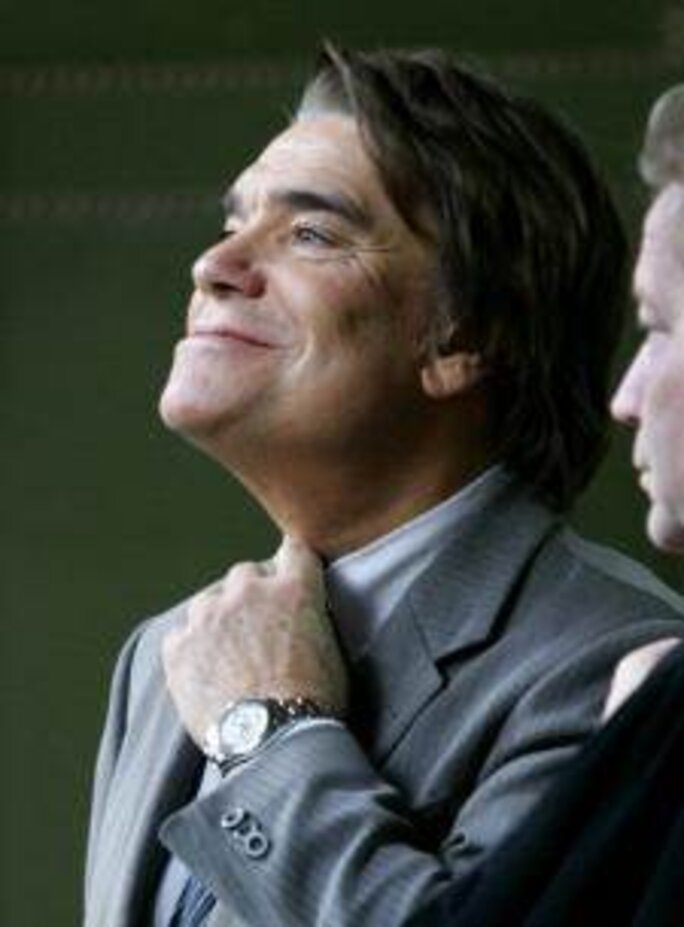

A French court will decide early next month whether the new IMF chief Christine Lagarde will be investigated for her role, when French finance minister, in the controversial 2008 award of more than 400 million euros of public money to French tycoon Bernard Tapie. The case took a new twist this week after Mediapart led revelations over a secret pact between flamboyant, twice-fold rags-to-riches Tapie and an equally colourful entrepreneur called André Guelfi, aka Dédé la Sardine. The two men, who first met in prison, agreed to share their winnings in Tapie's compensation claim against the Crédit Lyonnais bank, and Guelfi's astronomic and ongoing compensation demand of more than 1 billion euros from oil giant Total, with funds destined to an offshore tax haven. Laurent Mauduit reports.

-------------------------

The agreement between French tycoon Bernard Tapie, now 68, and André Guelfi, now 92, a one-time Formula-One racing driver who set out in business in the fishing industry, earning him the life-long nickname of Dédé la Sardine, involved them splitting 50-50 the spoils of court cases over business deals in which they allege they were cheated out of their rightful due.

The secret accord, about which Mediapart has obtained exclusive details, was forged as they languished in adjoining cells in the Santé prison in Paris some 14 years ago.

The first of the compensation cases it alluded to was concluded in July 2008, when Tapie was awarded damages of 403 million euros in his case against French state-owned bank Crédit Lyonnais for alleged spoliation when it sold his controlling stake in sportswear and accessory firm Adidas in the early 1990s. Then-French finance minister Christine Lagarde, the newly-appointed Managing Director of the International Monetary Fund (IMF), allowed the case to be settled by private arbitration rather than see it continue through the courts where Tapie stood to be awarded substantially less.

Following suspicions of malpractice, the procedure surrounding the arbitration and Lagarde's handling of the case was referred earlier this year by France's most senior public prosecutor to a court for investigation. The court's decision on whether to investigate Lagarde is expected in early August.

At the time of the agreement between Bernard Tapie and André Guelfi, Tapie had emerged heavily in debt from a short prison term over match-rigging when he ran the Olympique de Marseille football club, following a series of financial investigations and bankruptcy. The 2008 settlement put some 240 million euros of public funds straight into his pockets. (For more on the background of the dispute, and the chequered life of Bernard Tapie, click here]

However, Tapie is now said to be eyeing an even bigger fortune from the second of the lawsuits whose proceeds they vowed to share - an unprecedented claim of over 170 billion dollars that Guelfi, imprisoned for his role in the Elf scandal, is seeking from French oil company Total. This centres on aborted deals in Russia by a former Elf subsidiary (click here for Mediapart's investigation into the claim). That case was given the go-ahead to proceed in January this year.

Meanwhile, Guelfi has engaged lawyers specialising in debt collection to try and enforce application of their agreement to Tapie's settlement in the Crédit Lyonnais case. Their pact had, curiously, fallen by the wayside, partly because things did not work out as Guelfi appeared expect at the time, after Tapie's case underwent many twists and turns. Guelfi recounted their friendship in an autobiographical book, L'Original(1) and detailed their pact together in an interview with Le Monde in December 2005.

On leaving prison, with Tapie down and out and Guelfi still immensely rich but full of bitterness over his time in jail, a mutual acquaintance suggested they become associates. They created a 50-50 "société en participation", an unusual corporate statute but one that is extremely simple to set up, into which each put a single, potential asset: the proceeds of a possible legal victory in the Credit Lyonnais case for Tapie and the proceeds of a possible legal victory against Total for Guelfi.

"When I got out of prison I told him [Tapie] that I would count him in for deals in Russia I was involved in[...] We said that half of what I earned would go to him and in exchange, half of what he got from Crédit Lyonnais would be for me," Guelfi said in the interview with Le Monde published in 2005.

-------------------------

1: Published in French by Robert Laffont, 1999.

A joint company with Malaysia HQ

Tapie, however, denies he had any agreement with Guelfi, or any interest in the Total case. "I like the fellow a lot, but here's his problem: he's always making mistakes," Tapie told Mediapart. "His memory is fading. But this Total affair, I'm not involved at all. There never was any question that we share [the proceeds of] our trials. Even if I had wanted to, it would have been legally impossible for me to do so," Tapie said, referring to the judicial constraints of the bankruptcy proceedings to which he was subject at the time.

"I give you my word of honour that the case never interested me and never will interest me," Tapie added, citing his longstanding friendship with Jean-Louis Borloo, a leading centre-right politician and former senior minister in President Sarkozy's government, who is close to Total CEO Christophe de Margerie.

A source close to Tapie admits that Guelfi lent the French tycoon money when he was released from prison, but said this was in the form of a salary and which would have amounted to around 1 million euros to 1.5 million euros. Tapie, however, said that a British company had paid him a salary, but gave no further details.

Despite these denials, there remains little doubt about the existence of the Tapie-Guelfi pact. Mediapart has talked to witnesses who were present when it was concluded. Then there is the creation of the société en participation, which was followed 18 months later by a new contract which, various sources say, was drawn up by a tax lawyer, Eric Duret, who now works in Canada but until 1988 was the associate of Maurice Lantourne, Tapie's lawyer.

Following Mediapart's revelations about the pact earlier this month, the investigative French weekly Le Canard Enchainé on July 20th published the "memorandum of understanding" between Guelfi and Tapie, dated May 4, 2000. A single copy was drawn up and placed in escrow with Duret with the proviso that it must not be given to anyone, the Canard reported.

The document begins: "It is expressly agreed as follows: that Monsieur André Guelfi and Monsieur Bernard Tapie agree to create together the company Superior Ventures Limited headquartered in Labuan (Malaysia)."

Total convinced that Tapie is in Guelfi's shadows

Tapie's court case is mentioned further on: "Superior Ventures Limited will also receive anticipated profits from the court case brought against Credit Lyonnais in the BTF/Adidas affair after payment of debts."

The document also contains another detail. The two associates each own 48% of the joint company, and the remainder is attributed to "a third party well known to the signatories".

However, the extracts of the memorandum of understanding quoted in Le Canard Enchainé did not say that Tapie may be entitled to half the proceeds that Guelfi could obtain if he won his legal battle with Total.

Lantourne, Tapie's lawyer, told news agency Agence France-Presse: "The question of an agreement is without object, the agreement was never validated by the commercial court" as would have been necessary after Tapie was placed in bankruptcy. The memorandum of understanding was not followed up and "Mr. Guelfi has not applied it from his side either," Lantourne said.

However, Mediapart became aware of tension between Guelfi and Tapie after the compensation awarded to Tapie in July 2008. According to information obtained by Mediapart, when Guelfi sought to enforce the pact, he first contacted William Bourdon, a lawyer specialising in cases such as misappropriation, to defend his cause as if it simply involved a commercial contract. But this did not go beyond initial discussions.

He then enlisted Francis Louvard, a former lawyer in Paris who used to work with a well-known business lawyer, Georges Berlioz, but who no longer has a practice in France and is understood to be based abroad. A source close to Tapie admits to having knowledge of the brief Louvard has been charged with carrying out, but says he has not yet made contact with Tapie.

The few specialists who are informed on the matter believe that Tapie's strategy is to not honour his pact with Guelfi but to avoid falling out with him too openly so as not to prejudice what might happen in future if Guelfi were to win his court case. Certain top managers at Mediapart understands that Total is convinced that behind Guelfi - who, given his age, is in a hurry - is the shadow of Tapie, who can afford to take his time. This could be a key to explaining the constant support for Tapie from President Nicolas Sarkozy and some of his close allies.

Tapie himself says that he does not owe anyone anything. "But if that were to be the case, it is simple, it only requires starting a procedure before the commercial court," he commented.

There is, however, a flaw in Tapie's argument. If Guelfi did advance him money or conclude financial agreements with him, Tapie can hardly claim that he was not legally entitled to enter into any such agreement and at the same time not honour his debts.

In any event, the timing of these revelations for Christine Lagarde as she eases into her new role at the IMF following the resignation of Dominique Strauss-Kahn, could not be more unfortunate. The Cour de Justice de la République, the court that investigates and judges suspected offences committed by government ministers, is due to rule on August 4th on whether it will open an inquiry into Lagarde's handling of the Tapie case while she was finance minister. The revelations about Tapie and Guelfi's joint company suggest a hefty part of the public funds awarded to Tapie were to transit secretly to Labuan, a tax haven in Malaysia.

-------------------------

English version: Sue Landau