Earlier this month it was revealed that French tycoon Bernard Arnault, chief executive of luxury goods firm LVMH, the wealthiest person in France and the fourth wealthiest worldwide, has applied for dual Belgian nationality. Whatever his subsequent explanations, this bulimic billionaire has demonstrated that when making money becomes not a means but an end in itself, it entails a dogged determination to escape common laws.

Tax evasion is not at the periphery but at the centre of an economy that has, under the influence of finance, become Mafia-like. Fighting it should be an urgent cause, both in France and across Europe.

In 1937, after Franklin Delano Roosevelt began a second term as president of the United States, the country advanced further on its democratic and social renewal in the face of an economic crisis that was comparable with that of today. In Europe, meanwhile, the forces of fascism were establishing their barbaric rule, leading to the inevitable outbreak of the Second World War.

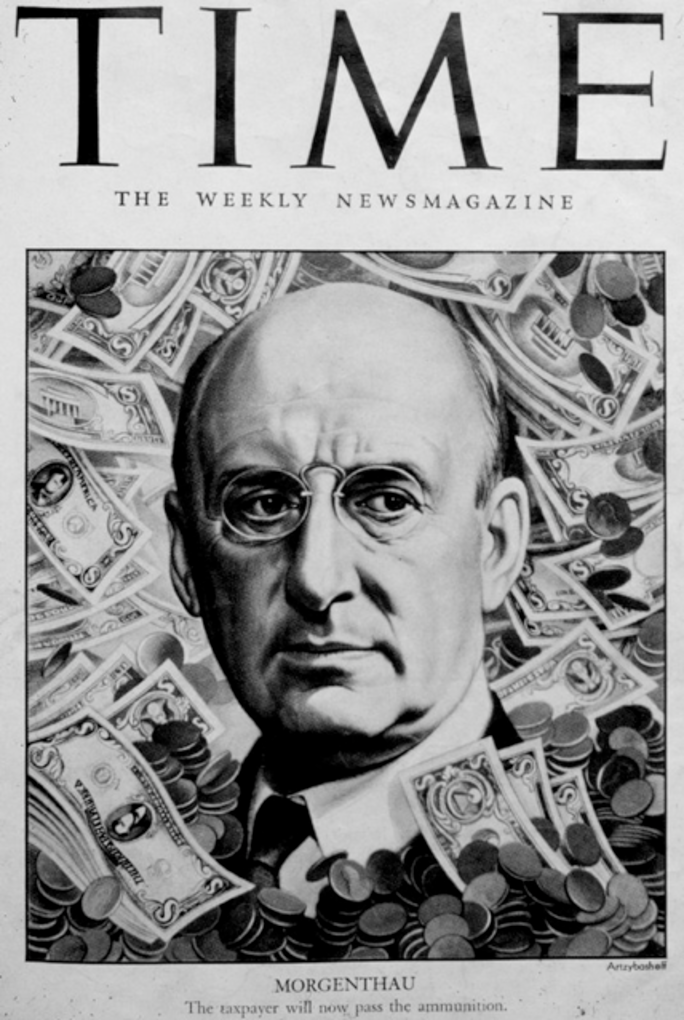

On May 21st that year, US Secretary of the Treasury, Henry Morgenthau Jr., submitted a memo to the president on the subject of fraud and tax evasion. "The investigation of the income tax returns for each successive year reveals the increasingly stubborn fight of wealthy individuals and corporations against the payment of their fair share of the expenses of their Government," began the memo. "Although Mr. Justice Holmes said: 'Taxes are what we pay for civilized society', too many citizens want the civilization at a discount."

To not pay taxes, to escape them, is to adopt the savage notion of everyone for himself. When it becomes the end and means of everything, money is nothing other than a weapon of a blind freedom, one that destroys society, amputating the solidarity and linkages that keep it together. When everything can be bought, there is no principle or value that remains, and the law itself is worth nothing.

Tax is not an enemy of freedom, which itself contains the liberty to become rich. It civilizes this individual liberty, placing it within a collective relationship in which everyone, each to their means, contributes to the wealth of a nation, in order to build schools, hospitals and roads, all in the hope that no-one is left out of society.

When leaders of the French conservative Right this month jumped to Bernard Arnault’s defence, such as former prime minister François Fillon, they unmasked how little is their interest in the general good and how great is their concern for a few private fortunes. Indeed, this was what underpinned their policies under former president Nicolas Sarkozy; that the people at large pay more and yet more, while the rich pay less and still less to become even richer (see Mediapart’s article on a recent study by the French national statistics institute INSEE which underlines this, here). This encouragement of a lack of civic spirit, and this praise for illegality, echo the extremism of the American Right, which is spreading a disastrous political ideal that champions the rights of the strongest, the wealthiest, as a social norm.

This intellectual regression can be properly measured by returning again to the situation in the US in the 1930s, so very relevant to the issues facing current-day Europe. Treasury Secretary Morgenthau’s memo to Roosevelt was prompted by a shortfall in tax revenues in 1936, notably because many of the richest avoided participating in the collective effort.

Morgenthau detailed the methods used to avoid taxes, the principle one being offshore tax havens, and cited the names and accounts of several of the millionaires involved. He denounced the immorality of those concerned, and compared their behavior with the honesty and contribution of “the ordinary salaried man and the small merchant”.

"But we still have too many cases of what I may call moral fraud -- that is, the defeat of taxes through doubtful legal devices which have no real business utility, and to which a downright honest man would not resort to reduce his taxes,” wrote Morgenthau. “Your administration has been notable for demanding a higher standard of morality in commercial dealings. We need a higher standard of morality in the dealings of the citizen with his Government."

In his conclusion, the Treasury Secretary observed: “[…] the ordinary salaried man and the small merchant does not resort to these or similar devices. The great mass of our 5,500,000 returns are honestly made. Legalized avoidance or evasion by the so-called leaders of the business-community is not only demoralizing to the revenues; it is demoralizing to those who practice it as well. It throws an additional burden of taxation upon the other members of the community who are less able to bear it, and who are already cheerfully bearing their fair share. The success of our revenue system depends equally upon fair administration by the Treasury, and upon completely honest returns by the taxpayers. We have a right to expect higher standards of morality in high places than the 1936 returns disclose.”

The ever-swelling coffers of tax havens

The alarm raised over fraud and tax evasion was part of the unambiguous approach of the New Deal. “Taxes, after all, are dues that we pay for the privileges of membership in an organized society,” said Roosevelt in 1936, two years after the passing of Revenue Act, which raised income tax on higher incomes, with a 63% tax rate on those earning yearly above 200,000 dollars (equivalent to about 2 million dollars today). The law was modified in 1936, raising the top rate tax to 79%, and again in 1941 when it became 91%. During almost half a century, up until the arrival of Ronald Reagan as president in the 1980s, the top-rate income tax in the US never descended below 70% and averaged about 80%.

Enlargement : Illustration 2

But, as underlined in the past by Morgenthau’s memo, and highlighted today by Bernard Arnaud’s application for Belgian nationality, imposing higher taxes for the richest incomes is not effective in itself; there must also be in place the means to prevent fraud and the flight of wealth, to prevent such crimes proliferating amidst a parallel economy, and to prevent delinquents from escaping the just rigour of the law. This is no minor affair given the extent to which, over the past 40 years, tax evasion has unceasingly spread like disease through the heart of the world economy. It has become ever-more professional in the financial structures it uses, protected behind legal barricades to the point of becoming an impregnable fortress, secret and opaque. It hides and reinforces a dangerous Mafia-like system worldwide, following no other law than that of profit and no other rule than that of secrecy.

In a speech at Madison Square Garden on October 31st 1936, four days before his landslide reelection to a second term of office, President Roosevelt similarly denounced “the old enemies of peace” who he defined as “business and financial monopoly, speculation, reckless banking, class antagonism, sectionalism, war profiteering”.

“They had begun to consider the Government of the United States as a mere appendage to their own affairs,” continued Roosevelt. “We know now that Government by organized money is just as dangerous as Government by organized mob.” Placing organized money on the same level as organized crime, Roosevelt went well beyond French President François Hollande’s election campaign opening speech at Le Bourget in January, when he described “anonymous capital” as his “enemy”.

But what Hollande was referring to is hardly anonymous, and it is above all criminal. Indeed, in his battle against fraud and tax evasion, Roosevelt’s Treasury Secretary Henry Morgenthau also fought against corruption and organized crime. What, one wonders, would these radical reformers, convinced that democracy demanded more than lip service, have thought of the free marketeers’ deregulations which have, in the space of a few decades, created a world in which money is lord and crime its master? Yes, crime; the refusal to obey laws and the violation of rules, made possible amid an indecent and cowardly climate to which States have turned their backs and in which oligarchs rule in arrogance. This state of affairs has simply worsened with the economic crisis.

This is the reality of a world which has fallen prey to a capitalism with no constraints, and at the heart of the system are tax havens. British writer and journalist Nicholas Shaxson, a specialist investigator of tax havens and author of Treasure Islands: Tax Havens and the Men who Stole the World, published in 2011, makes clear that they are not marginal entities but, rather, the norm. In his book, Shaxson, a member of the Tax Justice Network, writes: “More than half of world trade passes, at least on paper, through tax havens. Over half of all banking assets and a third of foreign direct investment by multinational corporations, are routed offshore. Some 85 per cent of international banking and bond issuance takes place in the so-called Euromarket, a stateless offshore zone. The IMF estimated in 2010 that the balance sheets of small island financial centres alone added up to $18 trillion - a sum equivalent to about a third of the world's GDP. And that, it said, was probably an underestimate. The US Government Accountability Office (GAO) reported in 2008 that 83 of the USA's biggest 100 corporations had subsidiaries in tax havens […] The Tax Justice Network discovered that ninety-nine of Europe's hundred largest companies used offshore subsidiaries. In each country, the largest user by far was a bank."

Gabriel Zucman, a researcher at the Paris School of Economics, has carried out pioneering studies that evaluate what he calls “the missing wealth of nations”. He concludes that the world’s tax havens secretly contain about 8% of global household wealth. “At the end of 2008, the wealth of households – that is, bank deposits, share holdings, stakes in investment funds and life insurance contracts held by households worldwide – amounted to 75 trillion dollars,” he said in a November 2011 interview with French magazine La vie des idées. “Thus, households held about 6 trillion dollars in tax havens.”

In a September 2012 study (that can be downloaded here) that Zucman co-authored with Niels Johannesen, an Assistant Professor at the University of Copenhagen, they observe that the trumpeted G20 move against tax havens “has until now largely failed”. They write: “There is currently as much money kept in tax havens as there was in 2009, and funds are being transferred to those tax havens that are the least cooperative.”

The dark side of globalization

Who knew, for instance, that a tiny Caribbean archipelago, the Cayman Islands, is now the world’s fourth-largest financial centre? Christian Chavagneux, a journalist at the French magazine Alternatives économiques, asks this question at the beginning of his very pedagogical handbook on tax havens, Les Paradis fiscaux (co-authored by Ronen Palan and published in France by La Découverte). This year’s presidential election campaign in the US has flushed these little islands out of obscurity in a series of revelations concerning the fortune amassed and concealed in the Caymans by Republican candidate Mitt Romney (click here for Nicholas Shaxson’s exposé in Vanity Fair). In a very Rooseveltian spirit, some Democratic activists have lampooned Romney’s tax avoidance habit in a music video.

Tax havens are “the dark side of globalisation” writes Chavagneux. “They nourish its opacity, its instability – they were one of the protagonists in the great financial crisis in the late 2000s – and its inequality by serving first and foremost its most powerful players.” And as the crisis spreads and deepens, darkness is gaining ground on the light.

This summer, the Tax Justice Network, an independent coalition of researchers (who include Shaxson and Chavagneux) and activists campaigning for fairer taxation, demonstrated that official assessments of international organisations underestimate the magnitude of tax havens. According to Tax Justice Network reports, the financial assets hidden there are not of the order of US$17 trillion, already an astronomical figure, but US$25.5 trillion, which is more than the GDP of the US and Japan put together.

And that’s only financial assets, without counting all the tangible assets concealed offshore, such as investments in everything from real estate and yachts to racing stables and works of art. It would be an error in perspective to believe these are merely isolated acts, those of individuals violating the laws of their nations to further enrich themselves. The truth is that the whole system is in on the act, from big corporations to big banks, all of which have organised their prosperity around offshore illegality.

All the banks, for instance, that have been bailed out with taxpayers’ money since 2008, without any real quid pro quo, have continued to thrive offshore. A recent report by CCFD-Terre Solidaire, a French Catholic NGO, finds that French banks have actually bolstered their offshore presence despite – or rather thanks to – the crisis. The seven banks under scrutiny have 547 subsidiaries in tax havens, representing close to 21% of their total number of subsidiaries. French banks, notably BNP-Paribas, Crédit Agricole and Société Générale, have 24 subsidiaries in the Caymans, 12 in Bermuda, 19 in Switzerland, 29 in Hong Kong and 99 in Luxembourg.

But it’s not just the banks. As Chavagneux and Palan write: “Big companies now manage their accounts and financing policies through offshore subsidiaries that centralise lending, borrowing and global profit sharing transactions etc. for the whole group.” Hence the paradoxical situation in 2008 in which the foremost foreign investor in France was none other than . . . France! French multinationals were investing in their own country via their offshore subsidiaries, and on a scale that outstripped investments by foreign multinationals in France.

What lies behind these figures and practices is quite simply the theft of a large part of the nation’s wealth, which is misappropriated and stashed away, rather than being redistributed for the public good. French journalist Antoine Peillon recently published an investigation into tax avoidance in France ('Ces 600 milliards qui manquent à la France'). The findings of his book prompted the opening of a preliminary judicial investigation on April 5th targeting the Swiss bank UBS, which had long been shielded from prosecution. No-one has refuted or contradicted Peillon’s assertions that “the assets hidden from the French taxman are nearly of the order of the country’s entire annual tax revenues” and that tax avoidance by individuals and companies combined “comes to at least 590 billion euros, of which 108 billion is in Switzerland alone”.

A shortfall of at least 40 billion euros per year

Far from concerning only isolated cases, the issue of tax avoidance and evasion is crucial to our nations’ economic and financial recovery – and to the social and moral recovery of our nations as well. Above and beyond legitimately surtaxing the highest incomes, France’s new government must take on the tax avoidance issue without delay, especially as that will be a formidable pedagogical weapon in the unfair battle between the aspirations of ordinary people and the corrupt practices of latter-day oligarchs. Moreover, a clampdown on tax avoidance would have the unanimous support of the various political forces that backed François Hollande in the second round of the presidential election, as emerges from a recent Senate committee report on the flight of capital and assets from France (see video below) and the effects this has on the fiscal system (the Senate report is available, in French only, here and here).

This uncontested - and incontestable - report shows that capital flight to tax havens causes annual shortfalls of at least 40 billion, and even as much as 50 billion euros, for the French national budget. That’s 10 (or 20) billion euros more than the 30 billion euros in the belt-tightening measures the government is now planning to inflict on the country. So what is the new government waiting for to seize on the Senate’s rich findings, flesh them out in the National Assembly and, in so doing, set off a broad-based parliamentary dynamic in favour of a resolute struggle to stop these financial crimes?

The frontlines of this battle emerge clearly from the many hearings that were held by the senators. On one side, a business community, buttressed by certain high-level finance officials, that treats national representation high-handedly, in a mix of brazen disdain and double talk. On the other side, all those people - from unionists and not-for-profit organisations to law enforcers themselves - who are hoping for a sea change at long last.

Christian Chavagneux and Ronen Palan explained their findings at length to the senate committee members with the aid of diagrams and graphics. “They once said to me over at the finance ministry,” Chavagneux told them, “that if one were to take Belgium, Switzerland, Liechtenstein and Luxembourg, that would cover the bulk of French tax evasion, both by individuals and multinationals. So there’s a fraud, an evasion and an aggressive optimisation of [geographic] proximity in which, all the statistics bring this out, our Luxembourgish friends play a special part.”

In other words, a tax evasion system entrenched right in the heart of Europe: Luxembourg and Belgium were, after all, among the six founding members of the European Union. And it should be recalled that, while offshore investors, taken together, hold the largest share of American public debt, the three main countries in which investors holding French public debt are located are none other than Luxembourg, the Cayman Islands and the UK.

The senators also consulted investigating magistrate Renaud Van Ruymbeke, a co-initiator of the 1996 ‘Geneva Appeal’ against offshore financial corruption. At the time, he told them, he hadn’t taken very seriously a remark made by one of his Swiss colleagues who warned “The big problem is tax evasion.” He said that now, 16 years on, he would no longer say, “Tax evasion is one thing, organised crime is another.” Van Ruymbeke explained: “Actually, even if organised crime only represents 1 to 5% of tax evasion, these two practices have some tools in common that might be called, without any political connotations, [free-trade] liberalism or financial globalisation.[...] As soon as money crosses borders, the law of the jungle prevails.”

If there has been just one demonstrative virtue in the revelations contained in Mediapart’s numerous investigations published since it was founded in 2008, it lies in having brought that reality to light. Apparently, among the protagonists of our most spectacular articles there are no hardened criminals. They include defence and economy ministers, finance and arms officials; L'Oréal heiress Liliane Bettencourt and her high-society entourage; lawyers, financiers, notaries, big businessmen and professional politicians; Franco-Lebanese arms dealer Ziad Takieddine’s circle of contacts, in which notably figures former high-flying conservative politician François Léotard, businessman Nicolas Bazire (second in command at Bernard Arnault’s LVMH group), former president Nicolas Sarkozy, former prime minister Édouard Balladur, conservative UMP party leader Jean-François Copé, among others.

However, even if with all of the above we are only considering here the Karachi Affair, the Woerth-Bettencourt scandal and the Takieddine network (we could also add the Bernard Tapie affair, too), all our investigations have revealed a massive use of tax havens and the widespread practice of tax avoidance and evasion: in a word, a habit, in privileged circles, of breaking the law and, worse still, a cultural acceptance of that illegality as a matter of course (see for example our latest revelations of Takieddine’s dealings with Barclays Bank).

An Italian warning about the Mafia on high

Palermo prosecutor Roberto Scarpinato, a leading figure of Italy’s independent judiciary who has devoted his life to serving the common good by fighting the Mafia, is wont to point out that real power, that of money and that of organised crime – which often intersect, converge and combine –, is always ‘obscene’ in the etymological sense of the word: ob scenum in Latin, literally ‘offstage’. For secrecy is the fundamental ‘obscenity’ of this kind of power. And this is why, once it has been exposed, as through the tape recordings made by Bettencourt’s major-domo or through the publication of Takieddine’s once-secret documents, we’re staggered and dumbfounded by its true nature, the greed, brutality and vulgarity of which it is composed. ‘Onstage’, in its institutional setting, this power puts on a show of law-abiding respectability to the public. ‘Offstage’ it reverts to its trafficking, scheming, and wheeling and dealing to serve its brutish and brutal interests, without any window-dressing for prying eyes.

In his book Il Ritorno del Principe (‘The Return of the Prince’, published in Italian by Chiarelettere and in French, ‘Le Retour du Prince’, by Éditions La Contre Allée), Scarpinato reflects upon the ‘mafia-isation’ of a deregulated world. This book is invaluable for gaining an understanding of what lies behind the word ‘mafia’: a world, our world, in which conflicts of interest, the proliferation of private interests that are served rather than those of general interest, have become de facto institutionalised. A world in which the abuse of power is legitimized by habit and resignation, in which corruption has become a cultural code moulding the very manner in which power is exercised, and in which the richest and the ruling classes shamelessly indulge in illegal practices for personal gain and aggrandisement.

According to Scarpinato, the mafia of killers, the ‘military mafia’ who figure widely in the media, serves as a smokescreen for the ‘high mafia’, whom he has succeeded in unmasking in his investigations at the risk of his own life: the politicians, notables and financiers who are the true beneficiaries of institutionalised crime.

Both Scarpinato and the journalist Roberto Saviano have loudly and plainly denounced how Mafia-infested Italy is not unfamiliar to either Europe or the rest of the world. Saviano, the author of the now famous Gomorrah (click here for his official website in Italian) never ceases to be amazed at French indifference or obliviousness to the very concrete presence of various Italian mafias in France, and which is consistent with France’s soft approach to Corsican crime.

“France is today a crossroads, a hub of negotiations, reinvestment and alliances between criminal cartels,” Saviano writes in the foreword to the French edition of his latest book, a message he has reiterated in the media . Above all, however, he emphasises that this proliferation of low-lying mafias goes hand in hand with that of mafia practices at the top. As Saviano points out in a recent interview with Italian daily La Repubblica, ever since the economic crisis began in 2008 the international banking system has hardly turned its nose up at the practice of recovering and laundering criminal gains to bail out banks and replenish their coffers with cash.

It would be putting it mildly to say that France, whose public prosecutors are not, as in Italy, independent of executive political power, lags behind in facing these facts. Nicolas Sarkozy’s previous sabre-rattling tirades against tax havens, the black list of which was subsequently miraculously whitewashed, were accompanied by a general demobilisation of the state in the fight against financial and economic crime, wherever it comes from. The French justice ministry’s Central Service for the Prevention of Corruption (SCPC) , whose very existence seems to have fallen into oblivion, has become an all but empty shell, at any rate a toothless agency, as its director himself admitted in his latest report in 2010 (available here, in French only).

This year, a report by the French national audit office, la Cour des Comptes, severely criticised (see here, in French only) the weaknesses of Tracfin, the finance ministry’s financial intelligence unit set up to investigate fight money-laundering, following the creation of the Organization for Economic Co-operation and Development’s (OECD’s) Financial Action Task Force. In July, French website acteurspubliques.com revealed that a confidential OECD report had expressed concern about the sluggishness of French efforts to fight international corruption, and surprise at the paltry number of its official investigations and the lack of sanctions.

Meanwhile, the US authorities, who are hardly prone to policies of collectivist confiscation, have taken opportunity of the economic crisis to beef up the fight against tax avoidance and evasion. They have set their sights on Switzerland and its banks, which at present hold one-third of the world’s missing – i.e. misappropriated – wealth. In the name of national sovereignty, which is the bedrock of the very principle of taxation and tax revenue, the US authorities do not spare private-sector offenders like the Swiss bank UBS, which they have prosecuted thanks to the whistleblowing programme set up by the IRS. Better yet, the Foreign Account Tax Compliance Act (FATCA), which is to come into force in 2013, is causing panic in the Swiss financial community because it requires financial establishments, under pain of sanctions in the US itself, to automatically pass on information about their American account-holders.

So why isn’t France doing the same thing? What is it waiting for to wage war on tax evaders and tax havens? What is it waiting for to boycott, by refusing to award them any government contracts, companies of any kind that have subsidiaries in those hotbeds of crime? What is it waiting for when taxes on corporate profits average only 25% in Europe as against 40% in the US? What is it waiting for when we know that over the past 30 years, with the relative decrease in wage rates and increase in profits, roughly 150% of the aggregate GDP of all the European countries put together has been siphoned off to the financial markets? What is it waiting for when the digital revolution is exacerbating these imbalances, as the leading oligopolists play the tax haven card to the hilt in order to pay as little tax as possible? Google’s tax rate, to wit, is a measly 2.4%.

In the conclusion to his book Treasure Islands: Tax Havens and the Men Who Stole the World, Nicholas Shaxson sounds the alarm: “[...]The offshore system is perhaps the strongest determinant of how political and economic power works in this world. It helps rich people, companies and countries stay on top, for no good economic or political reason. It’s the battleground of the rich versus the poor, you versus the corporations, the havens against the democracies – and in each battle, unless you’re very rich, you are losing.”

In other words, without a relentless war on tax havens, a war waged steadfastly and resolutely, socially progressive policies cannot possibly be lastingly implemented, much less prove their merits. For the offshore enemy is treacherous, sly and secretive, violent and powerful, with no borders and no scruples, just like organised crime.

- Edwy Plenel is Editor-in-Chief, and a co-founder, of Mediapart, and was previously editor of French daily Le Monde.

-------------------------

English version: Eric Rosencrantz and Graham Tearse

(Editing by Graham Tearse)