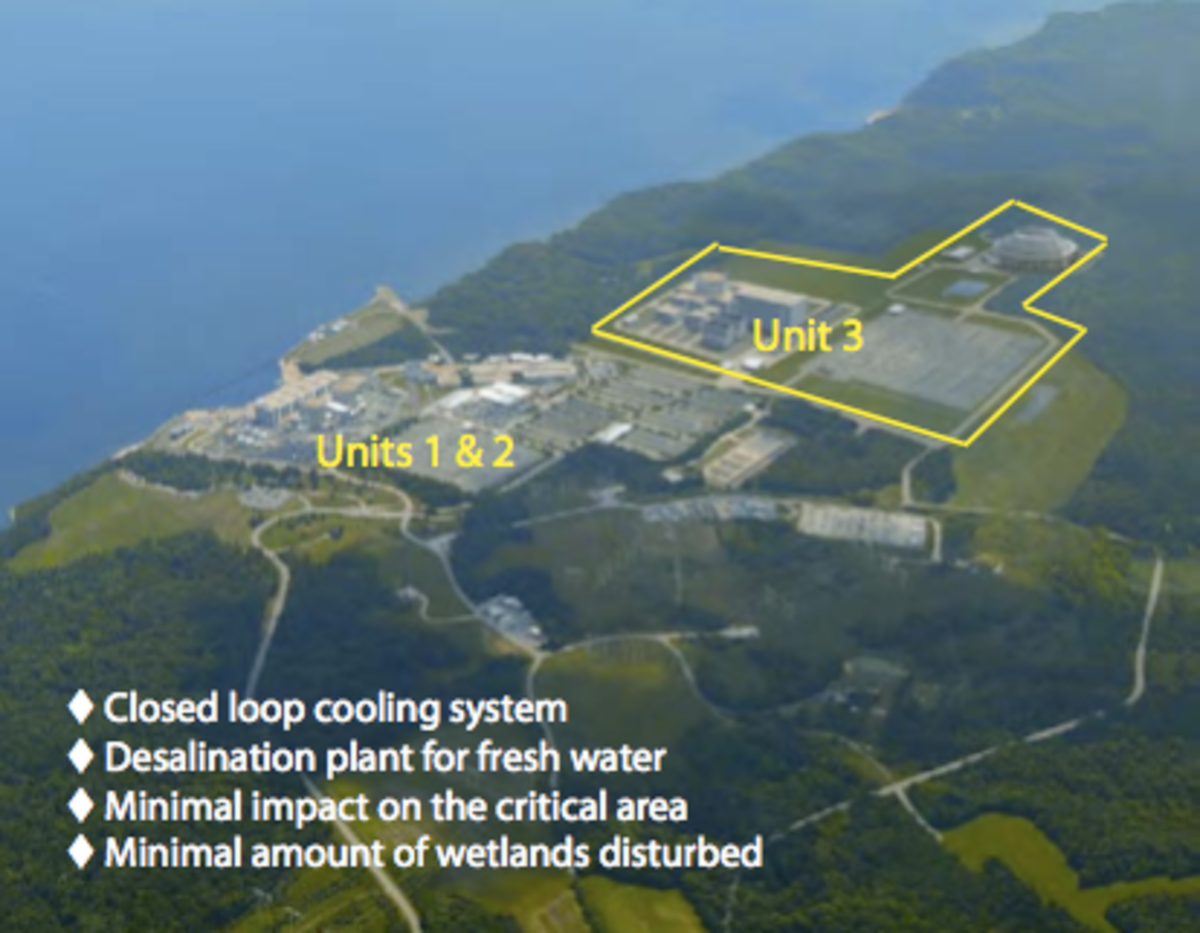

Initially, EDF had gone halves in the UniStar joint venture with the American Constellation Group. But in November 2010, Constellation decided the costs were exorbitant and pulled out, leaving EDF to buy out its stake in full. So now, when the NRC asked UniStar how it intended to comply with the foreign ownership regulations, UniStar (i.e. EDF) proposed a “Negation Action Plan” including “measures intended to ensure negation of potential foreign ownership, control, or domination of Calvert Cliffs Unit 3” – in other words, legal safeguards to limit EDF’s decision-making powers within its own group structure.

But that didn’t convince the judges on the NRC’s Atomic Safety and Licensing Board: “Applicants have had roughly two years to remedy the foreign ownership problem,” the board points out. “We do not doubt that Applicants have made substantial efforts to find U.S. partners, but they have thus far been unable to provide evidence to the Board indicating that a deal with an acceptable U.S. partner is imminent.”

In theory, EDF has another two months to find a new industrial partner, but in all likelihood the ruling spells the end of the Calvert Cliffs 3 project.

EPR technology per se is not targeted by the decision, which only refers to the infringement of the law against foreign control of nuclear reactors. Nonetheless, the technology has clearly reached an impasse in America. With no partner, there will be no EPR, and potential candidates are not exactly queuing up to step into the breach.

The other EPR project developed by UniStar, Nine Mile Point 3 in upstate New York, was simply taken off the waiting list for an NRC licence at the operator’s request. While the EDF subsidiary is involved in two other nuclear projects, but only in the capacity of a service-provider.

'Reactors always need massive public subsidies'

It is a significant blow for the EDF Group in particular and for EPRs in general. It comes at a time when, despite the recent North American boom in natural gas and petrol (including shale gas and petroleum extracted by ‘fracking’), other nuclear projects are underway. In February, the NRC approved two new reactors the Southern Company intends to build at its existing plant in Vogtle, Georgia. These are the first new reactors to be licenced in 30 years and the two units are to go on stream around 2016. With 104 reactors currently operating in the US (as against 58 in France), nuclear power supplies roughly 20% of America’s electricity.

EDF said the NRC decision came as “no surprise” after Constellation pulled out of the joint venture, especially in a current context far more favourable to fossil fuels than to fission. But according to Michael Mariott, head of a network of independent atomic experts called the Nuclear Information and Resource Service (NIRS), the EPR licence denial is a milestone decision. “Four years ago, Calvert Cliffs and South Texas [Editor’s note: another nuclear project]were flagships of the nuclear renaissance,” he said. “During the summer of 2007, the Calvert Cliffs project was the first in 30 years to seek an authorisation to operate.”

Peter Bradford, former member of the NRC and now teaching at Vermont Law School, said the units were never economic. “Not from the day their NRC applications were first filed in 2007 to 2008,” he said. “The same is true of several other reactors. Reactors always cost too much and entail too much economic risk compared to available alternatives. They depend on massive subsidies from tax payers and customers."

EPR’s American fiasco has cost French taxpayers dearly: EDF estimates it has spent roughly 600 million dollars in EPR development in the US, which is recorded in the group’s results for 2010. Moreover, buying half of Constellation Energy in 2008 cost much more more: 4.5 billion dollars (3.13 billion euros). EDF still owns 50% of the American group’s existing nuclear power business and maintains its commodities trading operations.

After this American debacle, EDF and Areva, which designs the reactors, have been eyeing growth prospects in the United Kingdom. But the skies across the Channel are clouding over for the French atomic industry.

In 2008, EDF bought up utility British Energy to gain a foothold on UK soil. The group announced plans to build two EPRs, one at Hinkley Point in the county of Somerset, planned to begin operating in 2018, the other at Sizewell in Suffolk, due to open in 2020. This was another historic announcement, for these were the first projects of their kind in 30 years. EDF’s industrial ambitions were buoyed up by the energy strategy of Prime Minister David Cameron’s government, which wanted to give nuclear power a substantial position in its energy mix.

A draft bill to reform the UK electricity market is currently before Parliament. The object of the proposed legislation is to introduce a guaranteed ‘strike price’ for renewables, but also for nuclear power, which is presented as “low-carbon” energy. Under the so-called “contracts for difference” system, if the market price falls below the strike price, UK consumers will have to make up the difference.

'Unlawfull state aid'

EDF describes obtaining this guaranteed price as an “important aspect” of EPR financing, especially for the Somerset EPR project at Hinkley Point which is currently under negotiaton between the British government and EDF’s British subsidiary, EDF Energy. But this summer, the Energy and Climate Change Committee of the House of Commons expressed concern over the hush-hush negotiations. “The proposed process for agreeing the strike price for nuclear lacks transparency and any perception that decisions are being made ‘behind closed doors’ could be hugely damaging to the low-carbon agenda,” the MPs note in their Pre-legislative Scrutiny of the Energy Draft Bill (click here for the report). They ask for an expert committee to be set up to oversee the talks – a demand so far refused by the government.

When questioned by the MPs, EDF Energy’s CEO Vincent de Rivaz refused to divulge the price range under negotiation. In an August 2011 interview with The Telegraph, he would not confirm that the price per megawatt-hour (MWh) for power generated by the Hinkley Point EPR would be under £100. According to several independent estimates, the strike price could go as high as £145 per MWh. Gerry Wolf, coordinator of a British group of independent energy experts called Energy Fair, said that is “nearly 3 times the current market price for electricity in the UK and is thus a very large subsidy.”

“EDF say that it is about the same as the subsidy for offshore wind power, but they have conveniently forgotten that, by the time EDF could build any new nuclear plant in the UK, around 2020, the price of offshore wind power will have fallen to about £100/MWh,” Wolf added.

Consequently, Energy Fair has made a formal complaint to the European Commission for “unlawful state aid for nuclear power”. They home in on the underfunding of insurance costs in case of an accident and the policy of a guaranteed purchase price for nuclear power. “It’s entirely appropriate for governments to give subsidies for new energy like offshore wind and PV [photovoltaic],” said Wolf. “But it’s not true of nuclear power, which has been around for years.” He also challenges the claim that nuclear power production emits less carbon than wind and photovoltaic energy.

Initially slated for debate in October, the British government’s draft energy bill is no longer on the immediate agenda, and it appears unlikely to return before next year. EDF, on the other hand, is intent on deciding before the end of 2012 whether or not to forge ahead with the Hinckley Point EPR project. If it does, it would run the risk of investing sizeable sums without obtaining the desired subsidies.

-------------------------

English version: Eric Rosencrantz

(Editing by Graham Tearse)