State-owned utility group EDF is in an increasing predicament over its unfinalised deal with the British government to build two pressurised water reactors (EPRs) at Hinkley Point, a nuclear plant beside the Bristol Channel in south-west Britain.

The project has caused deep divisions among the EDF board and has also met with opposition from staff unions. Last Monday, EDF finance director Thomas Piquemal resigned over his concerns of the financial risks involved in the venture. These centre on the recurrent problems for EDF with its building of similar EPRs in France and Finland, which have caused huge delays and gone well over budget.

The new nuclear reactors at Hinkley Point, managed by EDF’s British subsidiary EDF Energy (formerly British Energy), are due to enter service in 2023, but EDF chairman and chief executive Jean-Bernard Lévy has yet to announce a final decision to invest in the half-inked project which is officially estimated to cost 25 billion euros. Lévy is in favour, and is backed by economy minister Emmanuel Macron.

But just days after EDF’s finance director quit in protest at the dangers of the deal, it was the turn of the French national audit body, the Cour des Comptes, to voice alarm over the venture.

“While it is not as yet a finalised operation, the very complexity of the cited [financial] structure, and above all the manner in which it might impact EDF’s responsibility, are sufficient to raise strong questions,” reads a report by the Cour des Comptes (Court of Accounts) published on March 10th.

Enlargement : Illustration 1

Significantly, the auditors more usually report on the past actions and money wasting of French public institutions and companies. The warning contained in the document, which was more largely a report on EDF’s international activities between 2009 and 2014, was made, they said, because of “the potential impact for the French state of the risk of losses that EDF runs in projects of this size”.

The report raises concerns over the contract prepared between EDF and the British government. The deal guarantees that EDF, once the reactors are onstream, can price its electricity at £92.5 (about 120 euros) per MWh, and this for a period of 35 years (with a clause for adjustments according to inflation). “The concluded agreement therefore implicates a stable and foreseeable sale price for EDF Energy,” observe the auditors. “If the electricity market price exceeds the price set out in the contract, consumers will not have to pay more. If the market price is under the price set out, the operator [EDF Energy] will receive a supplementary payment.”

Echoing the alarm raised by many within EDF, the auditors doubt the group’s ability to finish the building of the reactors by 2023 as planned, given the huge delays caused by technical problems and the budget-busting in the building of EPRs at the Flamanville nuclear power station in northern France, at Olkiluoto in Finland and Taishan in China.

“The experience of the delays in the entering into service of the nuclear power plants of Olkiluoto, Flamanville and Taishan can obviously raise questions over the capacity of the project at Hinkley Point to keep to the initial timetable,” says the report. “If the cost of the construction is higher than the predicted amount, the added cost will be assumed by EDF and its minority partners,” the report continues, “whereas in the case of a super-performance, because of the mechanism set out in the contract, EDF will have a ceiling placed on its profits to the benefit of British consumers.” In other words, EDF is placed in a position of taking on all the financial risks in the project without any opportunity for a bonus in profits in the – however unlikely – event that all went better than planned.

The auditors’ report details previous blunders in EDF’s operations abroad, when the company was aiming to become a worldwide group, centring entirely on nuclear power to the exclusion of renewable energies. These include its purchase in the US in 2008 of stock in the then almost bankrupt – and now defunct – Constellation Energy Group, which the auditors described as an “expensive failure”. That operation was carried out with the blessing of the French government and notably the agency that manages the state’s majority holdings in companies, the Agence de Participations de l’État (APE).

The auditors observe: “The audit report on the conditions surrounding this operation, commissioned by EDF at the beginning of 2010 and carried out by the firm Accuracy, details that ‘the CENG [Constellation Energy Group] operation is a complex operation that is risk-prone (notably because of the lack of knowledge about the financial details of the entire purchased entity) and over which prior investigations [...] were virtually inexistent. Thus [...] CENG today presents a lower EBITDA than those that were estimated before the offers were placed in 2008’.”

After paying over the odds for the Constellation Energy Group in face of a rival bid, EDF also had to pump 1 billion dollars into the ailing US company. After that, it had to pay out to undo the surrender options made during its purchase of the company’s stock. “The operation Constellation Energy Group-CENG-Unistar should, by December 31st 2014, have cost about 6.5 billion dollars, of which almost 5 billion went into the purchase of the CENG,” the auditors report. “That sum, however, does not represent the final cost of the operation, which will depend upon spending still to come (notably impairment losses) and the price of the final sale.”

Dangers ahead

Enlargement : Illustration 2

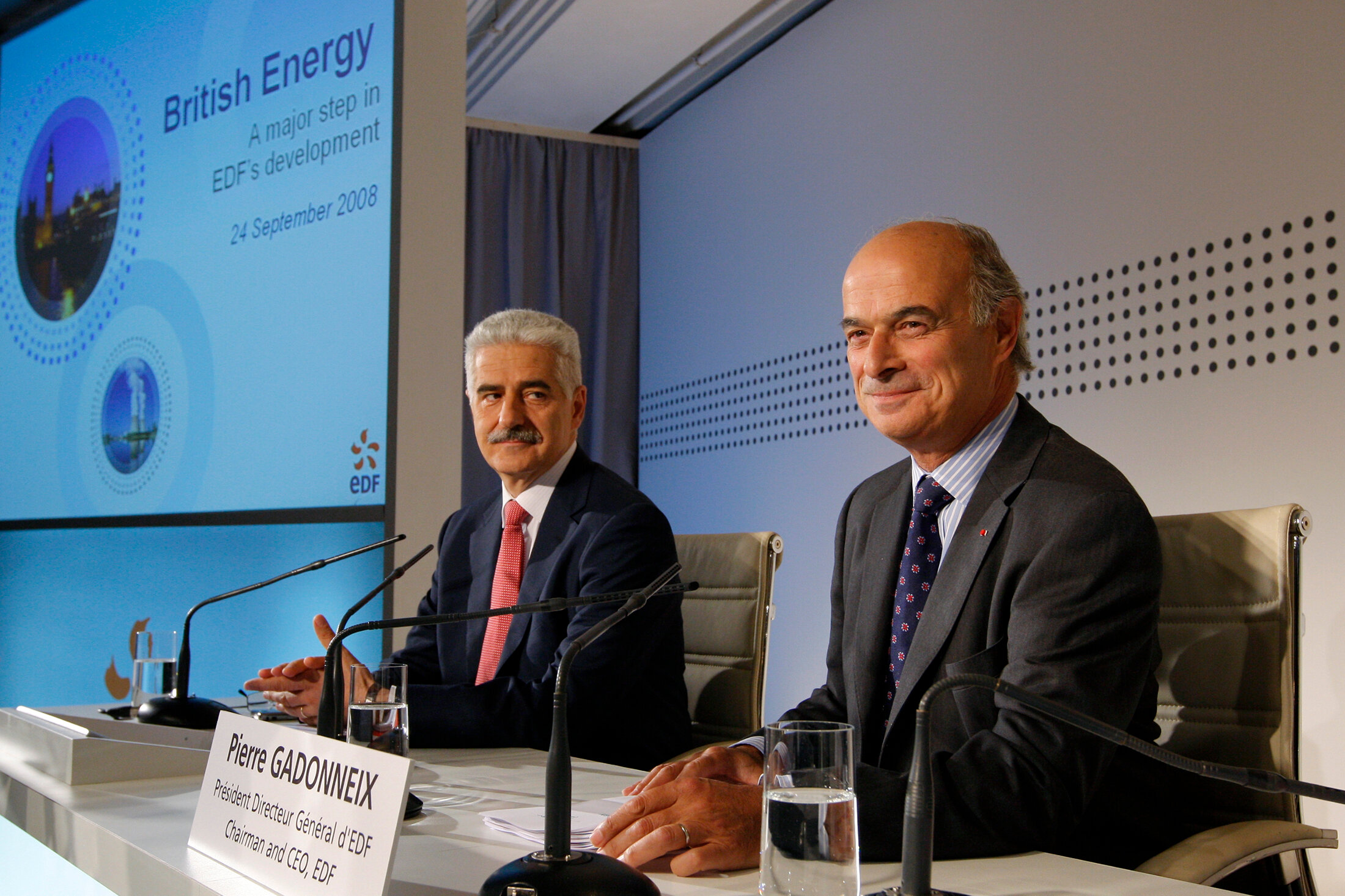

Meanwhile, EDF’s purchase of British Energy, also in 2008, was hardly less controversial. “The tender offer was made in financial conditions that were very unfavourable for EDF, with, as of the announcement of EDF’s intentions, British Energy share prices constantly rising, up until the eve of the operation, [and] against the trend of the heavy fall of prices on the markets,” the auditors note.

These purchases were made almost entirely by borrowing. The then-EDF chairman and chief executive Pierre Gadonneix stood down from his post in 2009, succeeded by Henri Proglio. The auditors report that by then, “the net financial debt of EDF had gone from 16.3 billion euros in 2007 to 24.5 billion euros in 2008, and reached 41.1 billion euros in 2009”.

The Court of Accounts auditors recognised the “financial realism justified by the level of the group’s debt burden” shown by Thomas Piquemal, EDF’s finance director who this month quit because of his disagreement with the Hinkley Point project. Piquemal, 46, was behind the selling off of a number of EDF stakes and subsidiaries, including its share in German electric utility firm EnBW and British electricity networks, which in all brought back 12.8 billion euros. It was also Piquemal who was behind EDF's acquisition of total control over Italian energy firm Edison, which had been bought up by EDF in questionable manner in 2003 but in which the French giant initially had no majority of voting shares.

While EDF has an international arm, EDF International, a share of the debts notched up in the expansion abroad is held by EDF France. The auditors report that, over the period 2009-2013, EDF’s international activities have brought the group more than they have cost it in investments. Nevertheless, their profitability has continued to decline. “The group’s operating income has gone from 10.1 billion euros in 2009 to 8.4 billion euros in 2013, representing a fall of 16.7%,” note the auditors. “During the same period, the operating income in the United Kingdom has fallen by 40%, that in Italy by 14% (but with important losses in 2010-2011), that of Belgium by 91%, and that in Poland by 52%. Globally, the EDF group’s international activities, notably in the United Kingdom, have resisted the vicissitudes of the energy markets less well than the French network.”

Underlining the difficulty in clarifying the strategy of EDF’s operations abroad, they cite it’s arguments for the expensive expansion as being the need to acquire international stature, and the exchanges and development it brings. But, they note, in 2013 just 387 of EDF France staff were dispatched around its foreign subsidiaries – which in all employ a total of 29,000 people.

While the group’s foreign operations appear to have become better controlled, the auditors warn of potential dangers ahead. “These acquisitions are not, however, devoid of the risks of a shift in costs in the coming years, whether that be in the United Kingdom, to finance investment in the prolongation of the existing network and the decommissioning of plants, or in Italy, to mobilise treasury resources in order to temper the volatility of gas contracts, and to make necessary investments (notably for exploration-production),” they write.

While the auditors criticise successive EDF managements, they also blame the government for taking little interest in the group’s international strategy, or the operations carried out, or its financial situation. “The major preoccupation of the state as [majority] shareholder has been that the group continues to hand out a substantial dividend, despite a fragile financial situation and even at the cost of an increase in debt,” they conclude. The state’s only involvement, add the auditors, has been “to encourage nuclear projects abroad”, including in Saudi Arabia, the United Arab Emirates, South Africa and the United Kingdom, with no geopolitical or financial discern.

-------------------------

The French version of this article can be found here.

English version by Graham Tearse