A recently-published study from the influential independent research centre the Observatoire Français des Conjonctures Économiques (OFCE) on France's economic outlook for 2014-2015 makes miserable reading. The study, entitled 'France: Croissance hors taxes' ('France: Growth before Tax') (see below) is written by four economists, Éric Heyer, Bruno Ducoudré, Hervé Péléraux and Mathieu Plane, and analyses various aspects of French economic policy. Despite its neutral tone it reads like an indictment, and its findings are damning. It concludes that President François Hollande's economic strategy of austerity for most people on the one hand and exorbitant payouts for companies on the other has slowed rather than boosted the economy.

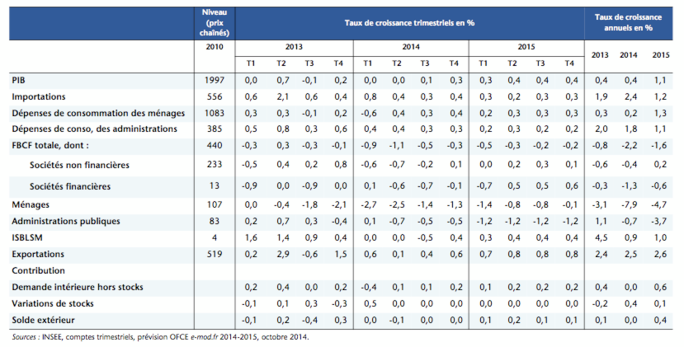

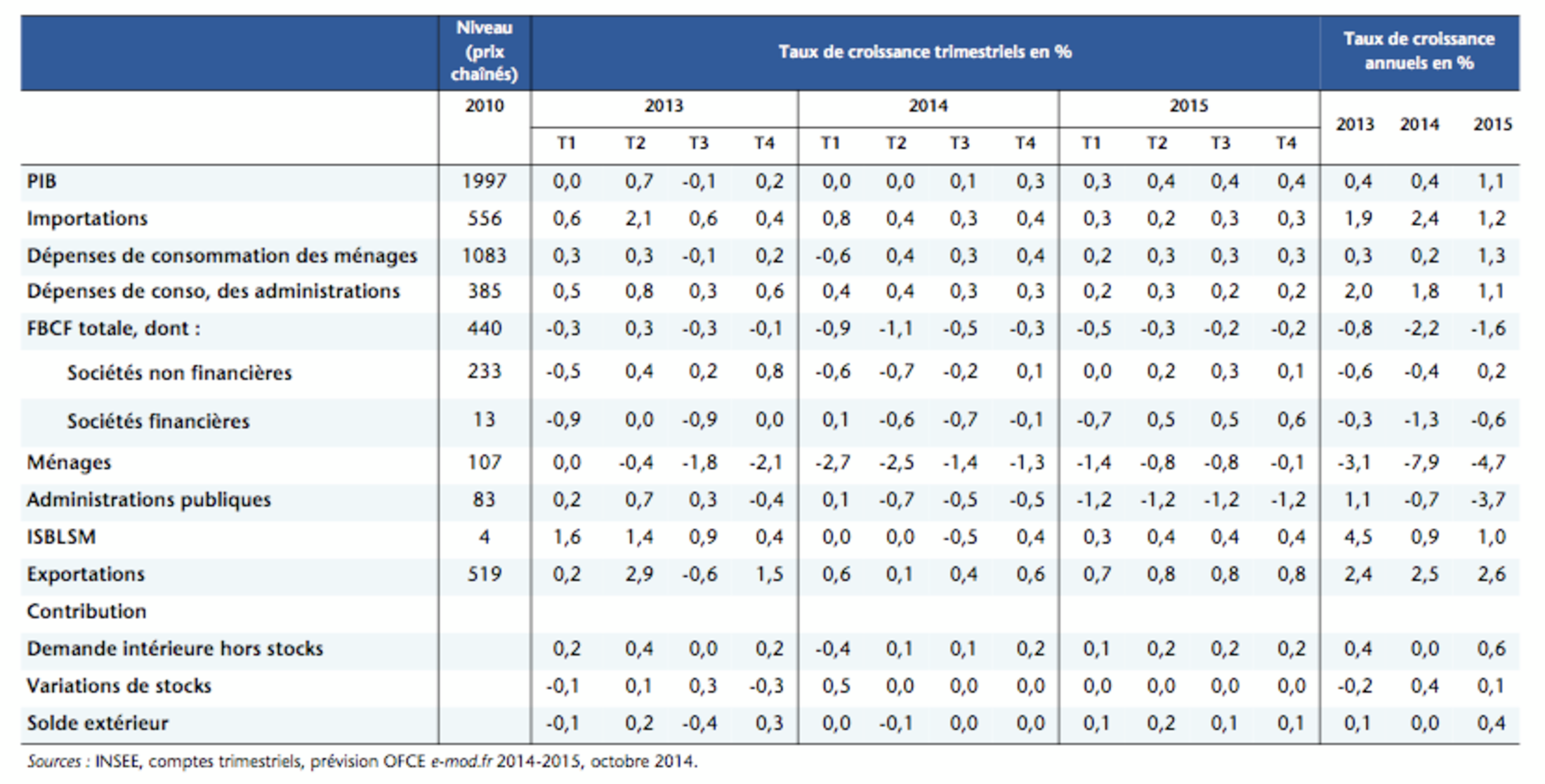

The study's forecasts are not substantially different from those published by other expert bodies – that is, they are just as pessimistic. Looking back, it notes that the recovery that appeared to be getting under way in 2010 ground to a halt in the early months of 2011, and that since then France has been treading water with growth close to zero. Nor does the study, published on October 29th, 2014, find any indication that a recovery is in the offing.

(Cliquer sur le tableau pour l'agrandir)

Enlargement : Illustration 2

France's economic growth, the OFCE says, is likely to be between 0.3% and 0.4% in each quarter of 2015, a rise of 1.1% for the full year. This compares with a desperately low 0.4% for each of 2013 and 2014. But with only 1.1% of growth next year, France would remain bogged down with storm clouds looming on the horizon in the form of government debt and unemployment. It should also be noted that the European Commission has downgraded its forecast for growth in the French economy in 2015 to just 0.7%.

France's growth was set to soar … then came austerity

There is, alas, nothing new in such a depressing analysis. However, the new element that the OFCE brings to the debate is its detailed look at the reasons why the short-lived recovery of 2010 melted away. The chain of economic events behind this makes for interesting reading.

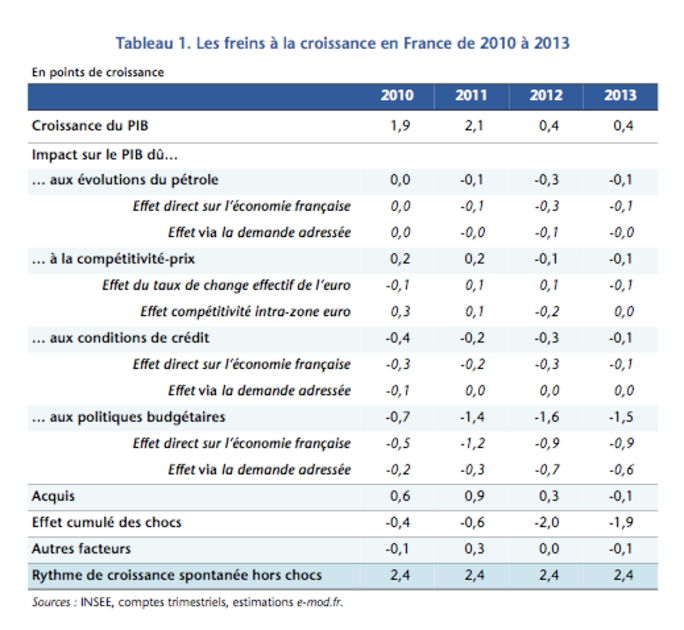

The direction of the French economy at the time, the study says, gave rise to the hope that it might grow by close to 2.4% a year. But the recovery was sharply reined in by four separate factors, each playing a greater or lesser role. It identifies these four factors as: the government's austerity budget, sliding competitiveness due to prices, the monetary environment and fluctuations in oil prices. Below is the table summarising the respective impacts of these various factors:

The table shows that by far the biggest brake on growth was budgetary policy, which played a much more significant role than the three others combined. In 2012 (the year President Hollande came to office), when French growth was 0.4% - and not the potentially realisable 2.4% - restrictive budgetary policy had the recessionary effect of knocking 1.6 points (or 160 basis points) off gross domestic product (GDP) either directly or indirectly. The other three factors had only a marginal impact in that year, lopping just 0.4 points off GDP in the same period. Things were pretty much the same in 2013, when budgetary policy took 1.5 points off GDP.

In other words, the current near-zero growth was not inevitable. On the contrary it is, as the report's authors explain, the result of the austerity policy that President Hollande has chosen to follow. “Four types of shock (budgetary policy, losses of competitiveness, monetary conditions and oil prices), of which the main one was the policy of budgetary consolidation instituted in Europe from 2010, explain how the post-recession recovery was snuffed out in 2011,” they say. “The effect of these four shocks remained moderate in 2010 and 2011, respectively -0.4 points and -0.6 points of GDP, but even at the time budgetary restrictions predominated. This was reinforced in 2011 and 2012 (-1.4 points and -1.6 points of GDP) and was hardly better in 2013 (-1.5 points of GDP).

“Successive French governments have gone along with the norms for reducing deficits decreed by the European Commission, while showing their concern about maintaining credit ratings on French sovereign debt to protect themselves from the disapproval of the financial markets and avoiding a rise in risk premiums on sovereign [debt] rates,” they continue. “So [budgetary] rigour was the blueprint for economic policy. Added to national budgetary restrictions was the negative effect of [tight] budgetary policies followed for the same reasons by France's European partners which, by weakening demand, reinforced the impact of budgetary consolidation on growth.”

The authors say that this policy had even more of a recessionary impact as it was applied at a time when the economy was still scarred by the recession, in particular with jobless levels still high. The output gap, the gap between actual and potential GDP, remained strongly negative. This shows that the economy has remained in the trough of the economic cycle, a point at which government finances always come under the most strain (1).

The study's authors go on to evaluate the overall effect of the government’s economic policy on growth in 2014 and 2015. Current government policy is based around two major priorities: firstly, the progressive impact of the reduction in payroll taxes and charges on companies, a measure worth more than 40 billion euros to businesses over the entire period (2), and secondly, and mainly to finance the first measure, increased budgetary restrictions of 50 billion euros over three years, starting with savings of 21 billion euros in 2015.

The government's arguments for imposing such a severe austerity plan on the country are well known, notwithstanding the serious social consequences, for instance on pay scales in the public sector, on family policy, or the risk of giving away such large sums of money to the corporate sector. It says the country will reap the reward of its efforts sooner or later, and the inducements to companies will not simply lead to windfall profits but will ultimately spur investment and growth, and at the end of the chain, employment.

------------------------------------------------------------------------

1. When economic growth is low, zero or negative, tax revenues inevitably shrink, and to compensate governments may raise and/or create taxes to try and maintain their revenue base.

2. These benefits are to flow through to companies from 2015 via a tax credit system called the Crédit Competitivité Emploi des Entreprises (CICE) introduced as part of the so-called 'competitiveness shock' in 2013, and via reductions in social security charges for companies brought in under the 2014 'responsibility pact' as an incentive to hiring.

Huge company tax breaks - tiny benefits

But that will not happen, says the OFCE's study, which comes firmly down on the side of numerous other reports on the subject – like that by the general budget rapporteur at the National Assembly, socialist Valérie Rabault, or from the Ifrap Foundation. It brings to bear arguments and figures demonstrating that austerity will continue to have a seriously recessionary effect, and that this will barely be offset by the enormous waste of public money involved in the competitiveness and employment tax credit (CICE) and the responsibility and solidarity pact.

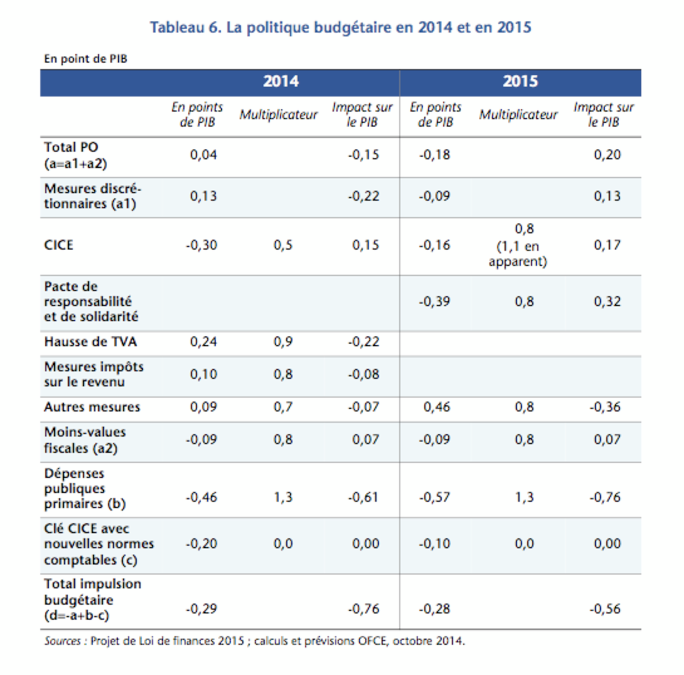

The table summarising the study's evaluation of these measures’ impact is below:

For 2014 the impact of these various measures is still negligible. Cuts in public spending, the OFCE study says, will knock 0.61 points off growth for the year, and the increase in VAT to finance the CICE could squeeze GDP by another 0.22 points. The pay-back from the tax credit's stimulus to growth comes out at a minuscule 0.15%.

In other words, the very measure taken to fund the CICE, the increase in VAT, will have a stronger recessionary effect than the positive impact of the tax credit itself. This reveals the absurdity of the government's economic policy. Even worse, the cumulative effect of these various measures, combining austerity for most people with generosity towards companies, far from acting as a stimulus to growth, will in fact herald a 0.76 point decline, according to the study,

Calculations for 2015 are no better. The stimulus to be expected from the competitiveness shock and the responsibility pact comes to 0.17 points and 0.32 points respectively, tiny in relation to the sums diverted to corporate coffers. And this is completely inadequate, given the negative effect of austerity policy. Next year the various measures taken together are likely to cost the French economy 0.56 points in growth.

The OFCE report thus represents a detailed and forensic examination of the true impact of Hollande's economic policy. “For the 2014-2015 period,” it says, “the reduction in statutory contributions [imposed] on the productive sector, with the CICE coming into force and the responsibility pact taking effect, will be coupled with a severe trimming of public spending, notably for 2015, and a rise in levies on households despite the abolition of the lowest tax bracket in 2015.”

The net effect of these measures is likely to be negative, the study says. Over 2014 and 2015, the positive impact on growth of measures in favour of companies will be less than the negative impact of cuts in public spending combined with earlier measures that increased the financial burden on households.

“In total,” it concludes, “planned and previous discretionary measures are likely to lead to a rise in statutory levies [editor's note, i.e. higher taxes and charges] on households of 19 billion [euros] over the 2014-2015 period, while levies on companies are likely to fall by 18 billion euros.”

The OFCE study calculates that the return of 6.5 billion euros in corporate taxes to firms as the CICE came into force in 2014 is equivalent to a fall of 0.30 points in taxes and charges. But this measure will only contribute to growth gradually, and resulting gains in employment and competitiveness will only become significant in 2015, it says.

The study also states that although a smaller amount - 3.5 billion euros - will be given back to companies in 2015 under the second tranche of the CICE, there will also be a delayed effect of 2014 CICE payments in 2015. This will add to the negative impact of this measure on GDP. There will also be an effective fall in corporate tax rates of 0.46 points over 2014 and 2015, leading to a cumulative dip of 0.32 points in economic growth.

In 2015, it adds, there will also be a negative knock-on effect from the responsibility pact, which cuts both employers' social security contributions on salaries below 1.6 times the minimum wage (1) to the tune of 4.5 billion euros, and also cuts contributions for the self-employed. This will result in a further 0.39 point fall in GDP in that year it says. Nevertheless, the study notes this measure will have a stronger positive impact on GDP in its first year than the CICE, since it targets low salaries.

“If you add to the corporate measures all the measures affecting households – reducing income tax for some of the middle classes and lower-income households for a total of 2.7 billion [euros] - the responsibility pact is likely to contribute positively to 2015 growth by 0.32 points,” the study says.

What this all means, in summary, is that François Hollande has chosen to impose an unprecedented austerity plan on the country to grant companies ruinous tax and social security breaks which will end up having only a minuscule positive effect. Because of this, the economy will ultimately be even weaker. It is economically absurd and socially incomprehensible.

-------------------------------------------------------------

1. The legal minimum wage in France (SMIC) is currently 9.53 euros/hour or 1,445.38 euros per month for a 35-hour working week.

--------------------------------------------------------------

- The French version of this artcile can be found here.

English version by Sue Landau

Editing by Michael Streeter