The announcement of the approval this week by a majority of shareholders of the astronomical pay rise for Carlos Tavares, CEO of the carmaking group Stellantis, has prompted outraged reactions in France. Tavares, 65, is in line to receive, in remunerations for 2023, made up of his salary, bonuses and other add-ons, a total of 36.5 million euros, representing a 35.6% rise on what he took home in 2022, and 47.9% more than he received in 2021.

The vertiginous rise in the CEO’s earnings is set to a backdrop of a 2.5% fall in the average net salary in France’s private sector. Since its creation in 2021 in a merger between the PSA group and Fiat Chrysler Automobiles, Stellantis, under the leadership of Tavares, has axed 26,000 jobs, representing just more than 8.8% of its workforce, while Tavares is now due to receive a bonus, part of his overall remuneration, of 10 million euros for the “transformation of the company”.

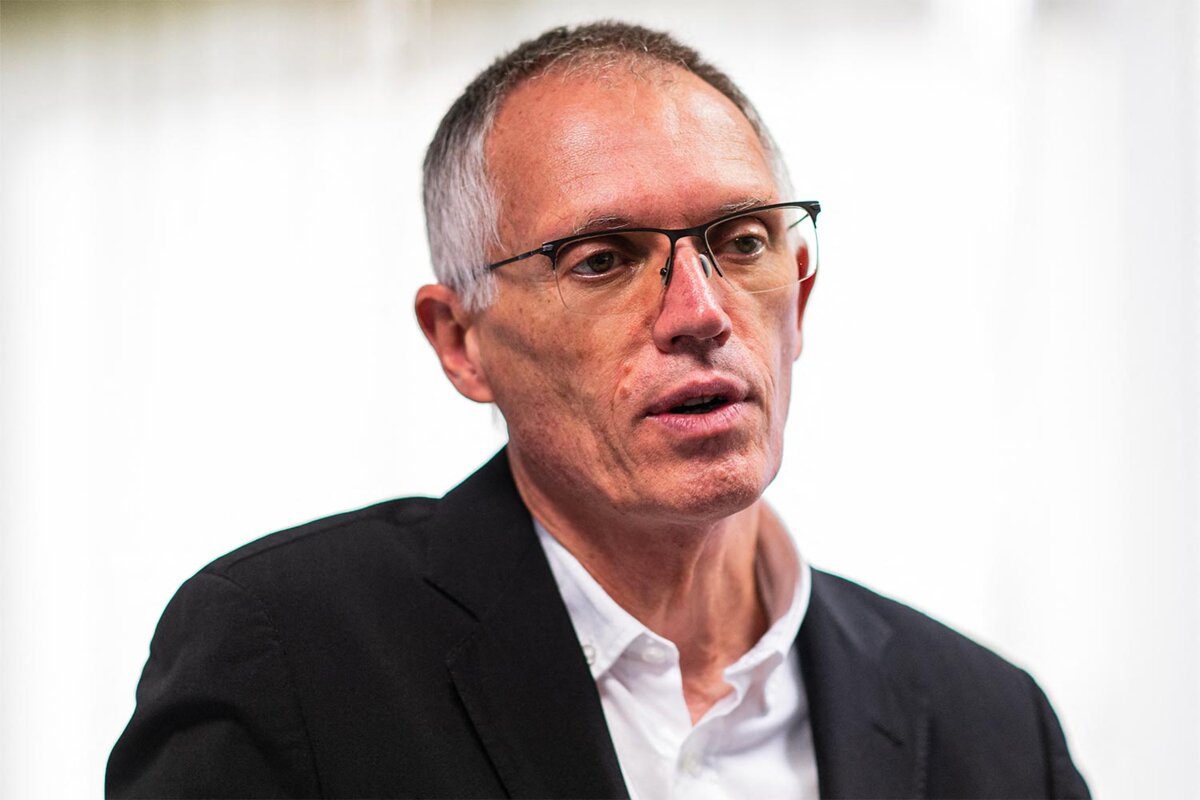

Amid the furore over the vast rise in earnings he is offered, Carlos Tavares appeared assured of his moral right to the sum. Questioned by the media during his visit to the group’s electric motor plant in Trémery, eastern France, earlier this week, he said 90% of the pay package was made up of bonuses linked to the group’s performance “so that proves that the results of the company are apparently not too bad”, adding that “if you have the performance of my competitors, the salary would have been much less”.

“If you reckon that it’s not acceptable,” he told reporters, “create a law, and modify legislation, and I will respect it.” It was one way of saying that, simply, the extravagant remuneration is legal and therefore nothing to be worked up about. Amounting to a familiar refrain heard in similar cases of exorbitant pay, the suggestion is that criticism comes from jealousy and people without the same talent.

Enlargement : Illustration 1

Beyond these recurrent episodes of indignation, one must look at the issue under a wider dimension and question the sense of these astronomical remunerations within the current social and economic system – and begin with the concrete reality of the payouts.

If Tavares earns 36.5 million euros for 2023 (it should be remembered that part of the final sum depends on the group’s performance between now and 2025), it is equivalent to a payment of 100,000 euros per day. If, just for one moment, one is to forget about the social inequality that represents, there is the issue of the real usage of such a sum. No-one can have the need, in the true sense of the word, for that amount, for it is almost impossible to realistically spend 100,000 euros on a daily basis, especially in the case of a CEO for who a large part of personal expenditure is covered by the company.

If there is not a concrete function for the sum – the only things it can buy are of the order of luxury acquisitions – it therefore has a symbolic function. But what counts here is the purchasing potential such a payout includes, rather than what it is in fact spent upon. That is, the purchasing power that represents social power in a society regulated by merchandise.

A salary unlike any other

It is there that lies the profound inequality between such big earners and the mass of others below. The multi-million sums and their growth have above all the aim of showing society who has the levers of power. Because the power of money is the power to buy work, and therefore to determine the use of human lives, and because such power comes itself from that work, the circle is complete; the mass of the population are caught in a downstream and upstream domination.

It is in that sense that the salary of the likes of Carlos Tavarez is not of the same nature as the salary paid to an ordinary worker. On a purely legal level, Tavarez is indeed a salaried employee, but his remuneration is close to that of holders of capital. It is a phenomenon which the Serbian-American economist Branko Milanović calls “homoploutia” (from the Greek “homo” for people and “ploutia” for “wealth”), whereby those who are in the upper category of earners of income from capital are also in the upper category of income from salaried earnings. Some might see in this a diminishing of the distinction between capital and work, but that is not the case.

Because the remuneration of such “work” is in reality based on the same criteria as the remuneration of capital – it mostly comes about after the production of profit, and is established according to that production. As seen, this is one of the arguments set out by the Stellantis CEO in defending his situation: his salary reflects the profitability of the group. As such, he strongly distinguishes himself from the situation of an ordinary worker whose remuneration is made ahead of the profit created.

From that angle, one can immediately see the central distinction between the two types of salaried employees. An ordinary worker represents a “cost” for profit, whereas the other is remunerated over the creation of that profit, and therefore on minimising that “cost”. Otherwise put, the formal character of paying a salary to Tavares does not mean he is situated at the same level as the workforce. He is in fact de facto an agent of capital, and it is for that reason that his remuneration can be compared to that of shareholders.

Homoploutia is about a change in the nature of the ownership of capital. With the financialization of the economy, the ownership of capital is more diffuse, but its power is not lessened. It takes the form of what French economist Michel Aglietta calls “shareholder capitalism” which concentrates powers into the hands of “salaried employees” who become as central, and therefore just as well remunerated, as the traditional capitalists who own companies.

The remuneration paid to Carlos Tavarez is therefore not only a moral scandal, it is also, and perhaps above all, a reminder of the mechanism of social domination in which we find ourselves. The force that is transforming our society is that of the accumulation of capital – that is, its widened reproduction, and the handout to Tavares is the reward for participating in this dynamic.

There is no contradiction between the increase in his remuneration and the axing of jobs or the low remunerations of the Stellantis workforce, for they are the source of that increase. That is precisely what CEOs mean when they talk about their “merit”, their capacity to produce profit, the alpha and omega of contemporary society.

What is interesting here is that these business leaders are themselves competing to be the most powerful among the powerful. Which is why, when huge payouts come under criticism, they justify their situation, as Tavares did during his press conference at the plant in Trémery, eastern France, by comparing themselves not with their workforce or the average salary, but with others in their same world. The Stellantis CEO compared his worth to that of “a football player” or a “Formula 1” driver. By seeking to be in the lead in this somewhat pathetic race of multi-million payouts, they drive the capitalist logic of accumulation. They are themselves permanently dominated by this logic. Their power is conditional to the acceptance of a greater power than theirs which pushes them into acting as they do.

Where lies the merit?

The underlying idea that allows Tavares to be so very much at ease over what he is paid is that the growth in the profit made by Stellantis is the result of his actions and choices alone. That is also a manner of justifying homoploutia.

But the profitability of a company depends upon things that are in no way uniquely the fruit of a CEO’s actions. It is not Tavares who determines the worldwide demand for vehicles, nor the technology that provides gains in productivity. Even if one accepts the argument that his decisions have an influence over the quality of production, and determine the market share that is won or lost, the concrete application of those decisions is down to a long chain of a workforce.

He may boast of having increased the profit made by Stellantis in 2023 by 11%, to reach close to 18.6 billion euros. But to credit him alone with that increase would be to forget the conditions in which the companies that make up Stellantis have all benefited over the past decade from state aid, and the massive public aid since the Covid crisis struck to keep production going. Added to this is also how states had, in 2020, helped to support household income to maintain consumption.

It is neither by chance nor down to Tavares that the major part of Stellantis’s profits are made in the US, but rather because the US public purse has since 2020 injected close to a quarter of the country’s GDP into the economy, allowing growth to regain its rhythm of before the Covid epidemic, with sustained consumption.

The financial accounts of the group show that it paid just 16.9% of its operating profit in taxes, a tad higher than the minimum of 15% which the OECD wants to see implemented. This shows that not only does it use all the optimisation possibilities allowed by existing legislation (its headquarters are situated in the Netherlands, even though no Dutch company is part of the group), but it also of course benefits from the fiscal benevolence that states offer multinationals.

Taking all this into account, the increase in the remuneration of the group’s CEO is simply excessive. It is superior to the increase in profits made by Stellantis (and which cannot be attributed to him alone). Furthermore, it is based on the short-term, without regard to the medium- and long-term consequences of an immediate growth of profit.

One could also cite the stretching of logistical chains, the limits of which were highlighted during the Covid crisis, and which are at the base of the operational model of carmaking groups worldwide. We have seen how Western multinational carmakers have missed the boat with regard to electric motorisation, both in terms of development and largely abandoning the bottom-of-the-range. It has paved the way for a deluge of Chinese electric vehicles on the markets, which now threatens the European carmaking industry.

A systemic issue

Finally, the sum paid to Tavares underlines the disconnection of capital with the reality of the economy. While households are still subjected to rising costs and prices, and a fall in real salaries, and while pressure on workers and the unemployed deepens, those who live off profits consider that they have done their job well and do not see a problem.

The additional cost that the likes of Carlos Tavarez represent for capital is very largely absorbed by the fact that the total of the vast sums paid to them are not (and cannot be) spent, but are very largely “reinvested” in the financial circuit which allows, in turn, the maintaining of the rhythm of accumulation. These remunerations have very little to do with a so-called merit, and are instead about a form of economy of capitalist domination.

That is principally where the problem lies in the payout. It rewards a logic that is today in an impasse, one which consists of believing that profit is an answer to every difficulty. Whereas profit is also in fact now the problem, whether that be in dealing with social difficulties or the climate and environmental crises. Worse still, the logic of domination that is highlighted by Tavares’s remuneration is precisely that which for a large part prevents society from defining a new and sustainable economic and social organisation. Behind that remuneration and its amount is a harmful system.

On the occasion of every similar controversy, there is never any shortage of political propositions for putting an end to what is presented as a scandal. Again, this time round, socialist Members of Parliament in France have announced the relaunch of a proposition to reduce pay gaps, while others call for tax increases on the highest salaries.

Such propositions are of interest, but they overlook the national character of measures for twisting the arms of multinationals who are used to permanently playing with different legislations, and above all they ignore the systemic nature of the issue. Their corrective vision on inequalities considers that there is a “happy medium” for profitability, whereas the whole system leans towards perpetual growth.

It is for that reason that Carlos Tavares can fire off a challenge to his critics: change the law if you want, but there will always remain a law that will be superior to that adopted by Parliament – that of the accumulation of capital. When blackmail over employment and investment is felt, the political laws are adjusted. The Stellantis boss is therefore quite at peace, and no-one can be really surprised that the indignation expressed by Emmanuel Macron, who during his 2022 re-election campaign already described the sums paid to Tavares as “shocking and excessive”, never survived his electioneering.

If the issue of the huge remunerations paid to the heads of multinationals is important, it is because it is systemic, and if it is systemic the answer must also be so. The nature and the sense of the domination of Tavares and his kind must be repositioned at the centre of public debate.

-------------------------

- The original French version of this article can be found here.

English version by Graham Tearse