The scandal involving the pricing of automobile spare parts is not confined to France. Mediapart and its journalistic partners have already revealed how, thanks to a software supplied by consultancy firm Accenture, French car makers Renault and PSA Peugeot Citroën amassed 1.5 billion euros in additional revenue by artificially inflating the price of their parts by an average of 15%. Today it can be revealed that the same software was used by three other giants of the automobile industry: the Japanese firm Nissan, Britain's Jaguar Land Rover and the American Chrysler.

Enlargement : Illustration 1

The unjustified price rises implemented by these five manufacturers generated a total income of 2.6 billion euros over ten years, to the detriment of consumers – mostly in Europe but also in the United States as well. This is shown in new confidential documents obtained by Mediapart and shared with the European Investigative Collaborations (EIC) network, the news agency Reuters and the Belgian daily newspaper De Standaard.

The revelations also raise questions about the role of the giant American management consultancy Accenture and the use of the software, known as Partneo. In civil proceedings launched in Paris the firm is accused by the software's creator Laurent Boutboul of anti-competitive practices in relation to the way the software was used at Renault and PSA Peugeot Citroën, who achieved identical price rises. Accenture formally deny any such practices and note that the French competition authority, the Autorité Française de la Concurrence, did not find sufficient grounds to open an investigation into the issue (see Mediapart's original story here). In a statement Accenture said: “As you know Mr Boutpoul's allegations in relation to Partneo are the object of legal proceedings in France. We don't believe that the allegations have any foundation, but we will not discuss details of proceedings that are active, because of the legal risks that entails.”

Enlargement : Illustration 2

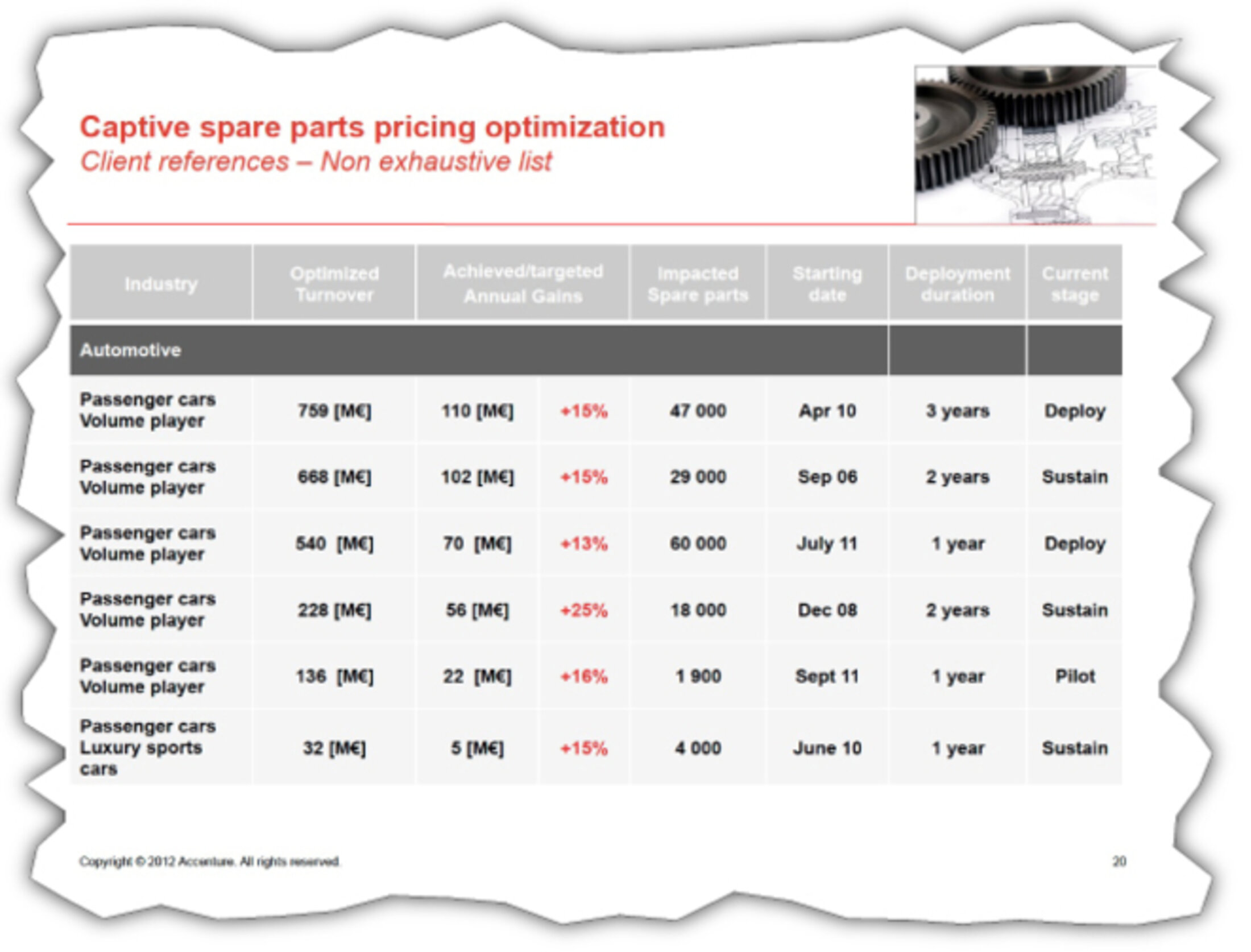

Accenture's other clients are not linked in any way to that court case and those allegations. But the new documents obtained by Mediapart show that with the exception of Nissan (+25%) and Jaguar land Rover (+9%) all the other car manufacturers who either bought or tested the software achieved similar price rises of between 13% and 16%. This suggests that the consultancy used the same parameters for the software with rival companies.

The American management consultancy was very active when it came to promoting its software in the automobile industry. It approached 31 different car makers, in other words virtually all of the world's car manufacturers. The message to each was the same, however: that the consultancy had already achieved price rises on spare parts of 10% to 20% at several of their large competitors and this was their chance to get on board and join the club.

In simple terms, Accenture informed the entire industry that it was in the process of increasing the price of spare parts. The risk was that those manufacturers who did not buy the software used this information to go off and achieve the same end result by employing their own methods.

The sophisticated software used by Accenture was invented in 2006 by Frenchman Laurent Boutboul and initially marketed by his company Acceria. Partneo allows a company to increase the price of so-called 'captive' parts – where there is a captive market and no competition – in all types of industry. The first automobile client, Renault, achieved spectacular results with a 15% average increase in prices and the system has netted it a total of 800 million euros so far.

The French company quite naturally shared this software windfall with its Japanese partner Nissan, which adopted the system for the European market in 2008. It proved a huge success, with Nissan Europe achieving an average price rise of 25%. That represents around 56 million euros a year in additional income and in total the company has earned an extra 500 million euros so far.

Accenture was attracted by the results and formed a commercial partnership with Acceria in 2009 and sold the software to PSA Peugeot Citroën. PSA saw their spare part prices rise by 15% and have so far netted an additional 675 million euros in total as a result.

Accenture then bought Acceria in July 2010 and made plans to broaden the use of its software. Its business plan envisaged that the Partneo software would generate 193 million dollars for them over five years. To achieve that the consultancy firm pulled out all the stops in relation to the sector that seemed the most promising: the automobile industry.

Enlargement : Illustration 3

In 2011 Accenture won its first client for the software in the United States, Mopar, who are Chrysler's spare parts distribution company. According to the documents obtained by Mediapart the American manufacturer increased the prices of its captive spare parts by 13% thanks to Partneo, generating 70 million euros in additional revenue a year and total extra income of 420 million euros up to now. Just under half of this came at the expense of American consumers.

Fiat bought control of Chrysler in 2009 and itself showed an interest in the software. The Italian car maker carried out a pilot project with Accenture in the Italian and Brazilian markets. Mediapart does not have any information on the outcome. A second pilot scheme took place with Fiat's Ferrari subsidiary which showed that a 15% rise in captive auto part prices was achievable

In the end Fiat did not buy Partneo. But in 2014, as part of the merger that led to the creation of Fiat Chrysler Automobiles (FCA), it was Chrysler through its subsidiary Mopar who took over Fiat's spare parts business. So did Fiat benefit from the Partneo software used by Mopar? Did the Italian manufacturer and its subsidiary Ferrari increase their prices following the pilot projects? FCA did not respond to questions on this.

In 2013 Accenture sold the software to the United Kingdom's largest car manufacturer Jaguar Land Rover. The British firm profited from a 9% rise in its spare part prices, a net gain of 45 million euros a year. So far the company has made a total of 200 million euros from using the software.

Accenture approached virtually every car maker

But the growing success of Accenture with the software in the automobile industry was fraught with legal risks. Back in June 2010 the management consultancy had identified a risk of breaching competition rules “if two or more competitors adopt similar rates or pricing strategies” because of Partneo. The consultancy therefore issued “anti-trust protocols” which in particular forbade the “use of the same pricing formula or solution to develop recommended pricing for competing customers or on an industry-wide basis.”

Yet the price rises implemented by Accenture for the majority of its clients are of a similar amount and in line with the firm's commercial promises – between 10% and 20%. In a confidential email sent in 2015 to executives in charge of compliance issues at Accenture, a consultant who was in charge of Partneo feared that the anti-trust protocols had been breached.

He said their automobile clients were aware that they had an industrial pricing approach that could be used and adapted for them. The tariff rules that they recommended were extremely similar from one client to another and were implemented with the help of a common algorithm, he added.

Enlargement : Illustration 4

Contacted by the EIC, Accenture said it did not want to comment. The consultancy says that it “helps manufacturers to take appropriate tariff decisions”, that it “doesn't exchange sensitive and/or confidential information between its clients” and that it fully respects all its legal obligations.

Meanwhile, Accenture had been busy marketing its product with car makers around the globe. According to Mediapart's information the consultancy offered to sell Partneo to 31 different car makers, in other words just about every major manufacturer, in Europe (Volkswagen, BMW, Mercedes, Fiat, Volvo, Aston Martin, and so on), in Asia (Toyota, Mazda, Honda, Mitsubishi, Hyundai, Mahindra, Tata…) and the United States (General Motors, Ford).

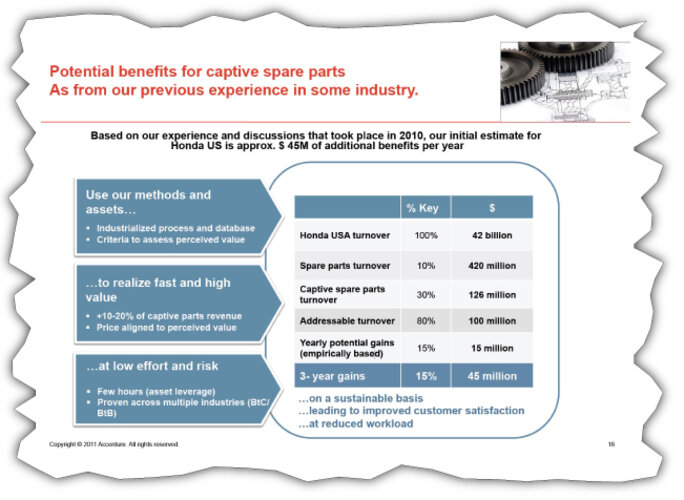

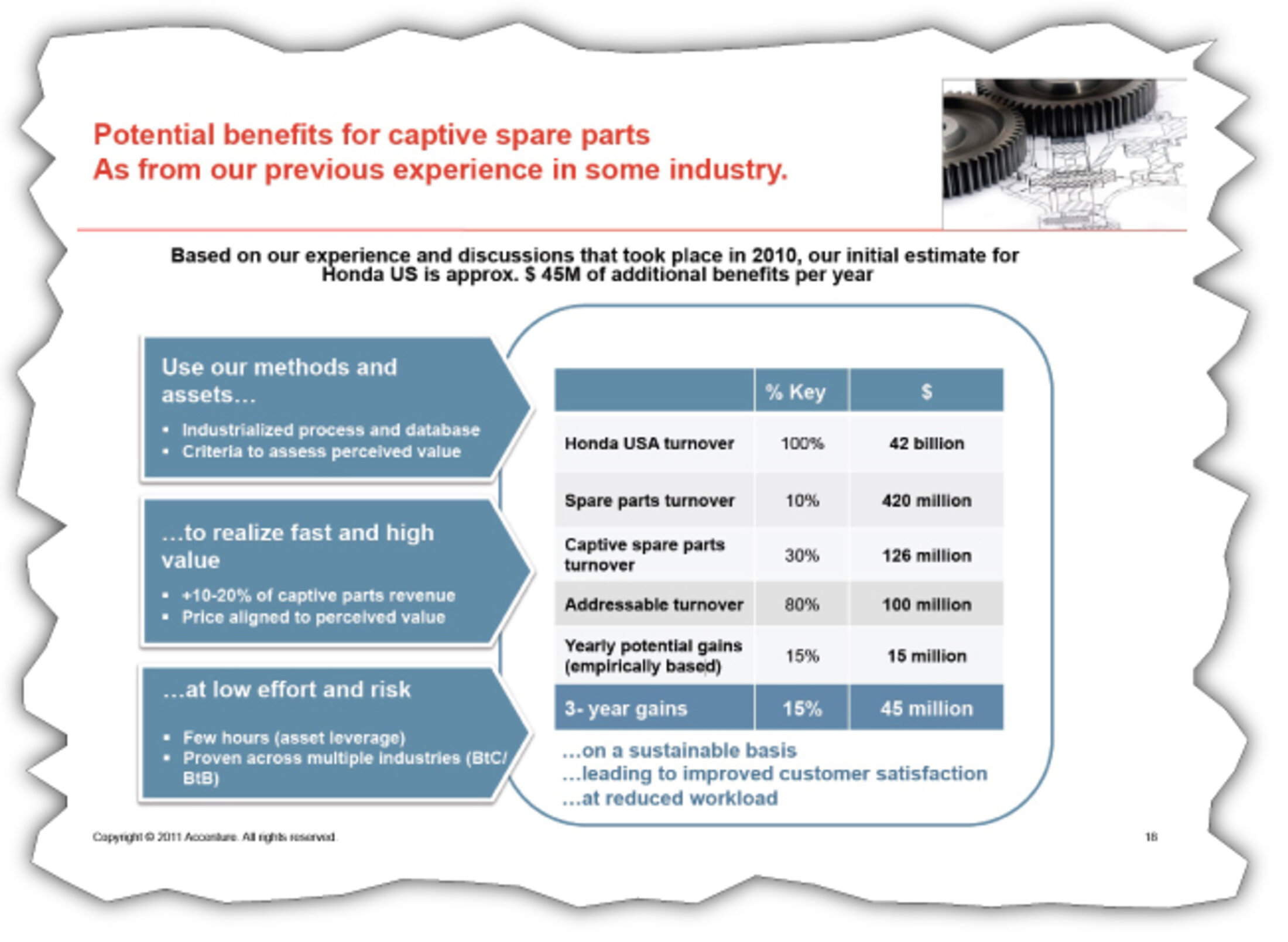

Mediapart has obtained four commercial presentations given by Accenture, to Mitsubishi, Volvo, BMW and Honda. On each occasion the firm promised to increase the price of captive parts from between 10% to 20%, pointing out that several large manufacturers had already profited as a result of the software.

The company told Volvo in 2013 that its results working with “original equipment manufacturers”(OEM) - companies who make the original parts - up to that point had led them to believe there was a major opportunity to boost the price of spare parts.

In order to convince the prospective clients of the software's effectiveness, each commercial presentation included a chart showing the results obtained by Accenture with four to six other manufacturers. The charts were anonymous but very detailed and gave the number of parts involved, the percentage of price rises and the actual or targeted financial gain (see table below).

Enlargement : Illustration 5

Did Accenture reveal too much information? The firm's anti-trust protocols allowed them to reveal to competitors anonymised data from “at least three companies”, which is in line with the content of these presentations. But the protocols also says they should not “disclose or share any non-public, competitively sensitive information obtained from one customer with another customer” or “advertise or suggest that the Company can or will provide industry-wide pricing or a uniform solution in any industry”.

Accenture says that it respects its “legal and contractual obligations in the context of its relations with its clients”. But Renault, questioned by the EIC on the use of its anonymous data that appears in the constituency's presentations, seemed surprised. It noted that it has “never authorised Accenture to disclose any information concerning it whatsoever to competitors”.

Be that as it may, Accenture informed virtually every large car maker that it was able to produce price rises at several heavyweights in the sector, with the risk that this might encourage those who did not buy the software to follow suit in their own way. This was even more of a temptation given that the captive parts market is a monopoly in which consumers do not have any choice but to buy from the car manufacturers.

Did those car manufacturers approached by Accenture later raise their prices? None of them responded to questions. However, the question is made even more pertinent by the fact that several of them - Volkswagen, Fiat, Ferrari, Honda and Aston Martin – took part in pilot schemes with the software and thus understood how it worked and obtained some reliable estimates of the likely benefits.

In September 2011 Accenture convinced the giant German car maker Volkswagen to carry out a pilot scheme on 1,900 of its spare parts in Germany and the United kingdom. The results were promising, with Partneo generating a rise of 16% in captive part prices in Germany alone, bringing in an extra 22 million euros a year.

But according to Mediapart's information Accenture, who were competing against the German consultancy Simon Kucher & Partners (SKP), were ultimately not signed up. Did Volkswagen in the end inflate the prices of its parts using SKP's methods? Neither the car maker nor SKP would say whether they have worked together on the issue.

-----------------------------------------------------------------------

If you have information of public interest you would like to pass on to Mediapart for investigation you can contact us at this email address: enquete@mediapart.fr. If you wish to send us documents for our scrutiny via our highly secure platform please go to https://www.frenchleaks.fr/ which is presented in both English and French.

------------------------------------------------------------------------

- The French version of this article can be found here.

English version by Michael Streeter