In January, French luxury goods group Kering, whose brands include Gucci, Yves Saint Laurent, Bottega Veneta, Stella McCartney and Balenciaga, confirmed that, following a year-long investigation by Milan prosecutors, an Italian audit office report estimates it had evaded 1.4 billion euros in tax payments due between 2010 and 2016.

Kering, owned by French billionaire François-Henri Pinault, its chairman and chief executive, who took over the reins of the family business from his father François in 2005 when the group was still called Pinault-Printemps-Redoute, has said it contests both “the grounds and the amount” of the Italian claim over the unpaid taxes.

The prosecutors found that Kering’s Italian brand Gucci escaped tax payments by declaring profits through a Kering subsidiary in Switzerland, in a tax evasion scheme mounted by the group and revealed last year by Mediapart and its partners in the journalistic consortium European Investigative Collaborations (EIC).

Following Mediapart’s revelations, beginning in January 2018, and because “it appears nothing has been done over the past year”, Matteo Pronzini, a communist member of the parliament of the southern Swiss canton of Ticino, filed a complaint on Wednesday this week with the public prosecution services in Lugano over evidence that Gucci boss Marco Bizzarri and his predecessor Patrizio Di Marco obtained tax residence in the canton under false pretences, helped by the brand’s owner, Kering.

Ticino, an Italian-speaking canton, is situated in south-east Switzerland, on the border with Italy and about 60 kilometres from Gucci's offices in Milan.

Pronzini has also asked Ticino’s parliament to open a commission of inquiry to establish the details of tax breaks offered to Kering in exchange for basing in the canton its logistical arm, Luxury Goods International (LGI), through which many of the group’s products transit before being shipped worldwide.

Enlargement : Illustration 1

Thanks to a particularly low corporate taxation rate of 8% applied to LGI, Kering was able to declare 70% of its earnings in Switzerland, saving it around 2.5 billion euros in tax payments that would otherwise be due in those countries where its brands are based, including at least 180 million euros that it would otherwise have had to pay in France.

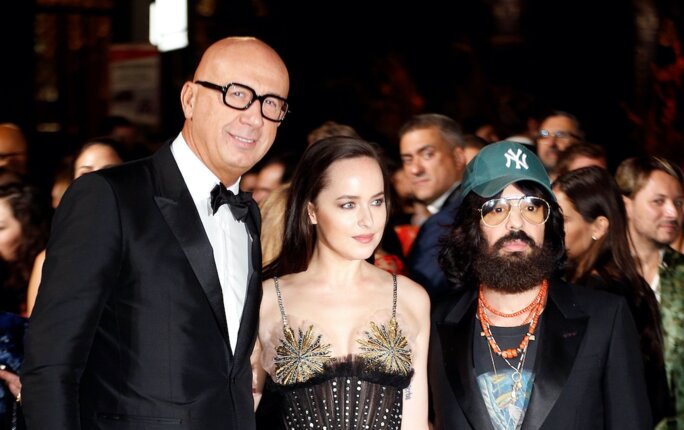

Mediapart and its EIC partners have already revealed (see here, and here) how Kering mounted a tax-evasion scheme for the remunerations of Gucci bosses Patrizio Di Marco (who left his post in 2014) and its current chief executive Marco Bizzarri who, while they worked and lived in Milan, both benefitted from the status of tax resident in Switzerland.

This was a scheme under which thousands of wealthy and mostly foreign individuals in Switzerland pay what is known as "forfait" – or “lump sum” – taxation, a system for those who declare no gainful employment in the country. Instead of paying tax on revenue, they pay a tax levied on their living expenses only. The arrangement is perfectly legal, on condition that they spend no more than 183 days per year in any other country, a requirement might appear constraining for the CEO of a major Italian luxury goods firm with a turnover of more than 4 billion euros.

As a result, Di Marco and Bizzarri paid between 2% and 4% in tax on income, while Kering escaped payments in tax and social contributions worth a total of about 89 million euros.

The formal complaint filed this week by Ticino MP Matteo Pronzini, based on the revelations by Mediapart and the EIC and also confidential documents obtained from “an anonymous source”, requests that the Swiss prosecution services investigate whether the status of fiscal residency in Ticino of Bizzari and Di Marco was fraudulent, given the suspicion that “false information” was given to the Swiss authorities. His complaint notes that if so, it would constitute an offence that carries a maximum three-year prison sentence.

In his complaint, Pronzini underlines that despite the revelations published by Mediapart more than one year ago, the authorities in Ticino have carried out no verifications; Kering, via the implantation of its logistical hub, was Ticino’s biggest corporate tax payer until it modified its financial structure shortly before the Italian investigation into its tax affairs was launched at the end of 2017. “One must ask whether the cantonal and communal authorities […] voluntarily closed an eye – and perhaps even two – so as not to ruffle the fashion business which is always described as the ‘principal tax payer in the canton’, and a ‘growth sector’,” wrote Pronzini.

Enlargement : Illustration 2

“Residing in Switzerland is an essential condition to benefit from taxation on expenses,” Pronzini insisted, referring to the “forfait” taxation scheme granted to Bizzari and Di Marco. But, as Mediapart has previously reported, both men worked and lived, with their families, in Italy, where they owned property. Under the tax-dodging system set up by Kering, the two were employed by Castera, a Luxembourg-registered subsidiary of the French group, established before it changed its name from PPR to Kering. Castera was in reality a letterbox company, with no employees, managed by strawmen and also, since 2011, successive human resources directors of the French group.

Being paid by Castera meant that they technically met the conditions for the Swiss “forfeit” taxation scheme, which can only be applied to people who have no income paid from within Switzerland.

Mediapart has obtained documents that further confirm Kering’s involvement in the scheme, which began in 2010 when Di Marco was CEO of Gucci, while Bizzarri was head of Milan-based Italian fashion brand Bottega Veneta, also owned by Kering.

The two men were provided with apartments in the same residential building in Paradiso, a suburb of Lugano. Their rental contracts were both signed on May 1st 2010 (see that of Bizzarri in the document below).

Enlargement : Illustration 3

The drab apartment building had none of the appearance of what might be expected to be the residence of the boss of a top Italian luxury brand, situated as it is in a noisy neighbourhood and with balconies that give onto a railway line. Swiss public broadcaster RSI questioned neighbours in the building (see video below, from timecode 17’08) who said they had never seen Patrizio Di Marco. One man interviewed in the report said that employees of Kering’s logistical subsidiary LGI occasionally visited the apartment to switch on electrical appliances, apparently in order that consumption on electricity bills would suggest a presence.

The apartment rentals were paid by Kering. In the case of Di Marco, the bills were addressed directly to its Swiss-based subsidiary LGI. In his complaint, Ticino MP Matteo Pronzini asked: “Why would LGI have had to pay Mr Di Marco’s apartment if it had no professional relationship with him? How is it possible that this benefit was not considered as a salary?”

“The residency and professional activity of the heads of the group in Ticino were an essential condition of the tax optimisation scheme put in place by Kering,” he added. Documents obtained by the Milan prosecution services, and detailed last year by Mediapart, show that Kering altered the employment contracts of about 20 Gucci management staff to officially transfer their working base from Milan to Ticino, in an attempt to justify the supposed importance of the brand’s activities in Switzerland.

It remains to be seen whether the Lugano public prosecution services will open an investigation, for until now they have shown little interest in the case, as also have the French authorities. More than a year after Mediapart’s initial revelations, no criminal investigation has been opened in France, while the finance ministry continues to refuse to comment on whether an inspection of Kering’s tax affairs has been launched, despite President Emmanuel Macron’s indication, in a television interview in April 2018, that it should.

Contacted during Mediapart’s previous reports, Kering failed to provide precise replies to the questions submitted to it, citing the confidentiality required by the investigation opened in Italy. However, the group insists that it acted in full respect of the law, and that its situation is “well known to the Swiss, Italian and French tax authorities”.

Lawyers acting for Patrizio Di Marco said he “has confidence in the fact that his behaviour has been appropriate and he will demonstrate that to the relevant authorities”.

Current Gucci CEO Marco Bizzarri did not respond to questions submitted to him by Mediapart.

-------------------------

If you have information of public interest you would like to pass on to Mediapart for investigation you can contact us at this email address: enquete@mediapart.fr. If you wish to send us documents for our scrutiny via our highly secure platform please go to https://www.frenchleaks.fr/ which is presented in both English and French.

-------------------------

- The French version of this report can be found here.

English version by Graham Tearse